2.9. Communications Policy and Activities

Effective communication of monetary policies is important for the public's understanding of the CBRT's implementations concerning price stability and financial stability as well as for fulfilling the responsibility of accountability which is brought about by the Bank's instrumental independence. Accordingly, in 2012, the CBRT further improved its approach to communications and transparency with a view to enhancing the public's confidence and the effectiveness of policies within its new monetary policy framework.

In accordance with Article 42 of the CBRT Law concerning the regulations on the responsibility of accountability, Governor Erdem Başçı delivered presentations on the economic outlook and monetary and exchange rate policy implementations before the Council of Ministers on 2 May and 22 October 2012, and before the Planning and Budget Commission of the Great National Assembly of Turkey on 14 June and 6 December 2012. In 2012, the CBRT also continued to publish its analytical balance sheet daily on its website in the framework of its responsibility of accountability and via a report, it disclosed to the public the results of the audits of its balance sheet and income statements, which were conducted by independent auditors.

MPC decisions and Inflation Reports are the main communication tools of the CBRT within the framework of the current monetary policy. Accordingly, Inflation Reports were announced at press conferences by Governor Erdem Başçı on 31 January 2012 in İstanbul, on 26 April and 26 July 2012 in Ankara and on 24 October 2012 in İstanbul. Via these Inflation Reports, the Bank informed the public about its general evaluations on international economic developments, financial markets and public finance as well as the developments on inflation, supply and demand fronts and its medium-term projections.

In 2012, the Bank also continued to post the decisions of the MPC on short-term interest rates and other instruments in the monetary policy instruments kit as well as the summaries of the MPC meetings on its website. The CBRT shared the Monetary and Exchange Rate Policy to be implemented in 2013 with the public on 25 December 2012, and announced that the "Monetary and Exchange Rate Policy for 2014" would be released on 24 December 2013. The CBRT also informed the public about the changes in implementations and the activities that are closely related to the public via various press releases in 2012.

In order to promote better understanding of monthly inflation developments by the public in the interval between the release of official price statistics and the MPC meeting, the Bank continued to publish the "Monthly Price Developments Report" the day following the release of inflation figures.

The CBRT, which also acts diligently to communicate financial stability as an auxiliary objective along with its main objective of price stability, released the Financial Stability Reports on its website on 31 May and 29 November 2012, in accordance with its pre‑announced calendar of data release and shared its perspective about the overall financial sector with the public.

In 2012, to improve publicity of the Bank and its policy implementations for segments of the public that are relatively less informed about the Bank, the CBRT published several booklets and released these publications in both print and electronic formats. For example, the booklet "The Central Bank of the Republic of Turkey from Past to Present" was issued in 2012. Booklets entitled "Independence of the Central Bank - The Central Bank of the Republic of Turkey and Independence" and "History of Banknote Printing in Turkey - Banknote Production Process and Issue Policies", which had been prepared in 2012, were printed in 2013. These booklets were disseminated to banks, economics education faculties, libraries, non‑governmental organizations and various other institutions in Turkey. The CBRT also continued to publish the quarterly "Bulletin", which informs the public about its policy implementations as well as its institutional structure, activities and publications. The Bulletin, which is distributed to a wide readership in Turkey and abroad, is also accessible on the CBRT's website. In addition, to introduce its policies and implementations to a wider audience, the CBRT published a brochure in Turkish and English on its website and delivered it to various segments of the public.

In the framework of the direct communications policy of the Bank, Governor Erdem Başçı delivered various speeches and presentations in Turkey and abroad, introducing the policies and implementations of the Bank and analyzing current economic developments. Within this scope, Governor Başçı made presentations about the economic outlook and monetary and exchange rate policies at conferences open to the press held by chambers of commerce and industry in Bursa, Adana, Elazığ, Kocaeli and Antalya. Moreover, the Governor also related the CBRT's policies to the public via visual media by attending TV programs on various national channels. Speeches and presentations delivered by the Governor, MPC members and senior Bank management and videos of some of the Governor's speeches are available on the CBRT's website.

As part of its communications policies, the Bank has been holding meetings closed to the press since May 2011 in response to requests from bank economists for meetings on a technical level. These meetings, held in the presence of the MPC members as well as the heads and deputy heads of the related departments, start with a presentation by the Bank's chief economist on the latest macroeconomic developments. This presentation is then followed by a question-answer session, where members of the MPC answer economists' questions. A total of twenty meetings were held in Ankara in 2012, attended by 596 Turkish and foreign economists and analysts. The presentations delivered in these meeting are posted on the Bank's website under the "Remarks/Technical Presentations" menu.

