2.2 Operational Framework of Monetary Policy

The funding need of the system decreased to TRY 100.53 billion as of end-2018 from TRY 137.52 billion as of end-2017.

After it was announced that the one-week repo rate would be the policy rate effective from 1 June 2018, the CBRT started providing its funding via one-week repo auctions and overnight market interest rates stood around (above/below) the policy rate.

A number of measures were introduced on 13 August 2018 to support financial stability and sustain the effective functioning of markets in the face of market shocks witnessed in August 2018. Accordingly, necessary steps were taken for financial stability by providing flexibility in collateral conditions and access to liquidity.

Technical work towards simplifying and making transparent the collateral conditions for CBRT transactions continued throughout 2018. Under the collateral management:

The CBRT started transactions at the “Committed Transactions Market of Sukuk” at Borsa Istanbul A.Ş. (BIST) as of December.

Having set an overall Turkish lira portfolio target of TRY 16 billion for end-2018 and taking into account the TRY 5.77 billion worth of nominal instruments to be redeemed during the year, TRY 6.21 billion worth of nominal instruments were accepted for the OMO portfolio, which was TRY 14.96 billion at the beginning of 2018. Accordingly, the year end OMO portfolio amounted to TRY 15.40 billion.

To ensure effective functioning of markets and taking into account the excessive volatility and unhealthy price formation in financial markets as well as the liquidity need of the financial sector, the CBRT introduced an array of measures that would boost the efficiency of TL and FX liquidity management.

In 2018, the CBRT did not conduct FX buying or selling transactions, neither directly nor via auctions.

FX deposit auctions against TL deposits, which commenced on 18 January 2017, continued while the auction amount was gradually reduced to USD 500 million from USD 1.5 billion.

The buying rate on collateral FX deposits for the USD was raised to 2% from 1.50% on 27 September 2018 and to 2.25% on 24 December 2018.

The CBRT continued the TL settled forward foreign exchange sale auctions that it introduced on 20 November 2017. In addition to these auctions, to support effective functioning of FX markets, the CBRT also started conducting TL-settled forward foreign exchange transactions at the Derivatives Market (VIOP) operating under the BIST on 31 August 2018.

On 1 November 2018, transactions were commenced at the Turkish Lira Currency Swap Market to increase the efficiency of banks’ Turkish lira and foreign exchange liquidity management. The upper limit for these transactions, which were conducted via the quotation method, was set at 10% of banks’ transaction limits at the Foreign Exchange Markets.

In addition to these instruments, banks have a total limit of around USD 50 billion that they can use to get FX deposits from the CBRT. Under this facility, a limited number of transactions were conducted in August. Also, the CBRT resumed its intermediary function at the Foreign Exchange Deposit Market as of 13 August 2018.

The remuneration rate on USD required reserves, reserve options and free deposits held at the CBRT was raised to 2% from 1.50% on 23 October 2018 in view of the benchmark interest rates in international markets.

