2.3. Financial Stability Developments

In the first half of 2014, the normalization process in the Fed’s monetary policy continued to have an adverse impact on capital flows towards Emerging Market Economies (EMEs) due to volatility in capital flows and decline in risk appetite. In this context, capital flows to Turkey also weakened, increasing the volatility of exchange rates and financial markets. Taking into account the relative deterioration in the inflation outlook, the CBRT delivered a strong and front-loaded tightening in its monetary policy in January 2014. Concerns over financial stability dissipated to a large extent through the first half of 2014 as a result of the CBRT’s cautious stance, macroprudential measures that took the steam out of consumer credit growth, the easing of uncertainties with regard to the national economy, and the slight improvement in the global risk appetite. In the second half of 2014, the weak global economic outlook was accompanied by decoupling of the United States of America (USA) from other developed countries in terms of growth trends and the sharp decline in commodity prices, especially in oil prices. Growth decelerated in EMEs while Euro area and Japan did not show a strong recovery compared to the USA. Such decoupling was reflected on monetary policies of these countries. In this context, despite the Fed’s normalization process, the Euro area, Japan and China took steps to support economic growth.

Growth in the Turkish economy, which decelerated in the second quarter of 2014, performed better in the third quarter of the year. There was a moderate recovery in the private consumption and investment demand and the domestic demand provided more support for growth. Meanwhile, the contribution of exports to annual growth declined due to the global economic slowdown. Despite this change in growth composition, the moderate trend in consumer loans and favorable developments in terms of trade are likely to support the recovery in the current account balance. On the other hand, the uncertainties over the global monetary policies, the geopolitical developments and vulnerabilities of external demand still pose a risk to the recovery process.

The asset-liability balance of households continued to improve in 2014. Growth in household assets continued especially in investment funds, as a result of the rise in the savings. On the liabilities side, the weight of housing loans in retail loans gradually increased, while consumer loans remained as a primary funding source of households. The annual growth of personal credit cards and vehicle loans was taken under control with the contribution of macroprudential measures, curbing the excessive growth pace of household indebtedness. The ratio of the financial liabilities of the corporate sector to the GDP continued to increase on the back of the rise in domestic liabilities. The rise in domestic liabilities was mainly driven by TL loans while FX loans remained relatively weak. The corporate sector’s external liabilities remained stable relative to the GDP and the weight of short-term debts in external financial liabilities has slightly decreased since the beginning of 2014.

The banking system remained resilient and strong in 2014. The interest rate shock analysis revealed that the sensitivity of the system to interest rate risk is limited. Moreover, despite the fluctuations in global financial markets, the sector had no difficulty in rolling over its external borrowings and had adequate buffers against FX liquidity shocks that may have emanated from foreign markets abroad. On the other hand, the banking sector has been using non-deposit funding resources in an incremental manner over the last few years. In response to the prospective effects of this tendency on financial stability, the CBRT remunerated the Turkish lira component of required reserves in a way to provide further support to core liabilities.

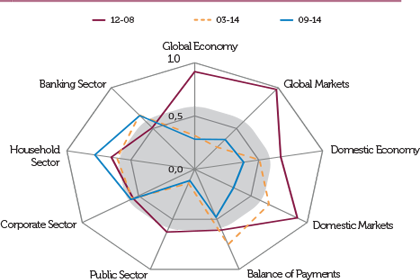

The macro display chart below illustrates the schematic reflection of the developments in financial stability in Turkey within the framework of the analysis conducted. Accordingly, while improvement in the global economy has been limited, volatility in global markets increased between March 2014 and September 2014. In the same period, domestic factors supported financial stability in general. The positive domestic economic outlook can be attributed mainly to the moderate improvement in confidence indices and the recovery in the loan trends. The strong support from domestic markets to financial stability can be attributed mainly to decline in fluctuations in exchange rates, asset prices and interest rate.

Graph 27. Financial Stability Map1,2

(1) Getting closer to the core means that the contribution of the related sector

to financial stability has increased on the positive side. The analysis allows an

historical comparison within each sub-sector. A cross-sector comparison is

available only in terms of the direction of the change in the positioning as to

the core.

(2) For the methodology used in the financial stability map, see Financial Stability

Report (FSR) v.13, November 2011-Special Topic IV.10.