The CBRT continued to use its website efficiently and effectively in 2012 and had around 109,000 hits per day on average on weekdays. Visitors accessed approximately 9 million pages in 2012, Inflation Reports and MPC Meeting Decisions being the most frequently viewed.

Responding to the demand from universities as well as public agencies and institutions, the Bank organized informative programs both within the Head Office of the Bank and outside Ankara in 2012. As a result of these programs, 19 groups of third and forth year university students were informed about the history of the Bank, monetary and exchange rate policies and career opportunities.

In 2012, the CBRT continued to respond to requests for information via its electronic mail address, iletisimbilgi@tcmb.gov.tr, which was introduced specifically to ensure communication with individuals, institutions and establishments outside the Bank, as well as through the 'Unit on Right to Information' and also 'BIMER' (the Communication Center of the Prime Ministry), both established pursuant to the Law on the Right to Information. Throughout 2012, a total of 11,129 applications were responded to via the Right to Information System and 1,376 applications were answered via BIMER.

To promote Turkey on international economic platforms and foster mutual relations and cooperation with fellow central banks and international institutions, the CBRT organized various meetings and conferences to discuss topics on the agenda both at home and abroad. The "Policy Responses to Commodity Price Movements" conference was held jointly with the IMF and the IMF Economic Review on 6-7 April 2012. In addition, the CBRT hosted the "Financial and Macroeconomic Stability: Challenges Ahead" conference and the "G20 Conference on Financial Systemic Risk" conference in İstanbul on 4-5 June and 27-28 September 2012, respectively, as well as the "Fragmentation in the International Financial System: Can the Global Economy Become One Again?" conference on 14-15 July 2012 in Nevşehir. These conferences brought together distinguished economists and central bankers from around the world.

Moreover, the CBRT and BRSA co-hosted the 145th Meeting of the Basel Committee on Banking Supervision and the 17th International Conference of Banking Supervisors on 11-14 September 2012. The Bank also hosted the "Reserve Requirements & Other Macroprudential Policies: Experiences in Emerging Economies" conference on 8-9 October 2012, which provided a platform to share empirical and theoretical studies on reserve requirements and other macroprudential policies and an insight into the experience of emerging economies regarding the use of such policies as well as the challenges faced by central banks in the aftermath of the global financial crisis. Participants from international institutions and fellow central banks attended the conference.

In 2012, the CBRT took important steps toward enhancing communication and technical cooperation with other central banks. First, a bilateral currency swap agreement was signed with the People's Bank of China on 21 February 2012, to facilitate bilateral trade in respective local currencies of the two countries. Then, on 16 May 2012, a memorandum of understanding was signed with Bank Negara Malaysia and the Central Bank of Mauritania to promote bilateral investment and liquidity arrangements and to enhance economic and financial linkages between Turkey and these countries. Later, another Memorandum of Understanding was signed between the CBRT and the European Central Bank on 4 July 2012, which laid the foundation for continued cooperation between the two central banks in the field of central banking through regular dialogue on technical and policy levels. Finally, a memorandum of understanding was signed with the National Bank of Tajikistan on 18 December 2012, to provide a platform to enhance cooperation in the field of central banking between the two central banks.

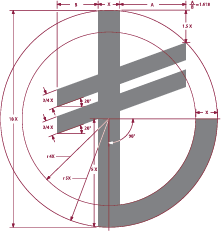

In consonance with the strategic aim to "introduce a sign for Turkish lira to promote it both at home and abroad", the CBRT launched a "Turkish Lira Sign Competition" in 2011 to select a unique symbol for the Turkish currency that would be easily recognizable, aesthetically pleasing, eye-catching and at the same time easy to reproduce by hand, hence raising worldwide recognition. The result of the competition and the Turkish lira sign were unveiled at a press conference held on 1 March 2012 in the presence of Prime Minister Recep Tayyip Erdoğan and the Deputy Prime Mister Ali Babacan. To promote the use of the Turkish lira sign by the public and to ensure its use in the electronic environment, a "Turkish Lira Sign" page was created on the CBRT's website; the "Frequently Asked Questions" link was inserted on this page and the use of the Turkish lira sign was emphasized in meetings/conferences held with public institutions and establishments, representatives of the financial sector, economists and press members. To make the Turkish lira sign known to all segments of the society and provide a maximum level of information about the sign, the Bank got in touch with several public institutions and establishments; studies were conducted to integrate the sign to some processing systems and international character encoding standards and finally, meetings with software and hardware producers were held.