2.4 Financial Infrastructure

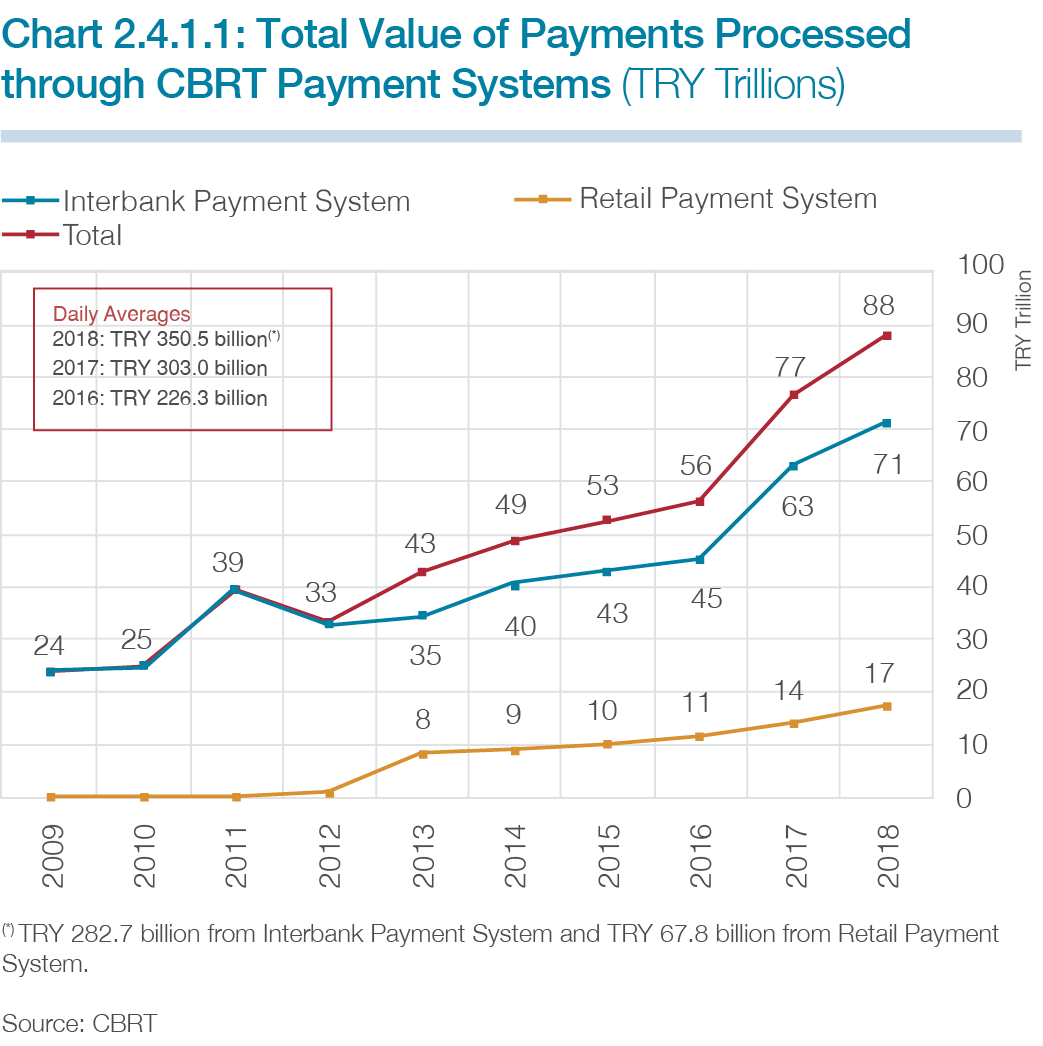

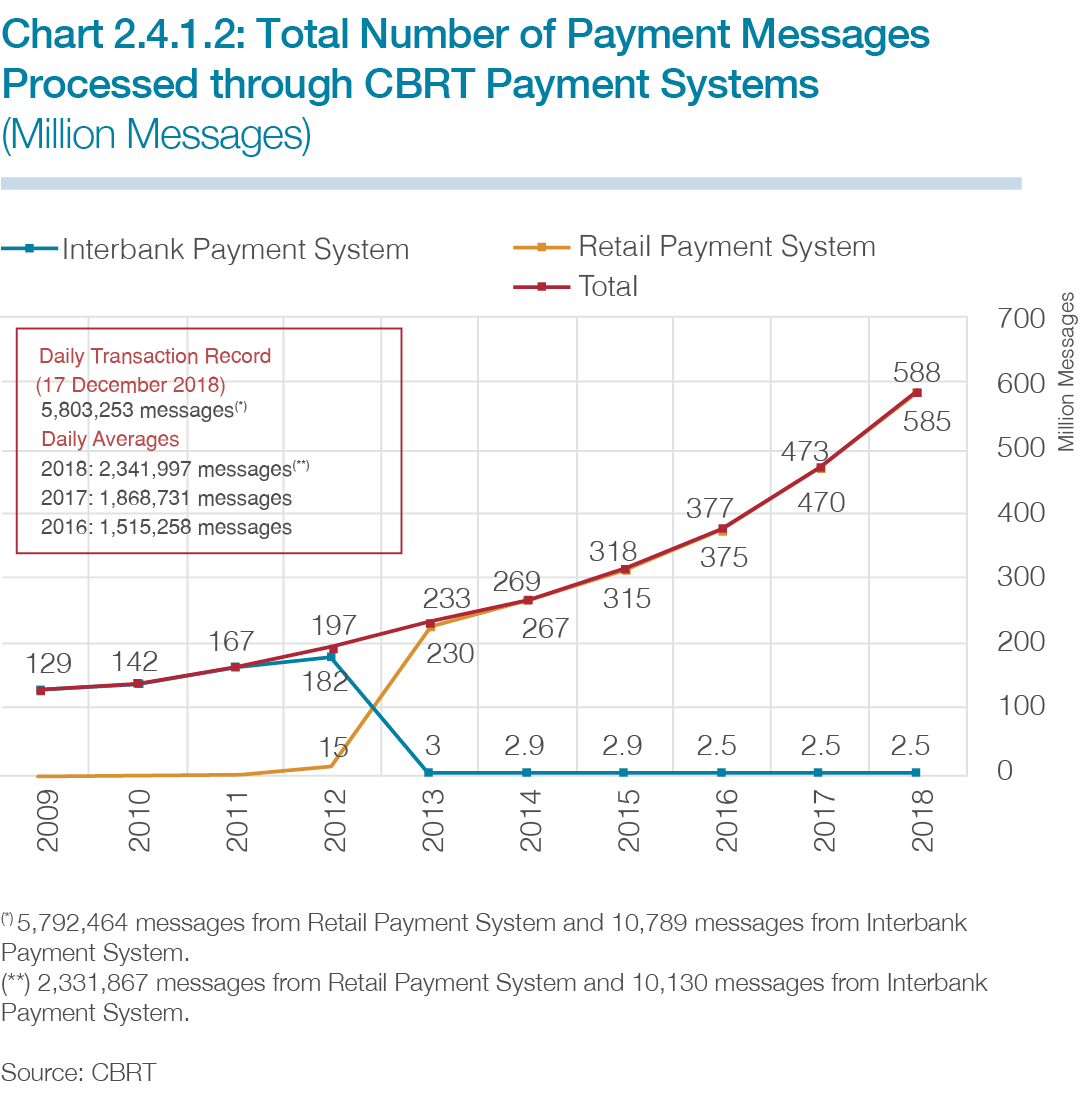

In 2018, the total value of transactions conducted through the Interbank Turkish Lira Transfer System and through its Electronic Securities Transfer and Settlement System (ESTS) was TRY 71 trillion. The average daily transaction volume was TRY 282.7 billion. Approximately 2.5 million transactions were conducted through the system, which corresponds to an average of 10,000 messages a day. The volume of settlements conducted through the Interbank Turkish Lira Transfer System increased in 2018 by approximately 12.7% over the previous year (Chart 2.4.1.1).

