2.2.3. Reserve Requirement Ratios

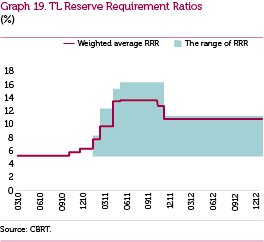

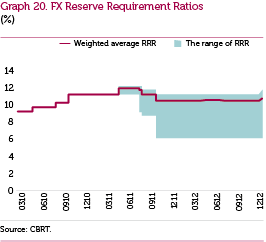

The CBRT continues to use reserve requirements to achieve an effective liquidity management and bolster reserves. There has been no change in the TL reserve requirement ratios since October 2011, and the weighted average of the TL reserve requirement ratios realized as 10.5 in this period. Meanwhile, to be effective from the calculation period of 21 December 2012, FX reserve requirement ratios were raised by 0.5 percentage points for other liabilities excluding deposits with maturities of one year or longer and longer than three years in order to support the extension of the maturity of FX liabilities of the Turkish banking system. The arrangement elevated the weighted average FX reserve requirement ratio to 10.6 (Graphs 19 and 20).

Reserve Options Mechanism (ROM)

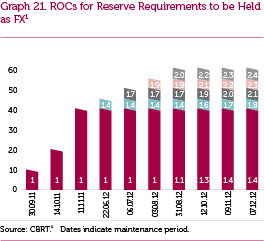

To enhance financial stability, the CBRT completed much of the work regarding the establishment and enforcement of the ROM in 2012. The ratio of TL reserve requirements that can be held in FX was raised gradually from 40 percent to 60 percent with increments of 5 percentage points as of June 2012. The ROC for the first tranche of 40 percent and the subsequent tranches of 5 percent ranged from 1.4 to 2.4 (Graph 21).

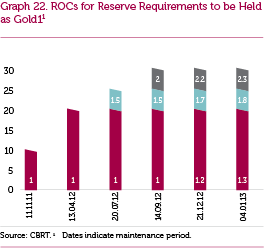

To be effective from the calculation period of 30 March 2012, the upper limit for standard gold reserves that may be held to meet TL reserve requirements was raised from 10 percent to 20 percent, while the limit for standard gold reserves that may be held to meet FX reserve requirements excluding precious metal deposit accounts was reduced from 10 percent to 0 percent. Then, as of July 2012, the upper limit for standard gold reserves that may be held to meet TL reserve requirements was raised from 20 percent to 30 percent with increments of 5 percentage points; ROCs for the first tranche of 20 percent and the subsequent tranches of 5 percent gradually increased from 1.3 to 2.3 (Graph 22).

Banks use the facility of holding TL required reserves in FX and gold widely and consistently. By the maintenance period of 21 December 2012, the utilization ratio of the FX facility became 85 percent, and that of the gold facility reached 88 percent across the sector. Banks can also maintain standard gold for precious metal deposit accounts, the utilization ratio of which is around 72 percent.