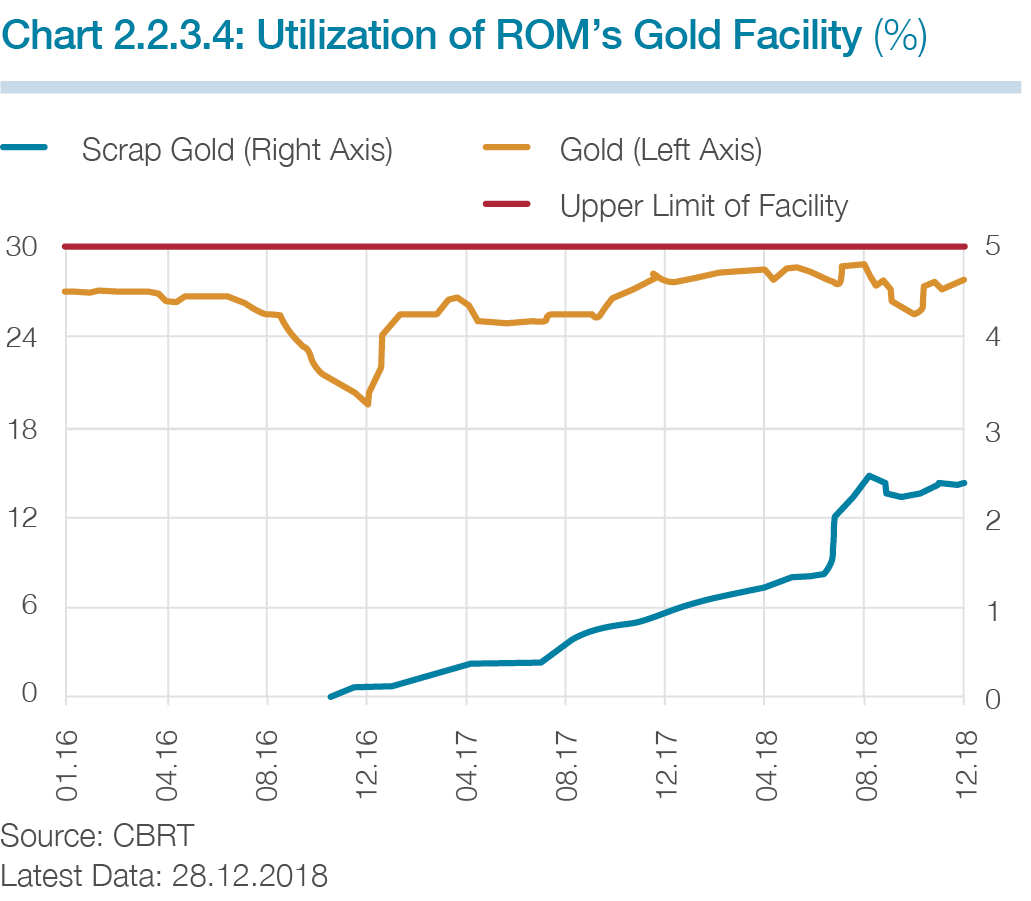

The CBRT continued with the efforts to bring out domestic gold savings into the financial system. On 5 January 2018, in exchange for Turkish lira, the CBRT started accepting standard gold converted from wrought or scrap gold to be collected from residents and also standard gold domestically produced from gold that is extracted from ores. At the same time, transactions at the Gold against Foreign Exchange Market were launched, and banks were provided with the location swap facility in their gold transactions.

As part of the efforts to encourage the use of local currencies in foreign trade, for the financing of trade and investment activities between the Republic of Turkey and the People’s Republic of China, rediscount credits were extended within a total credit limit of CNY 2 billion via the acceptance of Chinese yuan bills for rediscount. Following the release of the “Circular on Rediscount Credits denominated in Chinese Yuan” in January 2017, the net amount of rediscount credits extended to banks against bills stood at CNY 26.3 million in 2018. Moreover, a swap agreement was signed with the Qatar Central Bank on 17 August 2018.

The CBRT continues to use reserve requirements as both a monetary policy and macroprudential policy instrument.