The total volume of all transactions conducted via the CBRT Retail Payment System in 2018 amounted to TRY 17 trillion, while the average daily transaction volume was TRY 67.8 billion. The total number of transactions conducted in the system was 585 million and the daily average number of messages processed was 2.3 million. The greatest number of transactions occurred on 17 December 2018 when 5.8 million messages were handled. The number of settlements carried out through the Retail Payment System was approximately 24.5% higher in 2018 than in 2017 (Chart 2.4.1.2).

Meanwhile, approximately 173 thousand messages were processed in the auction system.

With the inclusion of the Bank of China Turkey Inc. in the CBRT Payments Systems on 11 April 2018, the number of participants in the payment systems stood at 52 by the end of 2018.

Under Article 8 (“Payment on account”) of the Check Law No. 5941, check clearing transactions in Turkey are performed by Istanbul Clearing, Settlement and Custody Bank Inc. (Takasbank) via the “Check Clearing System,” pursuant to the Regulation on Check Clearing Transactions prepared by the CBRT and published in the Official Gazette No. 30446 dated 9 June 2018.

On the other hand, as per the Law No. 6493 on Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions (Law No. 6493), the CBRT monitors the work on the uninterrupted and safe conduct of check clearing transactions.

In 2018, the total value of approximately 15.2 million checks cleared through the check clearing system was TRY 588.4 billion (Chart 2.4.2.1).

The “Communiqué Concerning International Bank Account Numbers” issued by the CBRT in 2008 stipulates that banks shall generate an International Bank Account Number (IBAN) for each of their customers subject to the rules set out in the communiqué and that their customers shall use these numbers when transferring money. This communiqué rapidly increased public awareness and use of the IBAN system in Turkey. By year end 2018, IBAN usage ratio for the senders was 99.5% whereas recipients’ usage ratio was 94.3% in money transfers through the Electronic Fund Transfer (EFT) system.

On 18 May 2018, Takasbank applied to the CBRT for the approval of the establishment and operation of the Check Clearing System that would enable clearing of the checks among bank branches, in addition to its main operator function of securities settlement systems. The official authorization for the establishment and operation of this system was granted by the decision of the CBRT Board dated 20 June 2018, which was published in the Official Gazette No. 30463 dated 29 June 2018.

As per the Check Law No. 5941 dated 20 December 2009, the legal entity status of the Interbank Check Clearing House Center (ICH) that was operating the Check Clearing System terminated on 2 July 2018 as the Regulation on Interbank Check Clearing House Center published in the Official Gazette No. 18879 dated 25 September 1985, which furnished the ICH with a legal entity status, was repealed by the Regulation on Check Clearing Transactions that was published in the Official Gazette No. 30446 dated 9 June 2018 and took effect on 2 July 2018. The CBRT’s announcement regarding this change was published in the Official Gazette No. 30470 dated 6 July 2018. Accordingly, check clearing transactions in Turkey that used to be conducted by the ICH before 2 July 2018 via the Check Clearing System started to be carried out by Takasbank thereafter.

Approval for the Operation of Takasbank Organized Wholesale Natural Gas Sale Market Cash Clearing and Collateral Services

With its decision dated 8 November 2018, the CBRT Board approved the provision of cash clearing and collateral services by Takasbank at the Organized Wholesale Natural Gas Sale Market as an additional activity of Takasbank besides its system operation activities. This decision was published in the Official Gazette No. 30595 dated 14 November 2018.

