2.1.2. Developments in 2013

Monetary Policy Developments

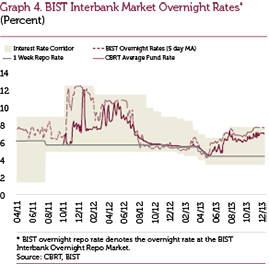

Despite strong capital flows in early 2013, overnight lending and borrowing rates were lowered in January and February by 25 basis points, each. Moreover, as the need for a broad interest rate corridor decreased thanks to ROM’s automatic stabilizer feature, the overnight lending rate was lowered by 100 basis points in March. Due to ongoing policy rate cuts in other emerging market economies and the resurgence of capital flows into Turkey, the policy rate, the overnight lending rate and the borrowing rate were cut by 50 basis points each in April to counterbalance risks to financial stability (Graph 4).

Since strong capital flows continued and credit expansion remained above the reference value in the beginning of the second quarter of the year, short-term interest rates were kept low, and macroprudential measures boosting foreign exchange reserves were maintained to balance the risks to financial stability. Accordingly, the policy rate and overnight lending and borrowing rates were cut by 50 basis points in May (Graph 4). In addition, foreign exchange reserve requirement ratios were increased to raise the effective reserve requirement ratio to 11.9 percent.

As of the end of May, due to increased uncertainty over global monetary policies, there were capital outflows from emerging markets as well as from Turkey and high volatility was observed in exchange rates. The high volatility in exchange rates and the credit expansion hovering above the reference value urged the CBRT to apply short-term additional monetary tightening and, subsequently, to start holding foreign exchange selling auctions to strengthen the effect of monetary tightening.

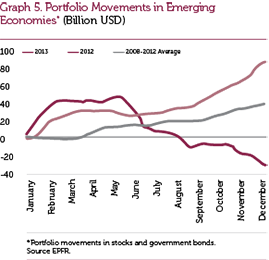

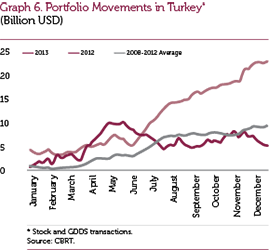

In the third quarter of 2013, the ongoing uncertainty about the US Federal Reserve (Fed)’s exit strategy from the quantitative easing policy and problems concerning the resolution of the debt ceiling in the US were the main factors causing uncertainty in global markets. After May, developments in global monetary policies caused re-pricing of all financial assets leading to capital outflows from global portfolio investments across emerging economies (Graph 5). Turkey witnessed similar capital outflows during this period (Graph 6).

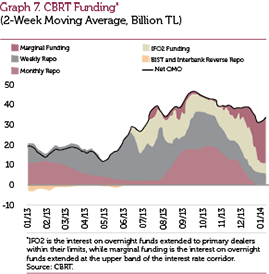

In the third quarter, the upper bound of the interest rate corridor was raised by 75 and 50 basis points, in July and August, respectively, in order to prevent global uncertainties, the depreciation of the Turkish lira and high inflation from deteriorating the overall pricing behavior. During this period, as the CBRT reduced the amount of liquidity injected to the market through quantity auctions, the banks resorted to high-cost overnight borrowing facilities (Graph 7). Moreover, the Bank decided not to conduct foreign exchange selling auctions and not to fund banks via the primary dealer facility on days of additional monetary tightening (AMT). In this period, the CBRT leaned toward implementing a monetary policy that focused on inflation and aimed at restricting the negative effects of uncertainties in global monetary policies. Following these measures, the BIST overnight repo rates have converged to the upper bound of the interest rate corridor.

The Fed’s monetary policy, which depended on high-frequency economic data releases, coupled with the volatility in such data, led to a rise in fluctuations in financial markets. In the third quarter of the year, the CBRT decided to increase the predictability of the Turkish lira liquidity policy to curb the impacts of global monetary policy uncertainties on the domestic economy. Accordingly, the CBRT adopted a strategy towards reducing interest rate uncertainty, and the economy was prevented from being dragged into a vicious circle that was not driven by economic fundamentals. Consequently, the CBRT started to announce the total and remaining days of AMT and decided to conduct foreign exchange selling auctions on AMT days.

