The funding need of the system, which was TRY 84 billion at end-2019, increased throughout the year by approximately TRY 541 billion, reaching TRY 625 billion by the end of 2020.

The CBRT implemented a comprehensive set of measures regarding liquidity management to contain the economic and financial impacts of the pandemic that started in early 2020. In this scope;

Coordinated tightening steps were taken in pandemic-specific policies since early August to contain inflation expectations and to curb risks to the inflation outlook. In August, banks’ borrowing limits at the Interbank Money Market (IMM) were halved, the primary dealer repo transactions were gradually zeroed, Borsa Istanbul (BIST) repo transactions were limited, one-month term repo auctions were held via the traditional auction method, and transactions started to be conducted through the Late Liquidity Window (LON) facility.

In early November, banks’ borrowing limits at the IMM were zeroed and overnight repo transactions via the quotation method against TL-denominated lease certificates in the scope of OMO were suspended. In its November meeting, the MPC decided, within a simple operational framework, to provide all funding at the one-week repo auction rate, which is the main policy rate, and did so during the rest of the year.

Additionally, in order to enhance flexibility of the banking sector collateral management, asset-backed securities, asset guaranteed securities and mortgage-backed securities have been accepted as collateral against Turkish lira and foreign currency transactions since April.

The CBRT continued to use reserve requirements effectively as a macroprudential tool to support financial stability throughout 2020.

In January, to strengthen the monetary transmission mechanism, support financial stability and bring out gold savings into the economy, within the scope of the Reserve Options Mechanism (ROM), the upper limit of the facility of holding standard gold was decreased from 30% to 20% of Turkish lira reserve requirements, and the upper limit of the facility of holding standard gold converted from wrought or scrap gold collected from residents was increased from 10% to 15% of Turkish lira reserve requirements.

In early March, to help channel loan supply towards productive and production-oriented sectors that will support sustainable growth, rather than consumption, affect the current account balance positively and support financial stability, the weight of consumer loans in the calculation of loan growth that is taken into account in the loan growth-based RR practice was reduced and loans extended to the selected sectors, rather than commercial loans, started to be taken into account. (Table 2.2.2.1). Accordingly, the following conditions were set to be eligible for RR incentives:

Table 2.2.2.1: Sectors Determined According to the Statistical Classification of Economic Activities in the European Community (NACE)

Section |

Definition |

A |

Agriculture, Forestry and Fishing |

B |

Mining and Quarrying |

C |

Manufacturing (excluding 11.01-Distilling, rectifying and blending of spirits, 11.02-Manufacture of wine from grape, 11.03-Manufacture of cider and other fruit wines, 11.04-Manufacture of other non-distilled fermented beverages, 11.05-Manufacture of beer, 11.06-Manufacture of malt and 12-Manufacture of tobacco products) |

D |

Electricity, Gas, Steam and Air Conditioning Supply |

H |

Transportation and Storage |

I |

Accommodation and Food Service Activities |

J |

Information and Communication |

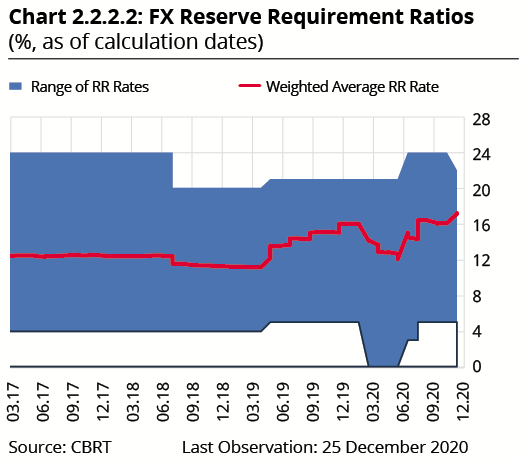

In mid-March, as part of the measures announced to reduce the adverse effects of the coronavirus pandemic on the economy, the FX RR ratios were reduced by 500 basis points in all liability types and all maturity brackets for banks that meet real credit growth conditions (Table 2.2.2.2).