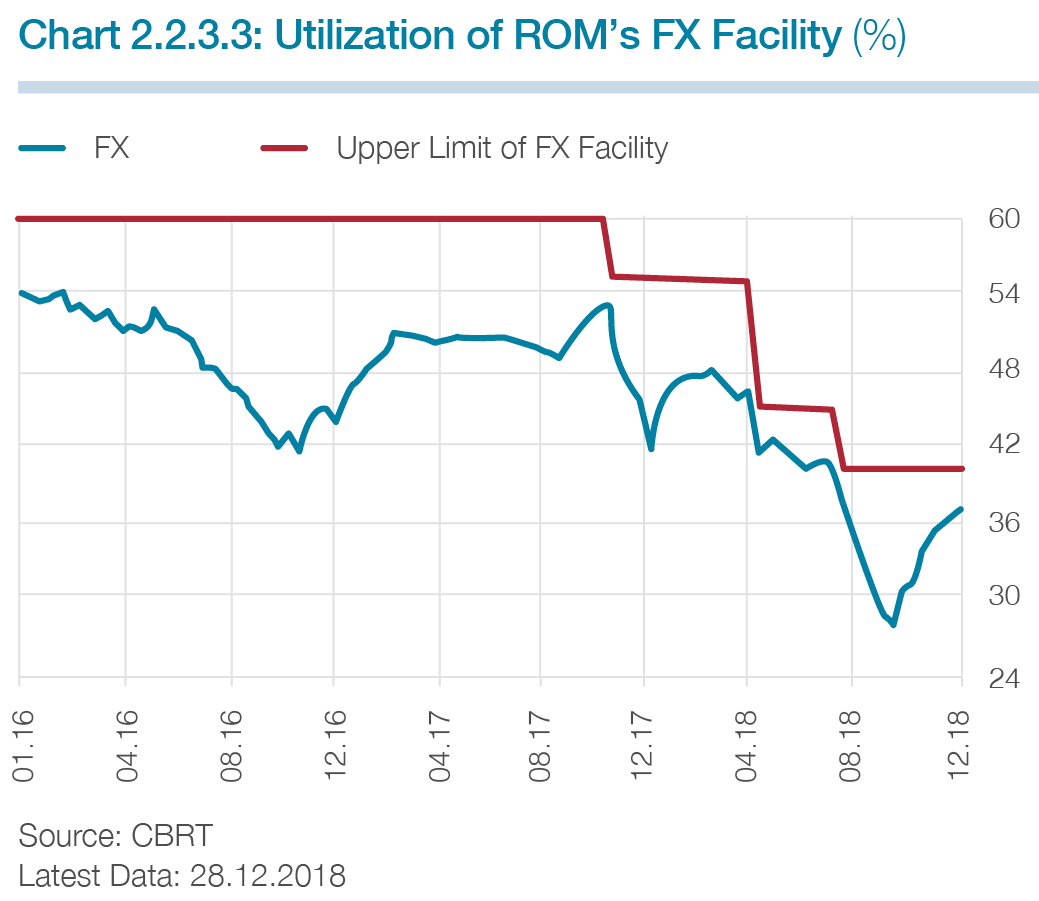

The upper limit for the FX maintenance facility within the reserve options mechanism (ROM) was lowered to 45% from 55% in May and to 40% in August, thereby providing a total of USD 4.4 billion FX liquidity to the markets.