In the last quarter of 2013, uncertainties regarding the monetary policies of the central banks of advanced economies persisted and inflation hovered above the target leading the CBRT to continue with the cautious monetary policy stance. Moreover, in this period of weak capital flows, interest rate volatility was reduced. Accordingly, a liquidity policy was implemented that kept overnight market rates close to the upper band of the corridor. One-month repo auctions were terminated and a liquidity management designed to fund the market mostly by overnight maturity was adopted to reduce interest rate volatility. Thus, the composition of liquidity injected was adjusted and overnight rates in the interbank money market were kept around 7.75 percent (Graph 4). In addition, it was announced that the weighted average funding cost would be kept at or above 6.75 percent, a move increasing the predictability of interest rates.

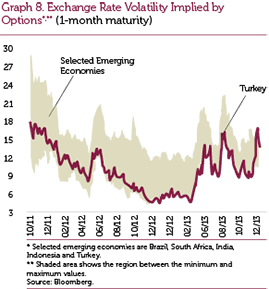

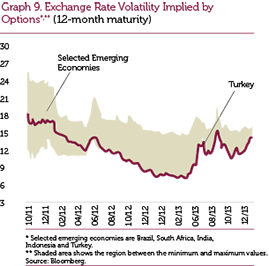

In December 2013, the Fed launched the exit strategy from the quantitative easing policy. In this period, implied volatility of the Turkish lira increased more than the currencies of advanced economies due to country-specific developments (Graph 8 and 9).

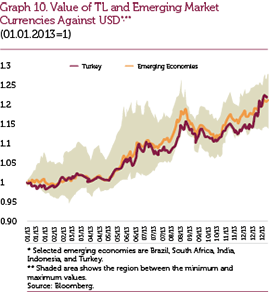

Throughout 2013, the Turkish lira followed a course parallel to the currencies of other emerging economies with a high foreign financing requirement (Graph 10). Nevertheless, recently, the Turkish lira has performed relatively worse against the US dollar due to Turkey-specific risks.

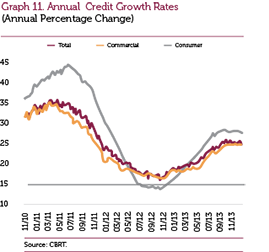

The uptrend in growth rate of credits extended to the non-financial sector observed as of November 2012 stimulated by the CBRT’s accommodative liquidity policy, low course of loan rates and the moderate rise in domestic demand, continued until October 2013 (Graph 11). The annualized total credit growth rate, which was pushed upwards both by consumer and business loans until mid-year, started to trend downwards due to the CBRT’s liquidity tightening besides increased credit costs due to global developments (Graph 12). Amid these developments, the annual growth of total credits became 25.0 percent on 27 December 2013.

Inflation Developments

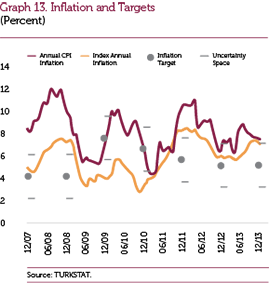

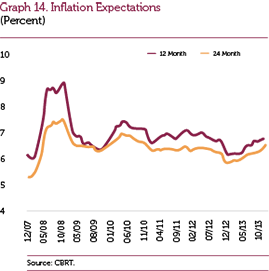

Having hovered above the uncertainty band across 2013, the inflation rate climbed to 7.40 percent by the end of the year. The course of annual consumer inflation was mostly shaped by unprocessed food and energy prices throughout 2013. Being pushed upwards by the effects of tax adjustments on tobacco products as well in January, inflation exhibited volatility in the subsequent period due to the unprocessed food and energy prices, but completed the first half of the year significantly above the values implied by the target. In the second half of the year, weak capital flows driven by the uncertainty regarding global monetary policies caused the Turkish lira to depreciate, which increased core inflation indicators particularly via the core goods group (Graph 13). Against these developments, inflation expectations slightly deteriorated in the last 6 months of the year (Graph 14).

