2.2 Operational Framework of Monetary Policy

The funding need of the system, which amounted to TL 95.54 billion as of end-2016, increased to TL 110.71 billion twelve months later.

Having set an overall Turkish-lira portfolio target of TL 15 billion for 2017 and taking also into account the TL 2 billion worth of nominal instruments to be redeemed during the year, TL 3 billion worth of nominal instruments were accepted for the open market operations (OMO) portfolio, which was TL 13.9 billion at the beginning of 2017. In this way, the year-end portfolio target was reached.

In 2017, the CBRT continued the technical work towards achieving simpler and transparent collateral conditions in TL operations within the CBRT. Therefore, in the framework of the Common Collateral Project, whose aim is to provide a common platform for the conduct of collateral operations for all CBRT markets, as of 11 August 2017:;

In 2017, the CBRT continued to adhere to a floating exchange rate regime in which exchange rates are determined by market supply and demand conditions. Under this regime, the CBRT does not have any nominal or real exchange rate targets. Nonetheless, in order to curb any risks that might impair financial stability, the CBRT does not remain unresponsive to excessive appreciation or depreciation of the Turkish lira.

In 2017, the CBRT did not intervene in FX market directly or by way of conducting auctions.

On 18 January 2017, the CBRT started conducting FX deposit auctions against TL deposits, by means of which it supplied a maximum USD 6.25 billion worth of temporary FX liquidity to the market. On 21 March 2017, the bank raised the buying rate on FX deposit as collateral from 0.75 percent to 1.00 percent, and then to 1.25 percent on 16 June and to 1.50 percent on 18 December.

On 20 November 2017, the CBRT initiated the TL-settled forward foreign exchange sale auctions. By means of this instrument, the maximum position carried in maturities of 1.3 and 6 months was USD 3 billion.

Taking into account the developments in international benchmark interest rates, the CBRT raised the interest rate on USD-denominated required reserve option accounts, and free accounts held at the CBRT from 0.75 percent to 1.00 percent on 21 March 2017, then to 1.25 percent on 16 June and to 1.50 percent on 18 December.

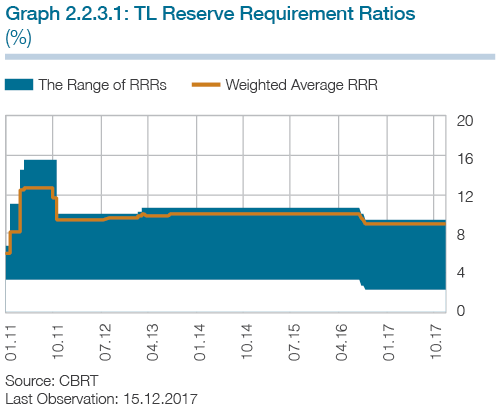

The CBRT continues to use reserve requirements as both a monetary policy and macroprudential policy instrument. As of end‑2017, the weighted‑average reserve requirement ratios for TL and FX were 10.0 percent and 12.5 percent, respectively (Graphs 2.2.3.1 and 2.2.3.2). ROM has not only contributed to total reserves but has also limited the potential impact of capital flow volatilities on FX markets.

The CBRT continues to use reserve requirements as both a monetary policy and macroprudential policy instrument. As of end‑2017, the weighted‑average reserve requirement ratios for TL and FX were 10.0 percent and 12.5 percent, respectively (Graphs 2.2.3.1 and 2.2.3.2). ROM has not only contributed to total reserves but has also limited the potential impact of capital flow volatilities on FX markets.

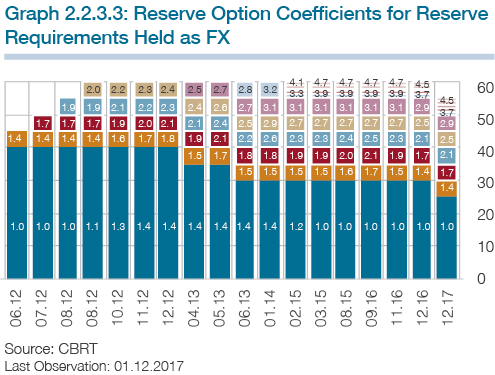

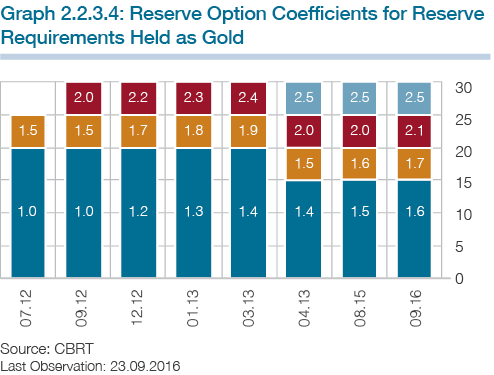

Banks and financing companies continue to use the CBRT’s ROM facility. As of end‑2017, the ratio of utilization for the FX facility was 75.5 percent and that for the gold facility was 90.9 percent. Banks in Turkey can also keep standard gold in their precious metal deposit accounts and this facility’s utilization ratio by the end of 2017 was 71.2 percent.