Table 2.2.2.2: FX Reserve Requirement Ratios (%, as of calculation dates)

Date of Effect |

27.12.2019* |

06.03.2020* |

10.07.2020* |

21.08.2020* |

11.12.2020 |

||||

Deposits/participation funds |

|||||||||

Maturity of up to 1 year |

17 |

19 |

12 |

19 |

15 |

22 |

17 |

22 |

19 |

Maturity of 1-year or longer |

13 |

15 |

8 |

15 |

11 |

18 |

13 |

18 |

13 |

Precious metal deposit accounts |

|||||||||

Maturity of up to 1 year |

17 |

19 |

12 |

19 |

15 |

22 |

22 |

22 |

22 |

Maturity of 1-year or longer |

13 |

15 |

8 |

15 |

11 |

18 |

18 |

18 |

18 |

Borrower Funds of Investment Banks |

17 |

19 |

12 |

19 |

15 |

22 |

17 |

22 |

19 |

Other liabilities |

|||||||||

Maturity of up to 1 year |

21 |

21 |

16 |

21 |

19 |

24 |

21 |

24 |

21 |

Maturity of up to 2 years |

16 |

16 |

11 |

16 |

14 |

19 |

16 |

19 |

16 |

Maturity of up to 3 years |

11 |

11 |

6 |

11 |

9 |

14 |

11 |

14 |

11 |

Maturity of up to 5 years |

7 |

7 |

2 |

7 |

5 |

10 |

7 |

10 |

7 |

Maturity longer than 5 years |

5 |

5 |

0 |

5 |

3 |

8 |

5 |

8 |

5 |

Moreover, in March, the remuneration rate for RRs maintained in TL was reduced by 200 basis points to 8% for banks that met the real credit growth conditions, while it was kept unchanged at 0% for other banks (Table 2.2.2.3).

Table 2.2.2.3: Remuneration Rate on TL Required Reserves (%, as of calculation dates)

Date of Effect |

Remuneration Rate |

|

04.10.2019-19.03.2020* |

0 |

10 |

20.03.2020-09.07.2020* |

0 |

8 |

10.07.2020-15.10.2020* |

0 |

7 |

16.10.2020-26.11.2020* |

2 |

9 |

27.11.2020 |

12 |

|

In June, to provide banks with flexibility in meeting the loan demand of corporates and individuals due to their disrupted cash flows during the pandemic, the enforcement of the rule of having adjusted real loan growth rate below 15% for the banks with a real annual loan growth rate above 15% was suspended until the end of the year.

In early July, the remuneration rate for RRs maintained in TL was reduced by 100 basis points to 7% for banks fulfilling the real credit growth conditions. The same rate was kept unchanged at 0% for other banks (Table 2.2.2.3).

In mid-July, as part of the normalization process, to support financial stability, FX RR ratios were increased by 300 basis points in all liability types and maturity brackets for all banks, (Table 2.2.2.2.).

In August, in the scope of the normalization process, the CBRT decided to raise FX RR ratios for banks fulfilling the real credit growth conditions by 700 basis points for precious metal deposit accounts and by 200 basis points for all other FX liabilities for all maturity brackets (Table 2.2.2.2). Additionally, in line with the steps taken towards the Turkish lira liquidity management, for banks fulfilling the real credit growth conditions, the TL RR ratios were increased by 200 basis points for all deposits/participation funds liabilities with a maturity of up to six months and other liabilities with a maturity of up to one year, and by 150 basis points for other liabilities with a maturity of up to three years (Table 2.2.2.4).

Table 2.2.2.4: TL Reserve Requirement Ratios (%, as of calculation dates)Date of Effect |

09.08.2019* |

21.08.2020* |

11.12.2020 |

||

Deposits/Participation Funds |

|

||||

Maturity of up to 3 months |

2 |

7 |

4 |

7 |

6 |

Maturity of up to 6 months |

2 |

4 |

4 |

4 |

4 |

Maturity of up to 1 year |

2 |

2 |

2 |

2 |

2 |

Maturity of 1 year or longer |

1 |

1 |

1 |

1 |

1 |

Borrower Funds of Investment Banks |

2 |

7 |

4 |

7 |

6 |

Other Liabilities |

|

||||

Maturity of up to 1 year |

2 |

7 |

4 |

7 |

6 |

Maturity of up to 3 years |

2 |

3.5 |

3.5 |

3.5 |

3.5 |

Maturity longer than 3 years |

1 |

1 |

1 |

1 |

1 |

In October, the remuneration rate for RRs maintained in TL was increased by 200 basis points to 9% for banks fulfilling the real credit growth conditions, and was set at 2% for other banks (Table 2.2.2.3).