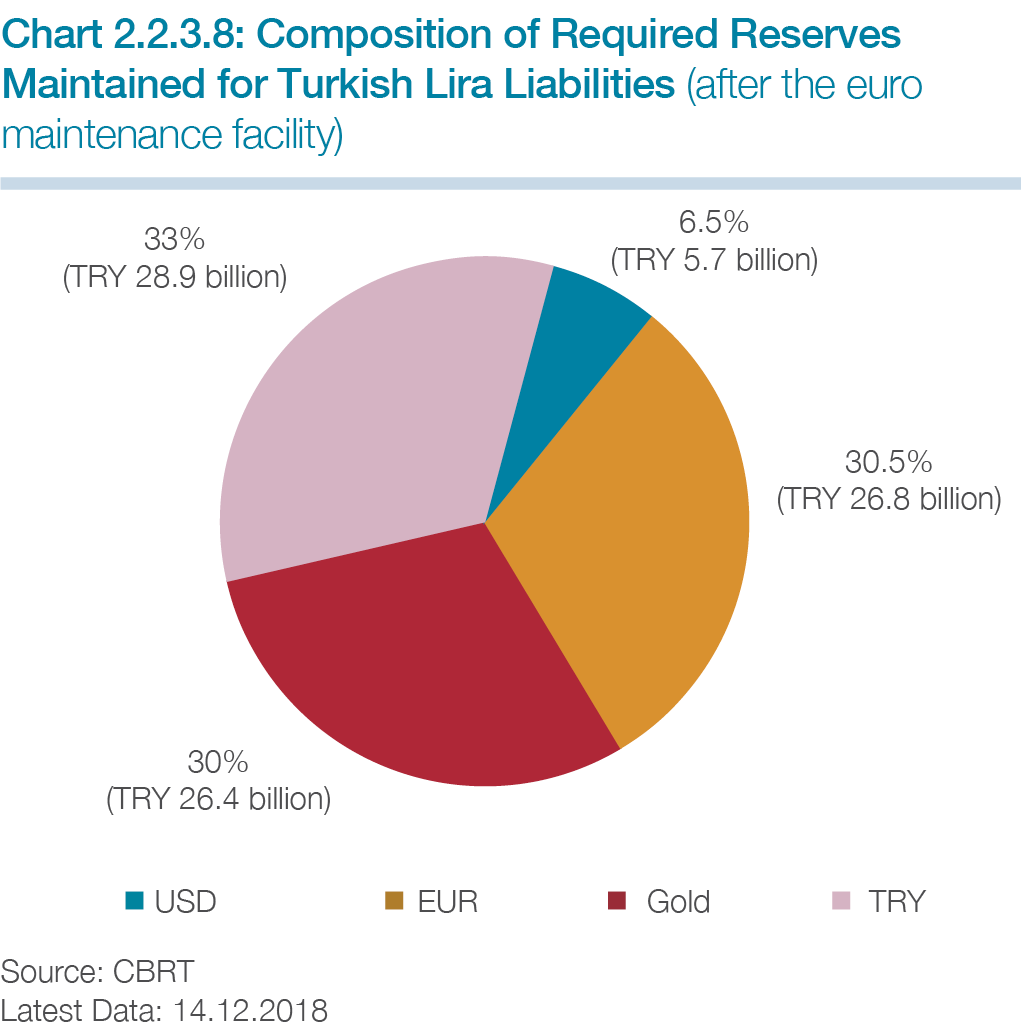

In August, Turkish lira reserve requirement ratios were reduced by 250 basis points for all maturity brackets while reserve requirement ratios for non-core FX liabilities were decreased by 400 basis points for maturities up to (and including) three years. In this way, TRY 10 billion, USD 6 billion and USD 3 billion equivalent of gold liquidity was injected into the markets. The maximum average maintenance facility for FX liabilities was raised to 8% from 4%. Under the ROM, it was allowed that in addition to US dollars, euros could also be used for the maintenance against Turkish lira liabilities, thus providing financial institutions with flexibility in their liquidity management.

The calculation method for the remuneration of Turkish lira required reserves was changed. Accordingly, it was decided that the remuneration rate on TL required reserves which was previously set at 400 basis points below the CBRT’s one-week repo rate would thereafter be determined at a fixed rate. The remuneration rate, which used to be 4% before this change, was announced to be 7% effective from 1 June 2018 and 13% as of 21 September 2018.

Funds raised from repo transactions at BIST, excluding those that banks conduct with the CBRT or among themselves, used to be subject to reserve requirement. However, via the change introduced in December to contribute to the deepening and effectiveness of financial markets, all funds raised from repo transactions at BIST were exempted from the reserve requirement scope.

