2.5. Banknotes in Circulation

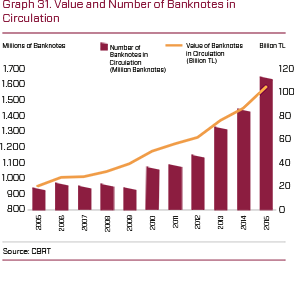

The value of banknotes in circulation increased by 21.1 percent compared to the preceding year and reached TL 103.0 billion by the end of 2015. The total number of the banknotes in circulation rose by 14.5 percent and reached 1,633.7 million banknotes at the end of 2015. During the last five years, the average annual growth rate of banknotes in circulation and the average growth rate of the number of banknotes in circulation were 16.2 and 9.1 percent, respectively (Graph 31).

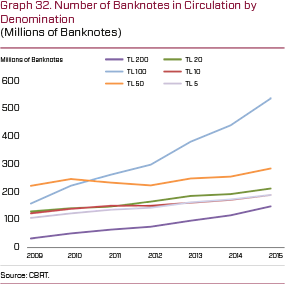

Excluding withdrawn banknotes which are still in a 10-year redemption period, 1,530.5 million banknotes were in circulation as of 31 December 2015. In terms of number, 100 Turkish lira and 50 Turkish lira banknotes accounted for the largest shares of banknotes in circulation (Graph 32). The share of the two denominations was 49.6 percent. In terms of value, 100 Turkish lira and 200 Turkish lira banknotes accounted for the largest shares, standing at 51.5 and 27.9 percent respectively at the end of the year (Table 1).

| Table 1. Banknotes in Circulation (as of 31 December 2015) | ||||

| Denomination | Amount | Share (Percent) | Pieces | Share (Percent) |

| TL 200 | 28,742,042,200.0 | 27.89 | 143,710,211.0 | 8.80 |

| TL 100 | 53,064,512,800.0 | 51.50 | 530,645,128.0 | 32.48 |

| TL 50 | 13,977,754,200.0 | 13.57 | 279,555,084.0 | 17.11 |

| TL 20 | 4,157,319,880.0 | 4.03 | 207,865,994.0 | 12.72 |

| TL 10 | 1,842,387,575.0 | 1.79 | 184,238,757.5 | 11.28 |

| TL 5 | 922,295,120.0 | 0.90 | 184,459,024.0 | 11.29 |

| SUB TOTAL | 102,706,311,775.0 | 99.68 | 1,530,474,198.5 | 93.68 |

| Others* | 336,324,393.5 | 0.32 | 103,217,295.5 | 6.32 |

| TOTAL | 103,042,636,168.5 | 100.00 | 1,633,691,494.0 | 100.00 |

(*) Banknotes that are still in the 10-year redemption period.

Source: CBRT

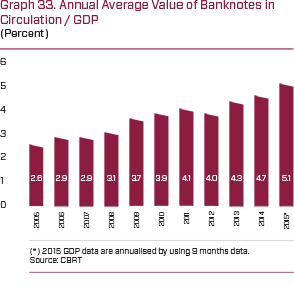

The ratio of the annual average value of banknotes in circulation to the GDP is increasing. The ratio, which was 2.6 percent in 2005, reached 5.1 percent at the end of 2015 as shown in Graph 33.

In 2015, a total transaction of 708.5 billion TL, (345.3 billion TL deposits vs. 363.2 billion TL payments), was realized through 21 branches, 16 banknote depots and 2 cash centers.

Moreover, in 2015, 41.4 billion TL deposits and 40.6 billion TL payment transactions were made in banknote depots, which have been established in 16 cities where our Bank does not have branches, with the objective of improving banknote quality and meeting various cash demands of the market on time. In other words, 11.6 percent of the Bank’s total transaction volume in 2015 was made through the banknote depots.

The European Side Cash Center that was established as a sub-division of the Istanbul Branch in 2012 received 38.1 percent share in total volume of cash operations of Istanbul in 2015. In the same period and among the total volume of cash operations, the shares of the European Side Cash Center, the Ankara Branch, the İstanbul Karaköy Branch, the Anatolian Side Cash Center and the İzmir Branch were 12.4, 11.3, 11.1, 9.1 and 7.8 percent, respectively.

The 10-year redemption period for the Seventh Emission Group (E7) banknotes withdrawn from circulation as of 1 January 2006 with denominations of 250,000, 500,000, 1,000,000, 5,000,000, 10,000,000 and 20,000,000 ended on 31 December 2015 and they lost their values as of 1 January 2016.

Thereby, the withdrawal of banknotes with multiple zeros, which had a negative effect on the credibility of our currency and caused great difficulty in payment systems, was realized and an important part of the currency reform was finalized.