2.4 Financial Infrastructure

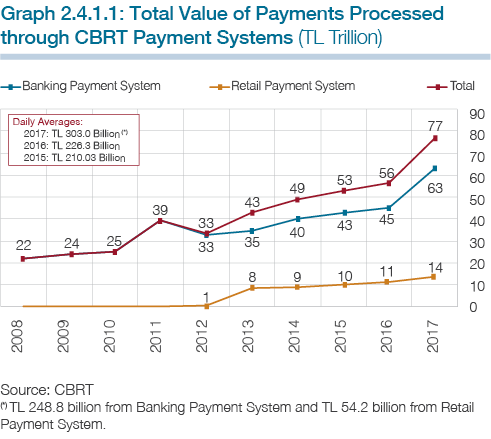

The amount of transactions conducted through the Interbank Turkish Lira Transfer System and through its Electronic Securities Transfer and Settlement System was TL 63 trillion in 2017. The average daily transaction volume was TL 248.8 billion. A total of 2.5 million transactions were conducted through the system, which corresponds to an average of 9,913 messages a day. The volume of settlements conducted through the Interbank Turkish Lira Transfer System in 2017 increased by 39.7 percent compared to 2016 (Graph 2.4.1.1).

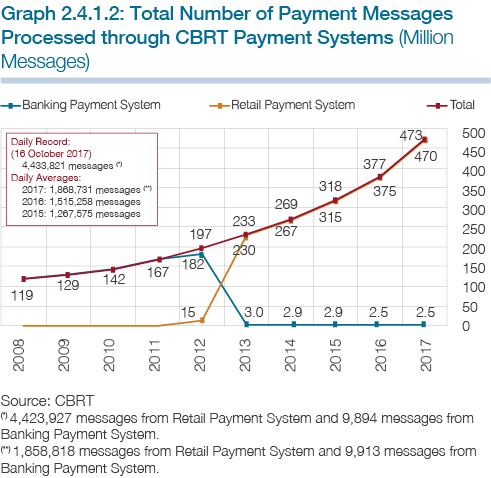

The total volume of all transactions conducted via the CBRT Retail Payment System in 2017 was TL 14 trillion, while the average daily transaction volume was TL 54.2 billion. The total number of transactions conducted in the system was 470 million and the daily average number of messages processed was 1,858,811. The greatest number of transactions occurred on 16 October 2017, when 4,423,927 messages were handled. In 2017, 25.5 percent more settlements were carried out in the CBRT Retail Payment System than in 2016 (Graph 2.4.1.2).

The number of transactions handled in the Auction System was 118,348 in 2017.

As the Turkish branch of The Royal Bank of Scotland Plc. exited the CBRT Payment Systems on 2 November 2017 on account of its voluntary liquidation, the number of banks participating in the CBRT Payments Systems in 2017 declined from 53 to 52.

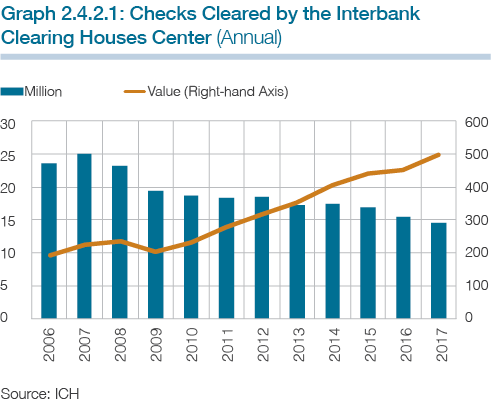

Check clearing in Turkey is performed by the Interbank Clearing Houses Center (ICH), which was originally set up pursuant to Law No. 3167 on Regulation of Payments by Check and Protection of Check Holders.

The CBRT engages in an ongoing effort to make sure that check clearing is handled smoothly and also to improve the check‑clearing system.

In 2017, the total amount of payments cleared through the ICH corresponded to about a quarter of Turkey’s GDP. The 14.5 million checks that were processed last year had an aggregate value of TL 498.5 billion (Graph 2.4.2.1).

The “Communiqué Concerning International Bank Account Numbers” issued by the CBRT in 2008 stipulates that banks shall generate an International Bank Account Number (IBAN) for each of their customers subject to the rules set out in the communique, which also provides rules concerning their customers’ use of these numbers when transferring funds. This Communiqué rapidly increased public awareness and use of the IBAN system in Turkey. By year‑end 2017, IBAN usage ratio for the senders was 99.5 percent whereas recipients’ ratio was 92.5 percent of fund transfers taking place through the Electronic Fund Transfer System (EFT).

In 2017, the CBRT formulated the “Policy on Prevention of Money Laundering and Financing of Terrorism”. With this policy, the CBRT redefined the general principles governing risk management activities towards assessment of customers and transactions and monitoring and control activities within the framework of the Bank’s overall risk-based approach.

Approval of Operation of the Electronic Board of Director System by the Central Securities Depository of Turkey (MKK)

The CBRT Decision dated 26 December 2016, which took effect upon issue in Official Gazette No.29941 dated 7 January 2017, expanded the scope of the MKK’s operating license with respect to Article 17 of the “Regulation on the Operations of Payment and Securities Settlement Systems”. As per the Decision, the Electronic Board of Director System (e‑BDS), which was planned to be developed by the MKK in addition to its existing system operation activities, was included in the scope of the initial authorization given to MKK by the mentioned Regulation and it was recognized as an activity that can be carried out by the MKK.