In order to attract gold savings into the formal economy and also to increase reserves, a new ROM tranche of 5 percent was added to the existing ones, thereby permitting wrought and scrap gold to be held in standard gold accounts. Use of this new facility increased steadily throughout the year and as of end‑2017, this facility was being used by twelve banks and the utilization ratio was 17.5 percent.

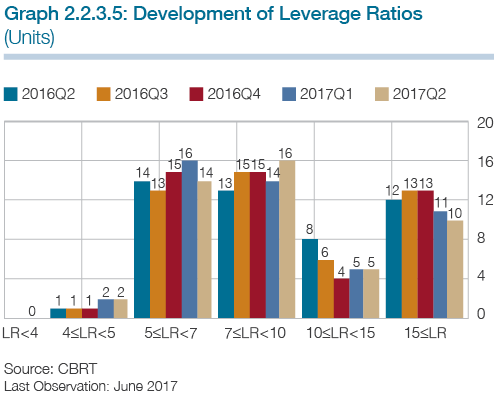

The leverage‑based reserve requirement regulation aims to counter risks associated with conducting high‑leverage operations in the banking sector and thus to improve the system’s resilience to shocks. The sector’s leverage ratio, which is calculated by dividing the Tier 1 capital by the sum of total liabilities and off‑balance‑sheet items (at certain weights) was around 7.5 percent as of June 2017. The Turkish banking sector’s leverage ratio in 2017 was stable and well above the minimum Basel III ratio of 3 percent and the minimum CBRT requirement for the last quarter of 2015 of 5 percent (Graph 2.2.3.5 and Table 2.2.3.1).

Table 2.2.3.1: Development of Leverage Ratios (Units, %)

|

No. of Banks |

Leverage Ratio (%) |

|---|---|---|

2016Q1 |

48 |

7.55 |

2016Q2 |

48 |

7.69 |

2016Q3 |

48 |

7.84 |

2016Q4 |

48 |

7.55 |

2017Q1 |

48 |

7.40 |

2017Q2 |

47 |

7.52 |

In the scope of article 45 of the Central Bank Law, rediscount credits are extended to exporters and firms that engage in foreign currency‑earning services and activities. These loans are extended as Turkish liras through the Export Credit Bank of Turkey (Turk Eximbank) as well as through commercial banks, which accept exporters’ FX‑denominated bills for discounting. The loans normally have up to 240‑day maturities (360 days for exports of high‑tech products and exports to new markets). The loans are repaid to the CBRT in foreign currency.

In line with efforts both to reduce Turkey’s current account deficit and to reinforce the CBRT’s reserves by supporting exports, the total limit available for rediscount credits is USD 20 billion, USD 17 billion of which is assigned to Turk Eximbank and the remaining USD 3 billion to commercial banks. Credit limits by types of companies are: up to USD 400 million for foreign trade capital companies and up to USD 350 million for other companies. The entire limit can be used in applications for credits with a maturity of up to 120 days and maximum 60 percent of the limit can be used in credit applications with a maturity of 121‑360 days.

As part of an effort to encourage the use of local currencies in the conduct of foreign trade, a swap agreement was signed between the Republic of Turkey and the People’s Republic of China. In the framework of the swap agreement, in January 2017, the CBRT published a set of implementation instructions, the “Circular on Rediscount Credits denominated in Chinese Yuans”, concerning the acceptance of bills denominated in Chinese yuan (CNY) for rediscount against a total credit limit of CNY 2 billion to be used in payments of trade and investment activities between the two countries. Within this framework, in 2017, CNY 23.5 million worth of rediscount credits was extended to seven firms for ten projects.

In February 2017, considering the provisions of Article 6 of the Decree Law No: 683 that was published in the Official Gazette No: 29957 dated 23 January 2017 and in November 2017 considering unsound price formations that are inconsistent with economic fundamentals, more convenient terms for the repayment were presented for the firms that have used rediscount credits by offering facility to repay their foreign exchange liability in Turkish liras. Within these facilities:

The total amount of rediscount credits, which was USD 18.1 billion in 2016, rose to 20.4 billion in 2017 and by the end of 2017, the outstanding value of rediscount credits was USD 12.5 billion.

Rediscount credits’ contribution to the CBRT’s FX reserves was USD 12.5 billion in 2017.

The CBRT sets and announces the maximum monthly contractual and default interest rates to be charged on credit card borrowing on a quarterly basis. Having previously set maximum monthly contractual rates for credit cards as 1.84 percent for TL and 1.47 percent for FX, maximum monthly default rates as 2.34 percent for TL and 1.97 percent for FX, the bank did not change them in 2017.