2.2.3. Reserve Requirement Ratios

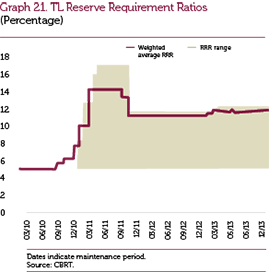

The CBRT continues to use reserve requirements as a monetary policy and macroprudential instrument. In order to promote the extension of the maturity of liabilities of the Turkish banking system, revisions were made in the reserve requirement ratios in 2013. Turkish lira reserve requirement ratios were raised gradually by 0.5 percentage points for all liabilities with a maturity of up to one year (Graph 21).

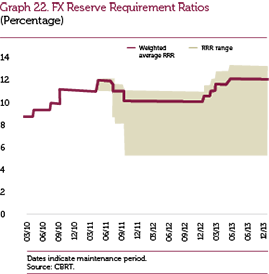

FX reserve requirement ratios were raised gradually by 0.5 percentage points for deposits with maturities of up to one year and other liabilities excluding longer than three-year maturity (Graph 22).

The arrangements elevated the weighted average reserve requirement ratios for Turkish lira and FX to 11 percent and 11.9 percent, respectively.

In order to simplify the structure of reserve requirements, immaterial items that had no direct effect on the monetary policy and that reduced the efficiency of operational process were exempted from the scope of reserve requirement liabilities with the Communiqué on Reserve Requirements No. 2013/15 published in the Official Gazette of 25 December 2013, No. 28862. Thus, a new approach was adopted in calculation of reserve requirements, directly taking into account the items that are subject to reserve requirements, instead of subtracting certain items from total domestic liabilities. The arrangement took effect as of the calculation period of 17 January 2014.

Considering the recent rise in credit volume and credit growth, especially in retail automobile loans, which significantly outpaced that of the banking sector and with a view to ensuring a sound monitoring of the credit channels of the non-bank sector as a requisite to financial stability, the financing companies were included in the reserve requirement coverage with the Communiqué on Reserve Requirements No. 2013/13 that became effective as of the calculation period dated 6 December 2013. With the Communiqué No. 2013/14, the ROM facility that allowed banks to keep their Turkish lira required reserves in foreign exchange or in gold became applicable to financing companies and any liabilities that they had before 4 October 2013 were excluded from reserve requirement coverage until the end of their maturity.

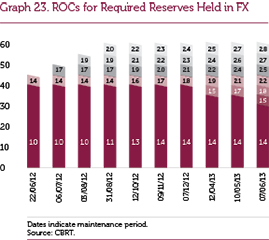

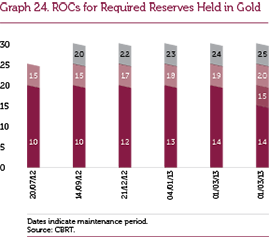

Throughout 2013, to complete the establishment process and thereby enhance the efficiency of the ROM, the tranches of 30 - 35 percent and 35 - 40 percent were added to the FX reserve option ratios and FX reserve option coefficients (ROC) were increased gradually except for the first tranche. Also the tranches of 15-20 percent were added to the gold reserve option ratios. Moreover, except for the first tranche, gold ROCs were increased by 0.1 percentage points in March and April. By the end of 2013, the coefficients corresponding to the last tranches of the FX and gold reserve options stood at 2.8 and 2.5, respectively (Graphs 23 and 24).

Banks use the ROM facilities widely and consistently. As of the maintenance period of 20 December 2013, the utilization ratio of the FX facility was 84 percent, and that of the gold facility reached 89 percent across the sector. Banks can also maintain standard gold for precious metal deposit accounts, the utilization ratio of which is around 74 percent.

The leverage-based reserve requirements system that controls the indebtedness of banks was put into effect in 2013 for monitoring purposes and will be gradually widened until the last quarter of 2015. Banks that raise the indebtedness to excessive levels might be subjected to additional reserve requirements. The leverage ratio of the sector amounted to around 7.5 percent in 2013. As per the arrangement, an additional reserve requirement of 1 to 2 percent in three stages was imposed on the banks with an average 3 to 3.5 percent leverage ratio in the last quarter of 2013 to be effective as of the second quarter of 2014.