2.1.1. Global Financial Crisis and New Monetary Policy Requirements

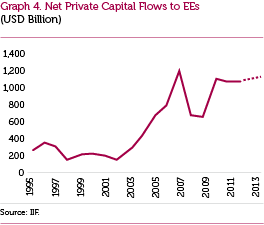

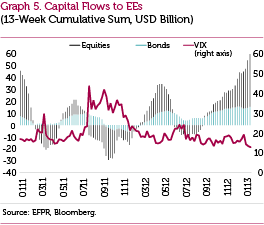

The monetary policy pursued by CBRT in 2012 relied on the new policy approach introduced gradually since late 2010, which was shaped by the circumstances in the aftermath of the global crisis. Advanced economies implemented accommodative monetary and fiscal policies simultaneously in the post-crisis period, which led to an increase in liquidity on a global scale. This ample liquidity had a bolstering effect on the risk appetite and capital movements in global financial markets at first. On the other hand, global economic activity is yet to recover although it has been more than 4 years since the outbreak of the crisis. Prolonged periods of deleveraging both in the USA and the Euro areas, limited capacity of fiscal policies to bolster growth coupled with ongoing uncertainty weighed on the growth outlook. Therefore, although risk appetite improved in line with ample liquidity following the crisis, it was negatively affected by the fluctuating course of the recovery, and capital movements proved highly volatile (Graphs 4 and 5). Against these developments that may challenge their macro-financial stability, emerging economies needed a flexible monetary policy approach that can respond faster to shocks.

Global liquidity has boosted due to the excessively accommodative monetary policies in advanced economies, and quantitative easing has led to the accumulation of risks in the financial systems of emerging economies. In other words, increase in the volatility of capital flows on a global scale affects those economies, which are the receivers of these flows through fluctuations in credits and exchange rates. Firms' balance sheets are positively affected by the exchange rates, which settled on an appreciation track rate due to the increased capital inflows. This feeds into the risk appetite of the financial intermediation sector causing a surge in credits and more pronounced systemic risks. An excessive rise in credits may have a distortive effect on financial stability due to an increased possibility of a fall in credit quality and a faster growth in domestic demand compared to total revenue. Thus, the economic literature emphasizes that excessive credit growth entails significant information on financial crises. Similarly, excessively appreciated exchange rates in an open economy can deteriorate macro-financial stability by increasing the systemic risk and distorting resource allocation through many channels, the leading one being the balance sheet channel. Against this backdrop, the new monetary policy patterns of emerging economies underline the significance of decreasing the volatility of capital flows. In this context, credit growth and exchange rate developments are closely monitored.