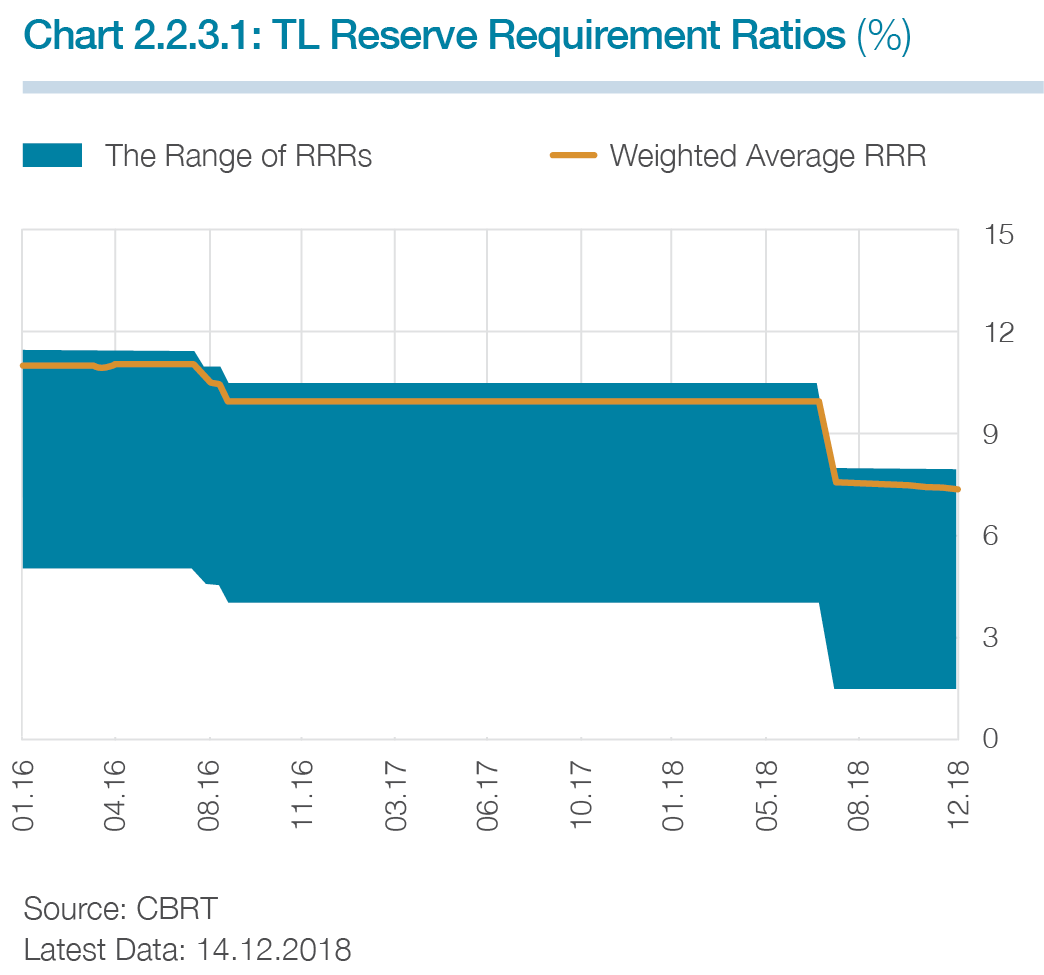

Following these regulatory changes, weighted average reserve requirement ratios for Turkish lira and foreign exchange liabilities stood at 7.4% and 11.3% at end-2018, respectively (Charts 2.2.3.1 and 2.2.3.2).

The majority of banks and financing companies continue to actively use the ROM facility. As of end-2018, the rate of utilization was 92.5% for the FX facility, 92.1% for the gold facility, and 48.1% for the scrap gold facility (Charts 2.2.3.3 and 2.2.3.4). On the other hand, banks in Turkey can also maintain standard gold for their precious metal deposit accounts and this facility’s utilization rate was 77.9% as of the same maintenance period.

