2.5. Banknotes in Circulation

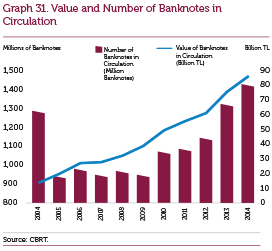

The value of banknotes in circulation increased by 13.8 percent and stood at TL 85.1 billion in 2014. The total number of the banknotes in circulation rose by 8.4 percent and reached 1,426.6 million banknotes at the end of 2014. Between 2004- 2014, the average annual growth rate of banknotes in circulation was 21.3 percent in value terms. In the same period, the average growth rate of the number of banknotes in circulation was 1.9 percent, mainly because of the introduction of higher denominations during the first and second phases of the currency reform that took place in 2005 and 2009, respectively (Graph 31).

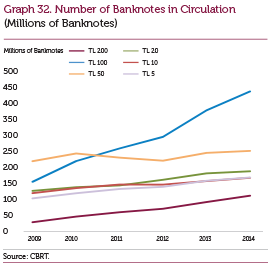

Excluding withdrawn banknotes which are still in the redemption period, 1,323 million banknotes were in circulation as of 31 December 2014. In terms of number, 100 Turkish lira and 50 Turkish lira banknotes accounted for the largest shares of banknotes in circulation (Graph 32). The share of the two denominations was 48.1 percent. In terms of value, 100 Turkish lira and 200 Turkish lira banknotes accounted for the largest shares, standing at 51.1 and 26.4 percent respectively at the end of the year (Table 1).

| Table 1 Banknotes in Circulation (as of 31 December 2014) | ||||

| Denomination | Amount | Share (Percent) | Pieces | Share (Percent) |

| TL 200 | 22,455,698,600.00 | 26.38 | 112,278,493.00 | 7.87 |

| TL 100 | 43,476,127,650.00 | 51.08 | 434,761,276.50 | 30.48 |

| TL 50 | 12,555,645,425.00 | 14.75 | 251,112,908.50 | 17.60 |

| TL 20 | 3,761,578,830.00 | 4.42 | 188,078,941.50 | 13.18 |

| TL 10 | 1,679,031,710.00 | 1.97 | 167,903,171.00 | 11.77 |

| TL 5 | 844,231,660.00 | 0.99 | 168,846,332.00 | 11.84 |

| SUB TOTAL | 84,772,313,875.00 | 99.59 | 1,322,981,122.50 | 92.74 |

| Others* | 345,907,824.50 | 0.41 | 103,610,579.00 | 7.26 |

| TOTAL | 85,118,221,699.50 | 100.00 | 1,426,591,701.50 | 100.00 |

(*) Banknotes that are still in the 10-year redemption period.

Source: CBRT.

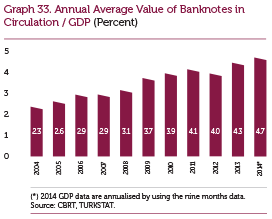

The ratio of the annual average value of banknotes in circulation to GDP was 2.3 percent in 2004. This ratio grew by an average of 7.4 percent annually during the 2005-2014 period and reached 4.7 percent at the end of 2014 (Graph 33).

In 2014, a total transaction of 610.3 billion TL, (300 billion TL deposits vs. 310.3 billion TL payments), was realized through 21 branches, 16 banknote depots and 2 cash centers.

Moreover, in 2014, 32.9 billion TL deposits and 33.3 billion TL payment transactions were made in banknote depots, which have been established in 16 cities where our Bank does not have branches, with the objective of improving banknote quality and meeting various cash demands of the market on time. In other words, 10.8 percent of the Bank’s total transaction volume in 2014 was made through the banknote depots.

The European Side Cash Center that was established in 2012 as a sub-division of the Istanbul Branch received 38.7 percent share in total volume of cash operations of Istanbul in 2014. The Anatolian Side Cash Center’s share was 29.4 percent. In this period, European and Anatolian Side Cash Centers had shares of 11.9 and 9 percent in total transaction volume and performed as the second and the fourth largest branches, respectively, among all branches.