2.3. Financial Stability Developments

Due to the supportive monetary policies put into effect since the global financial crisis, more favorable upturn signals have started from advanced countries in 2013. Despite this upturn, the recovery trend in the US economy has not stabilized and the problems in the functioning of the monetary transmission mechanism and public finance in Euro area have not been solved yet. In addition, the slowdown in the growth rate of emerging economies, which were the driving force of growth in the post-crisis period, has also emerged as a risk factor.

The statements made by the Fed in May 2013 led to a perception in the markets that the accommodative monetary policy implemented by the Fed came to an end and caused a global repricing of financial assets. Hence, long term US Treasury bond yields registered a significant rise while emerging economies experienced capital outflows from their currency and bond markets. At the September meeting, contrary to expectations, the Fed decided to maintain the bond buying program and thereby the normalization in the US monetary policy was postponed for a while. Consequently, in the subsequent weeks, volatility in the markets edged down and the losses from the foreign exchange and bond markets of emerging economies were partially compensated.

Increased uncertainties over global monetary policies as of the second quarter of 2013 have led to capital outflows from emerging market economies including Turkey. Although financial and non-financial sectors had no trouble borrowing from abroad, the recent volatility in portfolio flows to Turkey was higher than that experienced during the Euro area debt crisis in 2011.

The current account deficit makes the domestic economy more vulnerable to capital flows. Even if a slight deterioration was observed as of the first quarter of 2013, in the current account deficit due to the increase in imports demand as a result of revival in domestic demand, this deterioration was mainly driven by the gold trade. The recovery in the current account deficit excluding gold is expected to continue in the period ahead. Factors other than portfolio flows did not display a notable change in financing the current account deficit, which alleviates concerns over its financing.

The CBRT and other relevant authorities have continued to take the necessary structural measures to reinforce the strength of the financial system as well as to reduce its vulnerability to cyclical conditions. Accordingly, financing companies have been included in the reserve requirements coverage and regulatory actions have been taken to promote the utilization of export rediscount credits. The leverage-based reserve requirement practice, which is currently being monitored, will actually be implemented as of 2014. In this period, the Banking Regulation and Supervision Agency (BRSA), in line with its objective of boosting domestic savings and directing them to efficient fields, has launched regulations to restrain the growth in consumer loans, which will turn the loan breakdown in favor of corporate loans. The BRSA has continued its endeavors to harmonize national legislation and regulations with Basel III. These regulations are essential for financial stability as they enhance the resilience of the banking system’s capital structure against shocks and reduce the cyclical volatility of loans.

The Turkish banking sector, which has significantly increased the utilization of non-deposit funding sources recently and posted a loan-to-deposit ratio above 110 percent, was able to renew its external debts at reasonable costs in the period after May 2013. The foreign currency liquid assets of the sector are at a level that can cover almost half of its short-term external debts, implying that its financial structure is resilient against short-term external shocks.

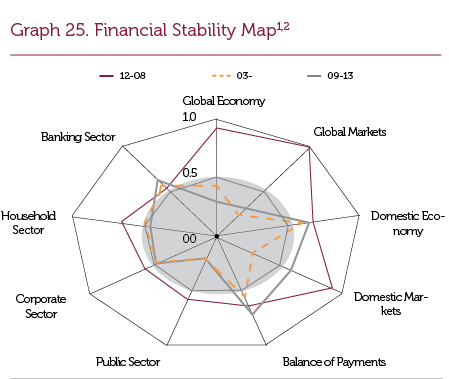

The macro display chart below shows a schematic reflection of developments regarding financial stability. In the last six-month-period, while the global economy has developed in a positive direction, global markets have deteriorated slightly (Graph 25). In the same period, the volatility in exchange rates and interest rates has increased in line with the volatility in global capital flows. However, the positive outlook in corporate and banking sectors has continued in addition to the economic recovery in households.

(1) Getting closer to the core means that the contribution of the related sector to financial stability has increased on the positive side. The analysis allows a historical comparison within each sub-sector. A cross-sector comparison is available only in terms of the direction of the change in the positioning as to the core.

(2) For the methodology used in the macro display of financial stability, see the Financial Stability Report (FSR) v.13, November 2011-Special Topic IV.10.