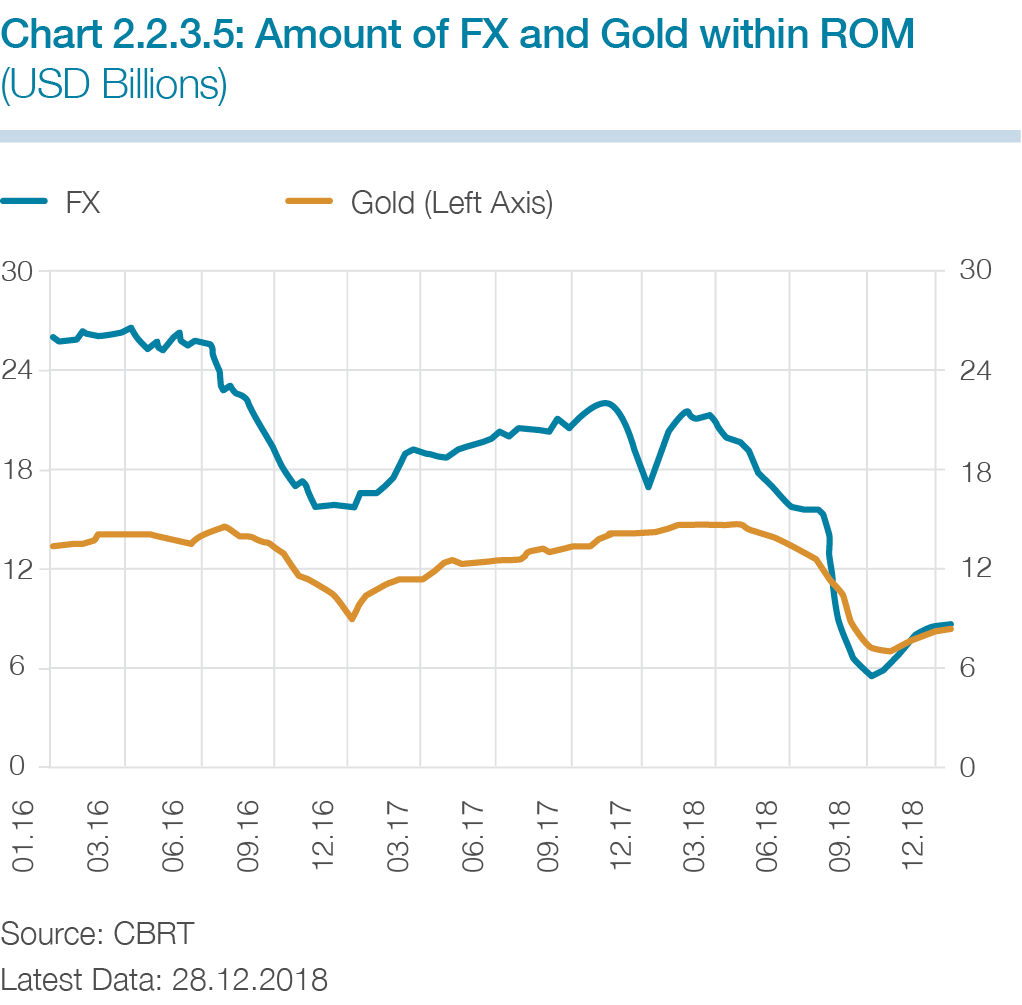

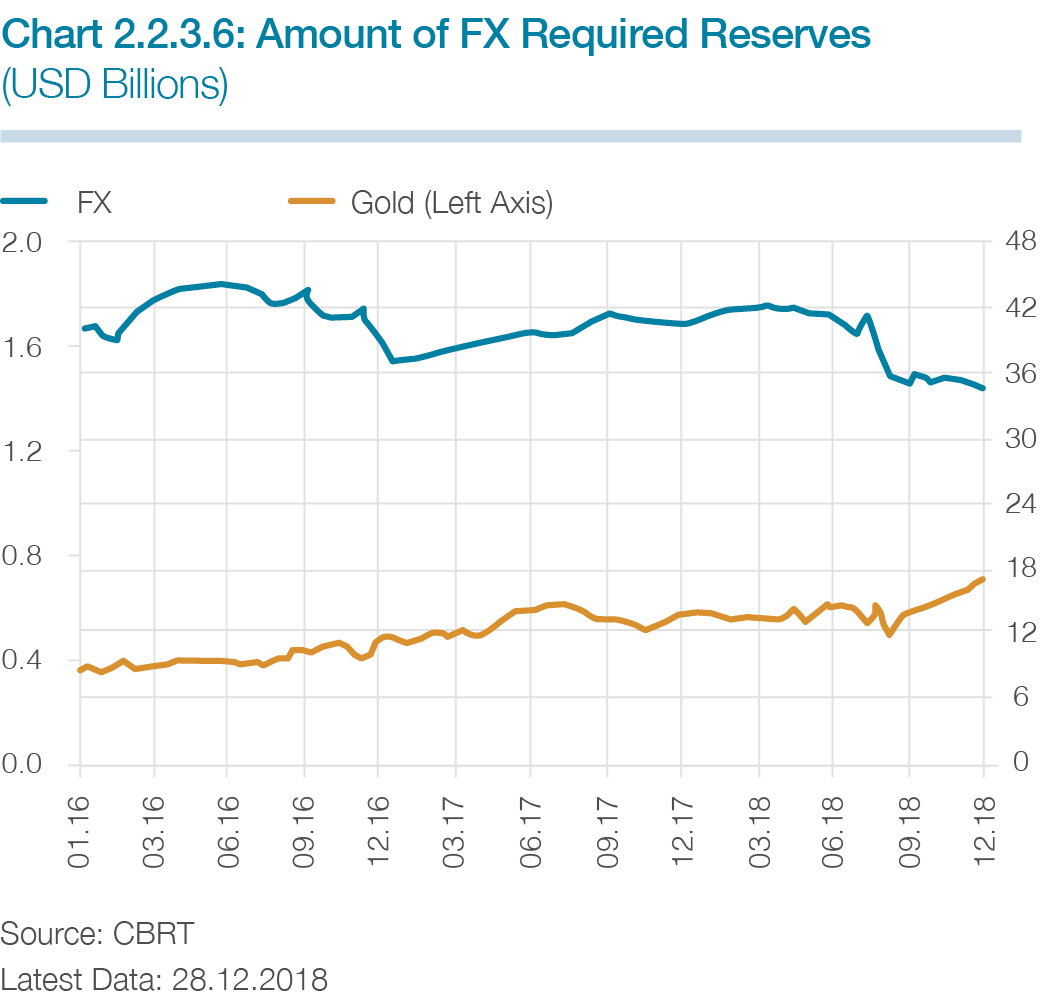

By the end of 2018, USD 8.6 billion worth of FX and USD 8.7 billion worth of gold were maintained for Turkish lira liabilities within the ROM (Chart 2.2.3.5). For FX liabilities, USD 34.8 billion worth of FX and USD 0.7 billion worth of gold were maintained (Chart 2.2.3.6).

