2.2.3. Reserve Requirements

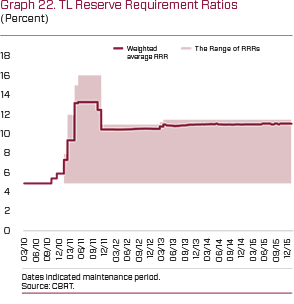

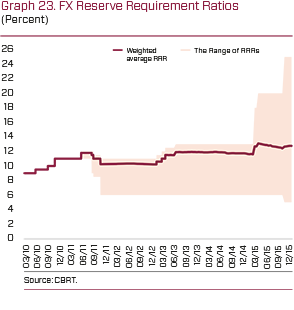

The CBRT continues to use reserve requirements as a monetary policy and macroprudential policy instrument. As of year-end 2015, the weighted average reserve requirement ratios for TL and FX are 11.1 percent and 12.8 percent, respectively (Graphs 22 and 23).

To limit macrofinancial risks and support financial stability, the CBRT started revising the reserve requirement ratios for foreign exchange (FX) denominated liabilities of banks and financing companies to encourage the extension of maturities of non-core liabilities in the first half of 2015. Beginning from 29 August 2015, required reserve ratios for non-core FX liabilities were revised to incentivize maturities of longer than three years for renewed and newly utilized liabilities.

On the other hand, ROM has been used actively in 2015. In this way, ROM contributes not only to total reserves but has limited potential impacts of capital flow volatility on the foreign exchange market as well. Besides, the automatic stabilizing feature of the ROM has constituted a buffer against possible changes in external finance conditions.

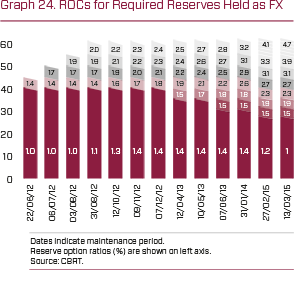

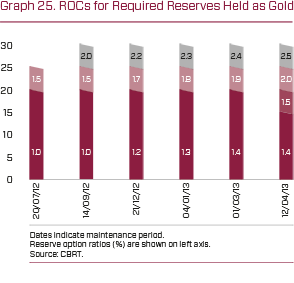

In order to strengthen the automatic stabilizing feature of the ROM and to provide the FX liquidity needed stemming from changes in reserve requirement ratios for FX denominated liabilities, technical adjustments have been made in reserve option tranches and coefficients. The top 5 percent tranche was substituted by 5 new tranches, each comprising 1 percent, to be implemented as of the calculation period of 13 February 2015. Moreover, in order to meet the foreign exchange liquidity needs of financial sector, the coefficient of the lowest tranche was lowered, while coefficients of the top 5 tranches of 1 percent were increased, starting from the calculation period of 27 February 2015. By the end of 2015, the coefficients corresponding to the last tranches of the FX and gold reserve options stood at 4.7 and 2.5, respectively (Graph 24 and Graph 25).

Banks and financing companies use the ROM facilities widely and consistently. As of the maintenance period of 18 December 2015, the utilization ratio of the FX facility was 91.2 percent, and that of the gold facility reached 89.8 percent across the sector. Banks can also maintain standard gold for precious metal deposit accounts, the utilization ratio of which is around 70.4 percent.

To spur balanced growth and domestic savings, the implementation of remunerating reserves maintained in TL, in a way to encourage core liabilities, financial institutions whose ratios of deposits and equity to loans are higher than the sector average have been remunerated at a higher rate unless they worsened their own situation in 2015. In line with the stated objectives, the remuneration of TL required reserves was raised by 50 basis points, as of the 8 May 2015 maintenance period. The CBRT decided that remuneration rates of the required reserves maintained in TL would be raised by 150 basis points in total, by three installments of 50 basis points each on 1 September 2015, on 1 October 2015 and on 1 December 2015 in order to reduce the intermediation costs of the banking sector and to provide additional support to core liabilities.

Under the changing global and local financial market conditions, USD required reserves, reserve options and free reserves held at the CBRT were remunerated starting from 5 May 2015 as well.

The coverage of liabilities subject to reserve requirements of foreign branches of banks incorporated in Turkey has been broadened for the liabilities that emerged after 29 May 2015; hence, foreign branches of banks have also been encouraged to borrow longer term.

To strengthen the automatic stabilizing feature of the ROM, instead of the exchange rate that pertains to the calculation date, arithmetic average of the foreign exchange buying rates of CBRT published in the Official Gazette on the days between the calculation date (including) and the third business day (including) prior to the start of the maintenance period are used to calculate the amount of FX that will be held under ROM for TL liabilities starting from the calculation period of 31 December 2015.

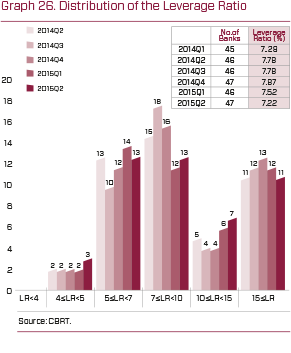

The leverage-based reserve requirement regulation that aims to boost the resilience of the banking sector to shocks by containing its indebtedness continued to be implemented with all of its aspects in 2015. The leverage ratio of the sector realized around 7.2 percent as of June 2015 (Graph 26). The data pertaining to the April-June 2015 term suggest that the leverage ratio of the banking sector followed a stable course that was well above the minimum ratio of 3 percent set by the Basel III regulation and 4 percent set by the CBRT for the first three quarters of 2015. Additionally, a bank-base analysis reveals that there was no bank whose ratio was below the regulatory minimum and required to hold additional reserve requirements at the beginning of the implementation.