2.3.1. Developments in Financial Stability

Global integration, growth and development process in the pre-crisis period was replaced by regional fragmentation, fragilities and spillover effects the global crisis loomed. While the restructuring of the financial system at national and international levels and new arrangements and protectionism in foreign trade occupied the agenda on the one hand; enhanced international coordination and cooperation were tried to be attained on the other. However, the recovery process is basically related to the policies implemented as well as the political will of the countries. Despite some signs of recovery in the international financial system, confidence is yet to be established. During this process, reforms regarding the financial system need to be implemented at the right time in the right sequence, and also need to be underpinned by effective and innovative policies.

In this context, the atmosphere of uncertainty, which affected the world as a whole following the global crisis, remained on the agenda throughout 2012 as well. Recovery in advanced economies lagged behind expectations spilling over into the growth outlook of emerging economies, which performed well in the preceding period. On the other hand, the recent fiscal measures taken by authorities to solve global economic problems were appreciated, supporting the relatively positive change of the outlook in global markets. Accordingly, the upward pressure on the Euro area bond returns was partially contained and the risk of deepening fiscal problems in the countries in the area alleviated in this period. In addition, monetary easing policies implemented by advanced economies to bolster their economies led to ample liquidity on a global scale limiting loss of value in stock and commodity prices. Increased liquidity also ensured the rise in risk appetite in the markets, thereby supporting capital flows towards emerging economies, the financial structures and growth potentials of which are relatively fine.

The atmosphere of global uncertainty emanating from advanced economies urges emerging economies to pursue flexible and efficient policies. Many emerging economies were engaged in structural changes to manage macro financial risks, and opted for unconventional policy practices in 2012. Accordingly, the CBRT adopted a new policy mix improving the inflation targeting regime by including financial stability (See Section 2.1.2). In this context, policy implementations regarding financial stability are conducted in coordination with relevant authorities, particularly the Financial Stability Committee.

Indicators pertaining to the banking sector show that the sector remained in sound condition throughout 2012. Basel II was put into practice in July 2012, the capital adequacy ratios of banks remained high, and the banking sector maintained its robust performance in profitability. Scenario analyses testing the resilience of the banking sector against the shocks emanating from credit and market movements show that the sector's regulatory capital is able to absorb shocks.

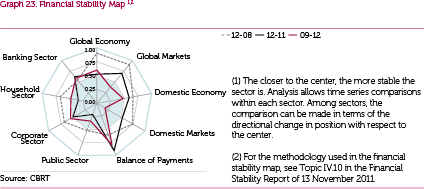

In this framework, the financial stability from a macro perspective suggests that global economic developments in 2012 proved worse than they were in 2011; whereas developments regarding global markets in 2012 exhibited a more favorable outlook compared to 2011 (Graph 23). While this difference points that the problems especially in advanced economies persist, it also suggests that the measures primarily affect markets through the expectations channel, and their manifestation in the overall economy takes time as indicators are issued with a time lag.

In Turkey, indicators pertaining to both the overall economy and the markets point to a more favorable outlook compared to 2011. This favorable outlook is not only observed in the domestic economy and domestic markets, but also in developments in the banking sector and the balance of payments. Meanwhile, the unfavorable outlook, albeit limited, regarding households, firms and the public sector compared to end-2011 should be monitored carefully.