By the end of November, the CBRT decided to simplify the RR system to enhance the effectiveness of the monetary transmission mechanism in line with its main objective of price stability. Accordingly1;

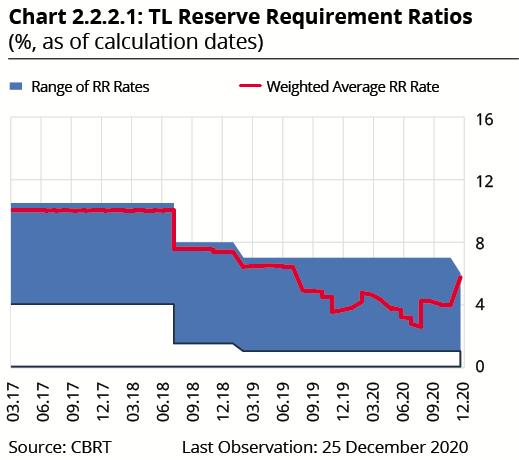

As a result of these changes, the weighted average RR ratios for TL and FX-denominated liabilities were 5.8% and 17.2%, respectively on 25 December 2020 (Chart 2.2.2.1 and Chart 2.2.2.2).

In the maintenance period pertaining to the calculation date of 25 December 2020, the ROM utilization rate was 96.9% for the FX facility, 90.5% for the gold facility and 72% for the scrap gold facility (Chart 2.2.2.3 and Chart 2.2.2.4). On the other hand, banks in Turkey can also maintain standard gold for their precious metal deposit accounts and this facility’s utilization rate was 74.2% as of the same maintenance period.

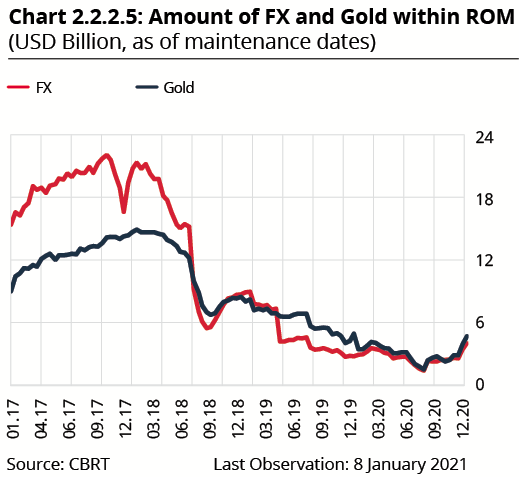

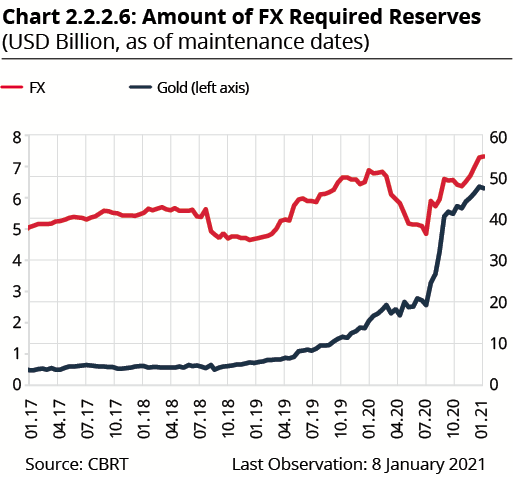

In the maintenance period pertaining to the calculation date of 25 December 2020, USD 4 billion worth of FX and USD 4.6 billion worth of gold were maintained for Turkish lira liabilities within the framework of the ROM facility (Chart 2.2.2.5). For FX liabilities, USD 54.8 billion worth of FX and USD 6.3 billion worth of gold were maintained (Chart 2.2.3.6).

Following the BRSA’s regulation regarding domestic banks’ swap transactions with non-residents, banks’ use of the CBRT swap facility increased. In this context, taking into account the needs and demands of banks regarding maturity and liquidity management, the total limit of outstanding Turkish lira currency swap market transactions conducted via the quotation method was raised in April from 20% to 30% of banks’ total transaction limits at the Foreign Exchange and Banknotes Markets. The total limit of outstanding Turkish lira currency swap transactions conducted via the traditional (multi-price) auction method was gradually raised from 20% to 60% of banks’ total transaction limits at the Foreign Exchange and Banknotes Markets. As of 31 December 2020, the outstanding amount of the Turkish currency swap market transactions conducted via the quotation method was USD 1.3 billion, while the outstanding amount of Turkish lira currency swap transactions conducted via the traditional auction method stood at USD 27 billion.

