2.3. Financial Stability Developments

Volatility in global financial markets has continued due to the downside risks on growth during 2015. In the second half of the year, investment outflows from emerging markets accelerated and risk premia of these countries also increased. The change in the risk indicators for the emerging economies was triggered by concerns about the Chinese economy, the downtrend in commodity prices and the uncertainties regarding the Fed monetary policy. Measures taken in emerging economies to boost resilience against external shocks have borne a particular importance.

Although domestic economic activity has lost some momentum due to the deceleration in external demand, domestic demand followed a moderate course and net external demand improved to some extent. The consumer price inflation rose slightly in the second half of the year due to increased food prices and exchange rate developments. The CBRT implemented a tight monetary policy to contain the impact of exchange rate movements as well as energy and food price volatilities seen since the start of the year in inflation and inflation expectations. The CBRT has also contributed to the resilience of the economy to shocks with its rebalancing stance in foreign exchange liquidity and supportive stance in financial stability.

The decline in commodity prices, the ongoing cautious monetary policy stance and the moderate growth of consumer loans achieved by macroprudential measures supported the improvement in the current account balance. While the rebalancing in the current account deficit continues, implementations supporting core liabilities and encouraging longer term external borrowing started yielding results.

The progressive improvement in the household leverage ratio (ratio of household liabilities to assets) continued in 2015. The regulations that ban households from borrowing in foreign currencies and over variable interest rates are believed to contribute to financial stability during this period of growing uncertainties, increased volatility in currencies and interest rates. The effect of exchange rate developments on indebtedness of non-financial corporates has been limited. Although there is net foreign exchange open positions, the fact that the short-term FX position is in surplus and foreign currency denominated loans are long term in maturity and mostly utilized by big-sized firms, which are relatively more successful in currency risk management, mitigated risks of non-financial corporates arising from currency developments.

The Turkish banking sector continued its sound functioning of intermediation activities in 2015. The loan growth, which had been pulled down to reasonable levels, lost some pace due further to the elevated uncertainties in external and domestic markets since the third quarter of the year. Asset quality of the banking sector remains stable. The non-performing loan ratio remains relatively unchanged and the ratio for firms’ foreign currency denominated loans remains at low levels. Though capital adequacy ratio of the banks decreased to some extent, the banking sector’s capital was sufficient to cover unexpected losses.

While there has been a limited decline in the external borrowing of the banks, this is considered to be caused largely by the preferences of the domestic banks. There has not been any increase in the costs of the banks’ external funding in this period of volatile global risk appetite. The CBRT raised the remuneration rate for the required reserves maintained in TL for the purpose of supporting core liabilities and took additional measures to extend the maturity of the banks’ non-core foreign currency liabilities in 2015. These measures contributed to the decline in short-term external debt and the improvement in the loan-todeposit ratio of the banking sector together with the moderate loan growth. Furthermore, thanks to the foreign currency liquidity measures taken by the CBRT, the transaction limits of the banks in the CBRT Foreign Exchange and Banknotes Markets increased, thus the foreign currency borrowing facility allocated to banks by the CBRT and the foreign currency and gold reserves maintained at CBRT within the ROM ensured full coverage of the external debt service of the banking sector within one year.

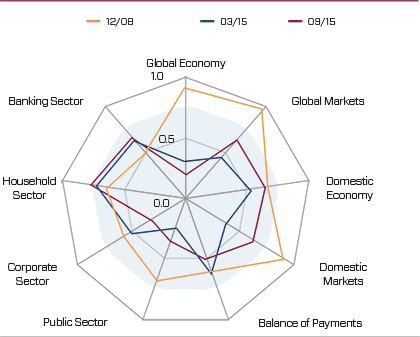

The macro display chart presents the schematic reflection of the developments in financial stability in Turkey (Graph 27). Accordingly, global markets and domestic economy developments have been determinant on financial stability in the last six-month period. In this environment of volatile financial markets due to the uncertainties pertaining to global monetary policies and concerns on global growth, the steps taken and envisaged to be taken within the scope of the “Road Map During the Normalization of Global Monetary Policies” announced by the CBRT has increased the resilience of the economy against the global volatilities.

Graph 27. Financial Stability Map1,2

(1) Getting closer to the core means that the contribution of the related sector to financial stability has increased on the positive side. The analysis allows an historical comparison within each sub-sector. A cross-sector comparison is available only in terms of the direction of the change in the positioning as to the core.

(2) For the methodology used in the financial stability map, see Financial Stability Report (FSR) v.13, November 2011-Special Topic IV.10.