2.4 Financial Infrastructure

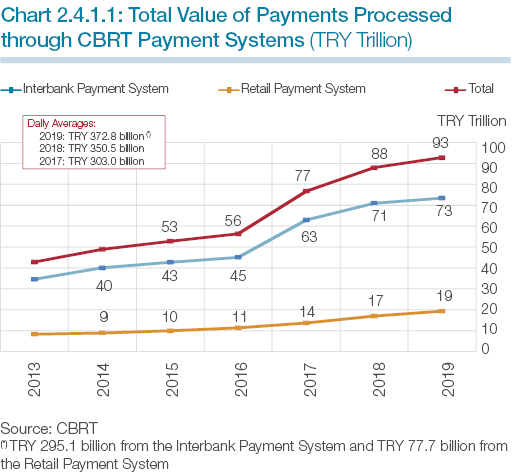

In 2019, the total number of transactions conducted via the Interbank Turkish Lira Transfer System was 2.8 million and the total transaction amount was TRY 73 trillion. The number of daily average transaction was 11 thousand and the daily transaction amount was TRY 295.1 billion. The amount of transactions conducted via the Interbank Turkish Lira Transfer System increased by 3.5% compared to the previous year (Chart 2.4.1.1).

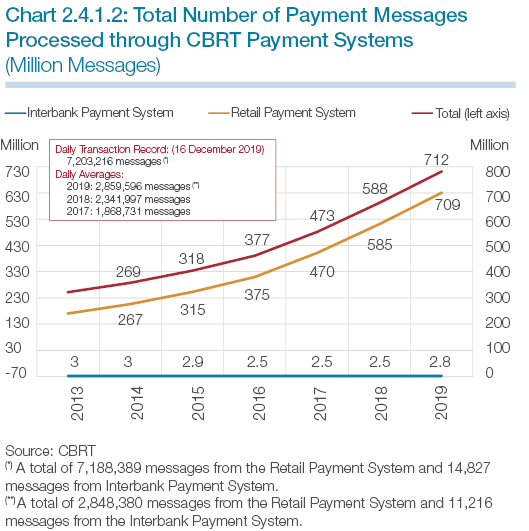

The total number of transactions conducted via the CBRT Retail Payment System in 2019 was 709 million and the total transaction amount was TRY 19 trillion. While the daily number of transactions was 2.8 million, the average daily transaction amount was TRY 77.7 billion. The number of settlements carried out via the Retail Payment System in 2019 was approximately 22.1% higher than in 2018 (Chart 2.4.1.2).

The sum of transactions conducted in both systems in 2019 was TRY 93 trillion.

The number of messages processed in the auction system was, approximately 130 thousand.

With the inclusion of the Emlak Participation Bank in the CBRT’s Payment Systems, the number of participants in the system became 53.

Terms such as “payment system”, “securities settlement system”, “payment service provider”, “payment institution” and “electronic money institution” were defined for the first time in Turkish legislation in the Law on Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions (Law No. 6493) that was enacted in 2013. Moreover, Law No. 6493 authorized the BRSA to supervise payment service providers providing payment services to customers or issuing electronic money, and authorized the CBRT with overseeing payment systems and securities settlement systems in which member banks, non-bank payment service providers or other financial institutions conduct transactions among each other.

Nevertheless, the advances and developments in the field of financial technologies since the enactment date of Law No. 6493 affected the field of payments as well and gave way to new payment services and implementations. Thus, the need for change and arrangements that emerged during the implementation phase necessitated a united structure for regulation, licensing and supervision that was divided between the CBRT and the BRSA. Authorizing a single institution with regulatory and supervisory duties regarding payment and securities settlement systems, payment services, payment and electronic money institutions was expected to accelerate the development of financial services and institutions providing these services as well as financial transactions and thus contribute to the general economy in a broader sense.

Accordingly, Law No. 7192 on “Amending Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions Law and Other Laws” was issued in the Official Gazette of 22 November 2019. It was stated that the article concerning the establishment of the Turkish Payment and Electronic Money Institutions Association would be enacted six months after the issue of the Law and other articles would take effect as of 1 January 2020.