The CBRT continued to conduct US dollar and euro transactions consistent with the monetary policy rates at the BIST Swap Market in 2020. As of 31 December 2020, the CBRT’s swap transactions at the BIST Swap Market amounted to USD 7.6 billion.

Within the scope of the targeted liquidity facilities offered to banks in March to contain possible adverse effects on the Turkish economy of the global uncertainty led by the coronavirus pandemic, the CBRT conducted Turkish lira currency swap quantity auctions: (i) against US dollars and euros at an interest rate 100 basis points lower than the CBRT’s policy rate for one-year maturity, and (ii) against US dollars at an interest rate 125 basis points lower than the policy rate for six-month maturity. As of 31 December 2020, the outstanding amount of TL currency swap transactions conducted via the quantity auction method stood at USD 2.7 billion.

In order to contribute to the banks’ liquidity management, the TL Gold Swap Market and FX Gold Swap Market transactions at the CBRT also continued in 2020. As of 31 December 2020, the net outstanding amount at the TL Gold Swap Market was 28.1 tons, and the net outstanding amount on the buy side at the FX Gold Swap Market was 31.5 tons. There is no outstanding amount arising from the sell side FX Gold Swap transactions. Moreover, in line with the press release of 17 March 2020, TL swap auctions were initiated against gold in order to contribute to the TL and FX liquidity management of banks. Accordingly, the net outstanding amount arising from these transactions stood at 64 tons as of 31 December 2020.

The surge of gold prices in global markets due to global uncertainties led by the coronavirus pandemic, along with the increase in the demand for gold from residents, caused banks to use the CBRT’s location swap and gold buying transactions against FX intensively since March 2020. In this scope, considering the gold supply and demand developments in domestic markets, the purchase of gold domestically produced from ore against Turkish lira was suspended on 8 October 2020, and gold selling transactions against FX were launched at the BIST Precious Metals and Diamond Market on 25 September 2020.

In 2020, depending on market conditions, the CBRT continued to conduct the TL cash-settled FX futures transactions, launched on 31 August 2018 at the BIST Derivatives Market (VIOP).

The first usage of the Chinese Yuan (CNY) funding under the renewed swap agreement signed between the CBRT and the People’s Bank of China in 2019 took place in June. The overall limit of the bilateral currency swap agreement, signed on 17 August 2018 between the CBRT and Qatar Central Bank, was increased from USD 5 billion equivalent of Turkish lira and Qatari riyal to USD 15 billion equivalent of Turkish lira and Qatari riyal.

In 2020, in parallel to the developments in global interest rates, the US dollar buying rate on FX deposits as collateral was gradually lowered to 0% from 1.50% in all maturities. The Foreign Exchange Deposit Market interest rates that the banks pay on borrowing from the CBRT were gradually reduced for US dollar borrowings to 2.50% from 3.50% at one-week maturities and to 3.25% from 4.25% at one-month maturities. Moreover, in addition to the current maturities, the CBRT introduced in February the facility of FX deposits as collateral at two-day maturity. With a view to enhancing the effectiveness and the operational flexibility of banks’ collateral management, in addition to the existing maturities of collateral gold deposits as two weeks, one month, two months and three months, the two-day and one-week maturities were also introduced.

Concerning the FX amounts held in the required reserve and notice FX deposit accounts at the CBRT, the annual commission rate;

The aim of rediscount credit for export and foreign exchange earning services is to facilitate export companies’ access to credits at favorable costs and to reinforce the CBRT’s reserves. Rediscount credits, which are governed by Article 45 of the Central Bank Law, are extended in Turkish liras to exporters and firms that engage in foreign FX earning services and activities by accepting exporters’ FX denominated bills for rediscount through intermediary banks. The loans normally have up to 240 day maturities (360 days for exports of high tech products and exports to new markets) and are repaid to the CBRT in foreign currency.