The e‑BDS system allows members of the board of directors of companies using the MKK‑provided e‑BDS system to participate in electronic (remote) board of directors meetings using their secure electronic signatures, to present their views and suggestions electronically, to cast votes online for or against the proposal submitted to the meeting, and to sign board decisions electronically.

Approval of Takasbank to Provide Central Counterparty Services in the Borsa Istanbul Money Market

On 7 October 2016, the CBRT provisionally authorized Istanbul Clearing & Custody Bank (Takasbank) to provide central counterparty (CCP) services in the BIST Money Market which was approved by the Capital Markets Board. Accordingly, Takasbank started providing CCP services in the BIST Money Market in October 2016. A CBRT Board decision dated 9 March 2017 concerning the above‑mentioned services went into effect upon publication in the Official Gazette No.30018 of 25 March 2017. Takasbank acts as a CCP in this market, which was set up to generate a long‑term Turkish‑lira interest rate that could serve as a benchmark for flexible rate TL borrowing instruments and flexible rate swaps, and guarantees transactions, within the framework of specific rules, by serving as borrower for lenders and lender for borrowers.

Approval of Takasbank to Mediate “TapuTakas‑ Services Regarding Payment of the Price of Real Estate Purchases and Sales via Takasbank”

Takasbank has set up and now operates TapuTakas, an electronic platform for the processing of payments in the sale and purchase of real estate properties. Being the creator and the operator of the system, Takasbank applied to the CBRT for a permanent approval to operate this infrastructure . The aim of TapuTakas is to prevent the problems that parties in real estate transactions encounter by ensuring that the cash payment for the property and the property subject to trading are exchanged simultaneously and safely between the buyer and the seller in real time. The CBRT Board granted authorization to Takasbank to carry out “Payment Services in the Conduct of Real Estate Purchases and Sales” on 5 October 2017. The CBRT Board decision was published in Official Gazette No.30214 of 18 October 2017.

Structural Changes to Take Place due to Takasbank’s New Role as CCP in the Borsa Istanbul Equity Market

Takasbank’s assumption of the CCP role in the BIST Equity Market required a number of structural changes to be made in the Equity Market Clearing System. These changes were approved by the CBRT Board on 29 May 2017.

Operating License of Mastercard Payment Transaction Services Turkey

The CBRT has authorized Mastercard Payment Transaction Services Turkey (MPTS), an entity based in Turkey, to act as a payment systems operator as a result of the evaluations pursuant to Law No. 6493 on “Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions”, as well as the “Regulation on the Operations of Payment and Securities Settlement Systems”.

The CBRT decision concerning this license was published in Official Gazette No. 30116 of 6 July 2017.

MPTS is an entity that provides clearing and settlement services for institutions that issue and acquire cards in the field of payments with cards. It also provides various technology‑based infrastructure associated with these cards such as managing ATM, POS, and printing cards etc.

MPTS, which was originally founded in 2001 under the name of “Provus”, was acquired by Mastercard Incorporated in 2014. A publicly‑traded company whose shares are quoted on the New York Stock Exchange, Mastercard Incorporated controls a 99.9 percent stake in MPTS. Active in Romania, Albania, and Kosovo as well as in Turkey and the Turkish Republic of Northern Cyprus, MPTS’s operations include clearing and settlement mediation, card and data‑management services, and transaction authorization services.

The CBRT license also authorizes MPTS to conduct other operations such as “Switching and Authorization Services”, “Card and Data‑Management System Services”, Public Collection Solution Services, “Masterpass Services”, “Mobile Contactless Payment Services”, and “Clearing And Settlement Mediation Services” pursuant to the CBRT’s regulation under the scope of the operating license granted to MPTS.

In accordance with the Law on Payment and Securities Settlement Systems, Payment Services, and Electronic Money Institutions (Law No.6493) and secondary legislation issued pursuant to this Law, the CBRT has authority and responsibility to oversee the payment and securities settlement systems and to ensure uninterrupted operation of these systems.

Pursuant to Paragraph 3 of Article 12 of the Regulation on Operations of Payment and Securities Settlement System, the Central Securities Depository of Turkey (MKK) has submitted the following issues for the approval of the CBRT:

The CBRT Executive Committee approved these links on 29 May 2017.

Also pursuant to Paragraph 3 of Article 12 of the Regulation on Operations of Payment and Securities Settlement System , the Interbank Card Center (BKM) submitted for the approval of the CBRT a link that it planned to set up on account of the center’s direct participation in the Discover Card system. The CBRT Executive Committee approved this link on 29 May 2017.

Based on its authorities and responsibilities given by relevant legislations, the CBRT constantly oversees payment and securities settlement systems in a process that begins with the licensing of organizations that set up and manage these systems and continues with the conduct of their operations.

As part of these supervisory duties and responsibilities, the CBRT monitors the system operators by checking information and documents collected, conducts on‑site visits when it deems necessary in order to perform more detailed examinations of transactions and documentation, and, based on the findings of its off‑site and on‑site oversight, prepares detailed reports concerning system operators’ compliance with the CBRT regulations and international standards.

Acordingly, in 2017, the CBRT carried out detailed oversight activities regarding the operations of BKM, Takasbank, and Garanti Payment Systems Inc, performed on‑site visits and prepared oversight reports by examining the operators’ compliance with the provisions of “Law No.6493 on Payment And Securities Settlement Systems, Payment Services, And Electronic Money Institutions” and secondary legislation issued pursuant to this Law, and “Principles for Financial Market Infrastructures” published by the BIS Committee on Payments and Market Infrastructures (CPMI) and by the International Organization of Securities Commissions (IOSCO).