The changes that Law No. 7192 introduced can be grouped under three main headings:

Accordingly, the key changes introduced by the Law are summarized below:

The Financial Technologies Permanent Sub-Committee, which was established on 6 April 2018, consists of executives from the Ministry of Treasury and Finance, the Banking Regulation and Supervision Agency (BRSA), the Capital Markets Board (CMB), the Savings Deposit Insurance Fund and the Central Bank of the Republic of Turkey. The Sub-Committee, which is chaired and coordinated by the CBRT, organized two meetings and one workshop in 2019. The outcomes of the meetings and the workshop were compiled in the Financial Technologies Country Report.

As per the authority given to the CBRT with Law No. 7192, several changes have been made in the organizational structure of the CBRT. Accordingly, to be effective as of 1 January 2020, the Financial Technologies Division was established under the Payment Systems and Financial Technologies Department in order to conduct research and cooperation activities, to address growing needs and necessary strategy in the face of FinTech developments worldwide, to monitor developments in the fields of payment systems, payment services and financial technologies, to understand the sector’s needs and to contribute to a strong ecosystem.

Approval of Istanbul Settlement and Custody Bank’s (Takasbank) Application for Collateral Uniformity

Takasbank operates the Equities Market, Borrowing Instruments Market and the Cheque Clearing System. Takasbank’s application for uniformity of assets that can be accepted as collateral and guarantee fund contribution in the central counterparty service in which it acts as buyer against seller and seller against buyer, as well as the methodology regarding valuation of these assets was accepted on 5 November 2019. The “collateral uniformity” is the first step of the “Single Collateral Pool” designed to increase the effectiveness of the collateral management in markets for which Takasbank provides central counterparty services and decrease market participants’ operational costs/risks. Takasbank continues with other steps towards the “Single Collateral Pool Project.

Approval of Share Transfer of Mastercard Payment Transaction Services Turkey (MPTS)

Mastercard/Europay U.K. Limited’s application to transfer its 99.99% share in Mastercard Payment Transaction Services (MTPS) Turkey to Kartek Holding Inc. has been accepted by the CBRT. After the approval, the company’s name has been changed to “Paycore Payment Systems Clearing and Settlement Systems Inc.”. The change in the company’s name was registered by the Istanbul Trade Registry on 19 June 2019.

Moreover, upon MPTS’s application, the Masterpass Service, which allows safe and easy conduct of payment and money transfer transactions via internet and mobile devices, was excluded from the scope of the official authorization given to MTPS. The decision concerning the action was issued in the Official Gazette of 30 May 2019.

Approval of Interbank Card Center (BKM)’s Application for a Collateral Mechanism to Intervene in Case of a Likely Default in the Domestic Clearing and Settlement System

The Domestic Clearing and Settlement System (YTH) operated by the Interbank Card Center (BKM), in which clearing and settlement operations of fund transfers emerging from card transactions between card issuers and institutions accepting payment cards, is included in the “Important Payment System” Category in the framework of the Oversight Framework for Payment and Securities Settlement Systems. The BKM is obliged to take necessary measures to manage credit and liquidity risks stemming from this system as per the Principles for Financial Market Infrastructures, PFMI.

Accordingly, in order to effectively address such risks, the BKM has applied to the CBRT for approval of a collateral mechanism to intervene in case of a likely default in the YTH system. At the end of the evaluations of BKM’s proposed collateral mechanism, the CBRT approved implementation of the mechanism with an Executive Committee decision dated 2 July 2019.

In accordance with the Law No. 6493 and secondary legislation issued pursuant to this law, the CBRT has the authority and responsibility to oversee the payment and securities settlement systems to ensure their uninterrupted operation.

Based on its authorities and responsibilities given by relevant legislations, the CBRT oversees payment and securities settlement systems in a process that begins with the licensing of organizations that set up and manage these systems and continues with the conduct of their operations. As oversight activities are progressive, the CBRT monitors the system operators by checking information and documents collected, conducts on-site visits when it deems necessary to perform more detailed examinations of transactions and documentation. Based on the findings of these oversight activities, the CBRT prepares detailed reports concerning system operators’ compliance with the CBRT regulations and international standards.

Accordingly, in the first half of 2019, the CBRT carried out detailed oversight activities regarding the Central Securities Depository of Turkey (CSD) and the BKM, made on-site visits and prepared oversight reports after examining the compliance of these operators’ systems with the provisions of the secondary legislations of Law No. 6493 and with the Principles for Financial Market Infrastructures (PFMI) published by the BIS Committee on Payments and Market Infrastructures (CPMI) and by the International Organization of Securities Commissions (IOSCO).

In addition to detailed oversight activities, all transactions and structural changes conducted by system operators are monitored closely.