The Organized Wholesale Natural Gas Sale Market operated by the Energy Exchange Istanbul (EXIST) and the continuous trade platform developed for this market have been established to make Turkey the regional natural gas trade center. Natural gas is priced under market conditions at this market and a reference price is set. This market also enables natural gas sale-purchase transactions in addition to market participants’ bilateral agreements. Takasbank provides cash clearing, collateral, default, and assignment services at this market.

Approval for the Operation of Takasbank Gold Transfer System

The application of Takasbank for the approval of the operation of the Gold Transfer System was ratified by the decision of the CBRT Board dated 12 July 2018 as an additional activity of Takasbank besides its system operation activities. This decision was published in the Official Gazette No. 30483 dated 19 July 2018.

The Gold Transfer System established and operated by Takasbank enables instant electronic transfer of gold balances among banks.

Approval for the Operation of Takasbank to Provide Central Counterparty Services in the Borsa Istanbul Swap Market

Takasbank applied for the approval of its operation to provide central counterparty services as an additional activity that it can perform besides its system operation activities. When providing these services, Takasbank acts as a seller against a buyer and as a buyer against a seller at the BIST Swap Market established to ensure that swap transactions, which are conducted mostly at over-the-counter markets, can be offered under the guarantee of an organized market. Takasbank’s application was approved by the decision of the CBRT Board dated 29 November 2018. The decision was published in the Official Gazette No. 30619 dated 8 December 2018.

In accordance with the Law No. 6493 and secondary legislations issued pursuant to this law, the CBRT has the authority and responsibility to oversee the payment and securities settlement systems to ensure uninterrupted operation of these systems.

Based on its authorities and responsibilities given by relevant legislations, the CBRT oversees payment and securities settlement systems in a process that begins with the licensing of organizations that set up and manage these systems and continues with the conduct of their operations. As part of these progressive oversight activities, the CBRT monitors the system operators by checking information and documents collected, conducts on site visits when it deems necessary in order to perform more detailed examinations of transactions and documentation. Based on the findings of its oversight activities, the CBRT prepares detailed reports concerning system operators’ compliance with the CBRT regulations and international standards.

Accordingly, in the first half of 2018, the CBRT carried out detailed oversight activities regarding the operations of CBRT Payment Systems and the Mastercard Payment Transaction Services Turkey Information Services Inc. (MPTS), made on-site visits to MPTS, and prepared oversight reports after examining the compliance of these operators’ systems with the provisions of the secondary legislations of Law No. 6493 and with the Principles for Financial Market Infrastructures published by the BIS Committee on Payments and Market Infrastructures (CPMI) and by the International Organization of Securities Commissions (IOSCO). Additionally, in the second half of 2018, the CBRT prepared oversight follow-up reports on the MPTS and Garanti Payment Systems Inc., in which it assessed the progress made concerning the findings and recommendations cited in the oversight reports on these operators in 2017 and 2018, and re-evaluated the compliance of these systems with the national legislation and international standards.

On the other hand, close monitoring by the CBRT of structural changes to be made in the systems, rules, procedures and applications of system operators also constitutes an important part of oversight activities. In this scope, as per Article 7, paragraph 4 of the Regulation on Operations of Payment and Securities Settlement Systems, the application of Takasbank for the approval of the structural change, which facilitates acceptance of letters of guarantee as collateral and guarantee fund contribution until 31 December 2018 for Borsa Istanbul Equity Market transactions performed via the Equity Market Clearing System, was ratified by the decision of the CBRT Executive Committee dated 18 May 2018.

Pursuant to Article 9, paragraph 7 of the same Regulation, structural changes in procedures regarding the Debt Securities Market Clearing System were approved by the decision of the CBRT Executive Committee dated 27 March 2018. These changes were introduced as a result of Takasbank’s new role as the Central Counterparty at Borsa Istanbul Debt Securities Market and the change and transfer of the Debt Securities Market Clearing System applications and technological infrastructure to the BISTECH platform.