The primary objective of the CBRT is achieving price stability. Accordingly, a cautious monetary stance was adopted to contain the impact of foreign exchange rate volatility on pricing behavior. Also the CBRT stated that this stance would be maintained until the inflation outlook becomes consistent with the medium-term targets.

Developments in the National Income, Balancing Process and the Labor Market

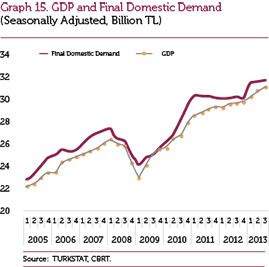

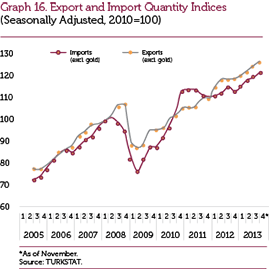

Owing to the new monetary policy that has been adopted since the end of 2010, besides macroprudential measures, a balancing process has been witnessed between domestic and external demand. Being a part of this process, the final domestic demand, which remained flat in 2011-2012, increased moderately in the first nine months of 2013 (Graph 15). Exports of goods excluding gold displayed a stronger growth as of 2011 compared to imports of goods excluding gold and supported the balancing of the current account deficit (Graph 16). In this period, the Gross Domestic Product (GDP) grew by 4.0 percent in the first nine months of 2013 following a growth of 2.2 percent in 2012.

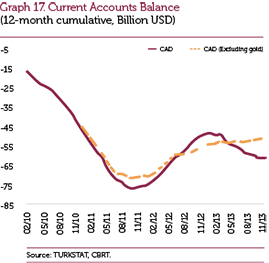

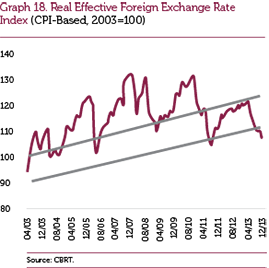

The balancing between the domestic and external demand that started in 2011 led to a notable improvement in the current account balance. Although the total current account deficit data have recently deteriorated due to the volatility in the gold trade, the current account deficit continues to improve gradually when the impact of the gold trade is excluded (Graph 17). Meanwhile, under the new monetary policy that has been implemented since the end of 2010, the real exchange rate has retreated from levels considered as overvalued by economic fundamentals (Graph 18). In 2012 and the first half of 2013, the real exchange rate was prevented from re-climbing to excessively appreciated levels by the measures implemented. Despite the depreciation in the real exchange rate after May 2013, the real exchange rate was not initially in the overvalued zone compared to the previous financial fluctuations. This was one of the factors that contained the real exchange rate volatility in comparison to the previous fluctuations.

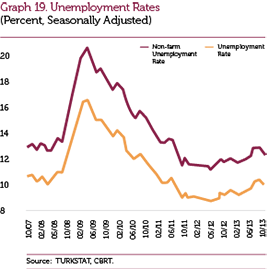

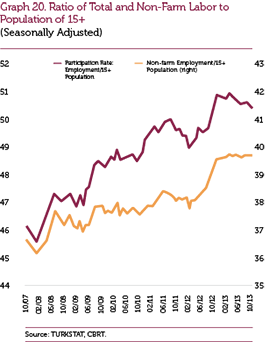

On average, unemployment rates displayed an upward trend during 2013 (Graph 19). The increase in unemployment rates was driven by the relative weakness in non-farm employment compared to the previous year. Across subcategories of non-farm employment, increases in industrial and services employment observed until May were replaced by losses after June. The construction employment exhibited a sluggish outlook during 2013 in spite of a slight recovery in the third quarter. Labor force participation rates moved parallel to employment rates (Graph 20).