The total limit available for rediscount credits is USD 20 billion, USD 17 billion of which is assigned to Turk Eximbank and the remaining USD 3 billion to other banks, and these limits remained intact in 2020. The credit limit is USD 400 million for foreign trade capital companies, and USD 350 million for other companies. The entire limit can be used in applications for credits with a maturity of up to 120 days, whereas a maximum of 60% of the limit can be used in credit applications with a maturity of 121 to 360 days. Moreover, these limits are doubled, tripled and quadrupled for firms with net sales revenues (pertaining to the last fiscal year) above TRY 5 billion, TRY 15 billion and TRY 20 billion, respectively.

The CBRT announced a set of measures regarding rediscount credits on 17 March 2020 and 31 March 2020 to contain adverse effects of the global uncertainty led by the coronavirus pandemic, to boost cash flow of exporting firms and to maintain uninterrupted access to financing. Accordingly, exporting firms and firms that engage in foreign exchange earning services were provided with much needed funding during an economic stagnation environment through rediscount credits at favorable costs. In the following period, as part of the normalization steps that started in August, measures related to rediscount credits were also eased gradually.

With the measures announced on 17 March 2020, the maturities for repayments of rediscount credits which will be due from 18 March 2020 to 30 June 2020 were extended by up to 90 days, and the maximum maturities for rediscount credits were extended to 240 days from 120 days for short-term credit utilization and to 720 days for longer-term credit utilization. Additionally, in the case of a likely failure to fulfill export commitments due to the stagnation in global trade, the maximum duration for the export commitment fulfillment of rediscount credits whose export commitment has not been fulfilled as of 18 March 2020 and for those credits to be used from 18 March to 30 June 2020 were extended to 36 months from 24 months. The facilities of extending maturities and the export commitment fulfillment duration ended on 30 June 2020. The maximum maturity for these credits was reduced to 360 days on 7 August 2020. By the end of 2020, the maximum maturities were reduced to 240 days, with those for the exports of high tech products and exports to new markets, as well as for financing foreign exchange earning services being set at 360 days. Moreover, on 27 October 2020, in order to facilitate accessing finance under favorable conditions for the aviation industry, one of the sectors severely hit by economic and financial challenges due to the coronavirus, it was decided that the provision stipulating that maximum 60% of the company limits may be use in applications for loans with maturities of 121 days or longer would not be applied for aviation companies until 31 December 2021.

To facilitate goods and services exporting firms’ access to finance and support sustainability of employment, on 31 March 2020 it was decided to extend Turkish-lira denominated rediscount credits at 150 basis points lower than the policy rate and with a maximum maturity of 360 days until the end of 2020.2 The scope of the services export was expanded and the condition of maintaining the employment level throughout the credit period, in addition to maintaining the export commitment, was introduced within the Turkish lira rediscount credit facility. This facility developed with a multi-faceted approach aims to support the access of small and medium-sized enterprises (SMEs) to finance as well as the continuity of employment. As part of the normalization process, on 12 August 2020, the interest rate applied to Turkish-lira rediscount credits was revised as the CBRT policy rate and it was decided to make these loans available only to SMEs.

The FX rediscount credit utilization, which was USD 24.4 billion in 2019, became USD 22.5 billion in 2020. The contribution of rediscount credits to the CBRT’s net FX reserves, which was USD 22.7 billion in 2019, became USD 23.1 billion in 2020. Within the scope of the measures taken to counter economic and financial effects of the coronavirus pandemic, the maturity of 2,083 loans amounting to USD 3.9 billion were extended to 90 days between 19 March-30 June 2020, and a total of 2,181 Turkish lira rediscount credits amounting to TRY 10.3 billion were extended to 1,374 firms.

Additionally, on 7 July 2020, as part of promoting local currencies in foreign trade, to allow extension as rediscount credit of the Qatari riyal (QAR) funds obtained upon the revision of the swap agreement between the CBRT and Qatar Central Bank on 17 May 2020, in addition to the CNY rediscount credit, the Implementation Instructions on Rediscount Credits denominated in Chinese Yuan were abolished and replaced by the Implementation Instructions on Rediscount Credit Arising from Swap Agreements. The swaps-driven rediscount credit use to finance trade or investment activities to be engaged between the Republic of Turkey and the People’s Republic of China with local currencies totaled approximately CNY 267 million (USD 39 million) in 2020.