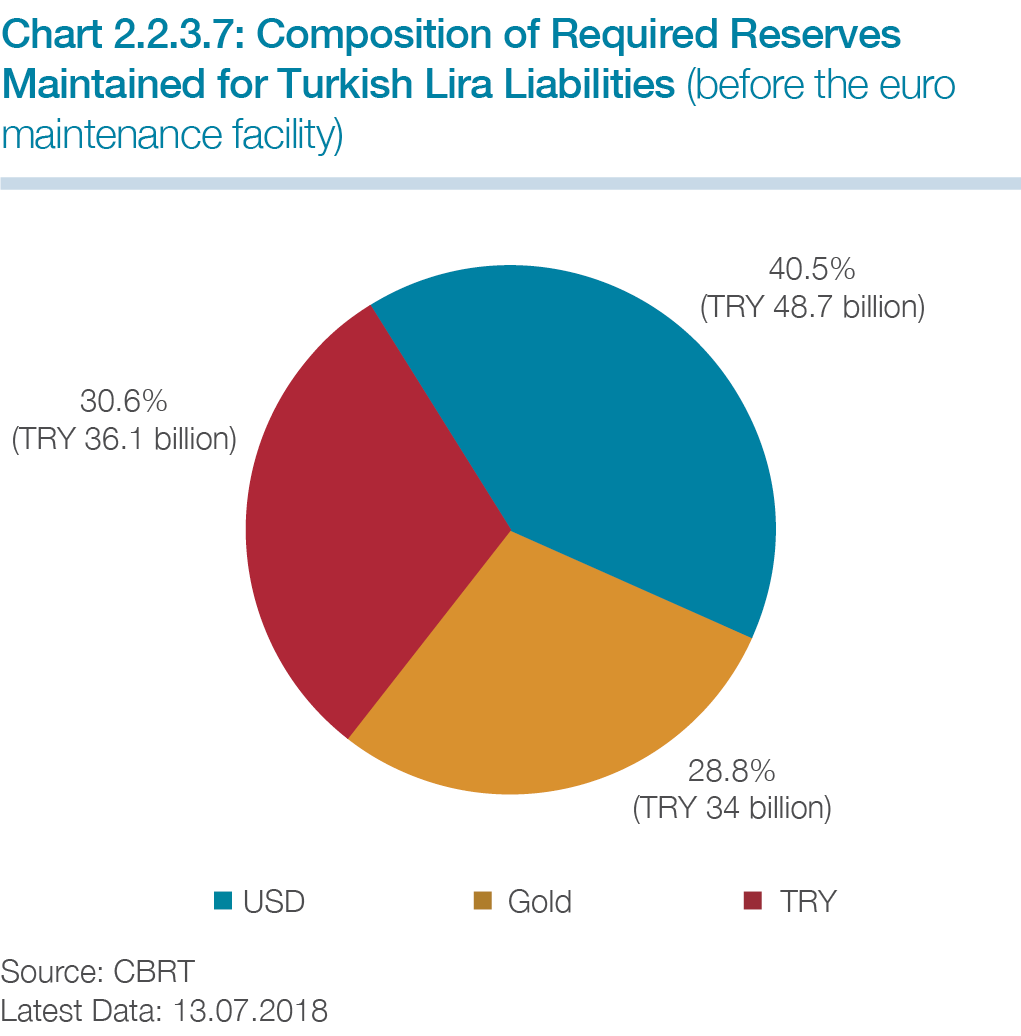

With the facilitation of maintaining required reserves in euros in addition to US dollars under the ROM, the share of the USD in total required reserves maintained for Turkish lira liabilities dropped to 6.5% as of end-2018 from 40.5% while that of the euro stood at 30.5% (Charts 2.2.3.7 and 2.2.3.8).

In line with the efforts both to reduce Turkey’s current account deficit and to reinforce the CBRT’s reserves by supporting exports, pursuant to Article 45 of the Central Bank Law, rediscount credits are extended to exporters and firms that engage in foreign FX earning services and activities. These loans are extended in Turkish liras through the Export Credit Bank of Turkey (Turk Eximbank) as well as through commercial banks, which accept exporters’ FX denominated bills for rediscount. The loans normally have up to 240 day maturities (360 days for exports of high tech products and exports to new markets) and are repaid to the CBRT in foreign currency.

The total limit available for rediscount credits is USD 20 billion, USD 17 billion of which is assigned to Turk Eximbank and the remaining USD 3 billion to commercial banks. Credit limits by types of companies are up to USD 400 million for foreign trade capital companies and up to USD 350 million for other companies. The entire limit can be used in applications for credits with a maturity of up to 120 days whereas maximum 60% of the limit can be used in credit applications with a maturity of 121 to 360 days. In 2018, several regulatory changes were introduced in rediscount credits:

The change in April stipulated that:

The change in May stipulated that:

With the changes in July:

The change in September stipulated that:

Through the changes in December:

As part of the efforts to encourage the use of local currencies in the conduct of foreign trade, for the financing of trade and investments between the Republic of Turkey and the People’s Republic of China in local currencies, ten firms were provided with CNY 27 million worth of rediscount credits against bills for 11 projects.

The total amount of rediscount credits rose to USD 22.9 billion in 2018 from USD 20.4 billion in 2017. By the end of 2018, the value of outstanding credits was USD 15.5 billion.

Rediscount credits contributed by USD 15 billion to CBRT’s FX reserves in 2018.

Monthly maximum contractual and overdue interest rates to be applied on credit card transactions are announced for quarterly periods by the CBRT. In the first half of 2018, monthly maximum contractual interest rates for credit card borrowings were left unchanged at 1.84% for Turkish lira and 1.47% for foreign currency transactions. Likewise, monthly maximum overdue interest rates were also kept at 2.34% for Turkish lira and 1.97% for foreign currency transactions. However, in the third quarter of 2018, the monthly maximum contractual interest rate was raised to 2.02% for Turkish lira and 1.62% for foreign currency transactions while the monthly maximum overdue interest rate was increased to 2.52% for Turkish lira and 2.12% for foreign currency transactions. With further increases in the final quarter of the year, the monthly maximum contractual interest rate stood at 2.25% for Turkish lira and 1.80% for foreign currency transactions whereas the monthly maximum overdue interest rate reached 2.75% for Turkish lira and 2.30% for foreign currency transactions.