Economic activity remained strong in the first quarter of 2021 on the back of domestic and external demand despite the restraining effects of the pandemic. With the easing of pandemic restrictions in early March, economic activity revived in services and related sectors. Although economic activity lost some momentum in the second quarter of the year following the pandemic restrictions and the tightening in financial conditions, it remained above its long-term trend. In the third quarter, domestic demand and net exports continued to contribute to annual growth, and annual and quarterly growth rates in this period stood at 7.5% and 2.8%, respectively. The spread of vaccination throughout the domestic population facilitated the recovery in services, tourism and related sectors, which were adversely affected by the pandemic, and led to a more balanced composition in economic activity. In the last quarter of the year, economic activity remained strong. While final domestic demand was the driver of annual growth in this period, net exports contributed further to annual growth, and Gross Domestic Product (GDP) increased by 9.1% year on year and by 1.5% quarter-on-quarter. Against this background, GDP increased by 11% in 2021, remaining above its long-term trend.

In terms of quantity, while exports remained strong in 2021 on the back of the rapid recovery in global demand, imports remained almost flat despite the recovery in economic activity. Services revenues registered a significant recovery in the third quarter driven by the acceleration in vaccination and the lifting of restrictions, and the positive contribution of the services balance to the current account balance increased. Thus, despite the rise in commodity prices, the real rebalancing in foreign trade, the decline in gold imports and the recovery in services revenues led to an improvement in the current account balance in 2021. The current account deficit narrowed to USD 14.9 billion in 2021. The recovery in capital flows and the increase in the debt rollover ratio of the real sector contributed to the financing of the current account deficit.

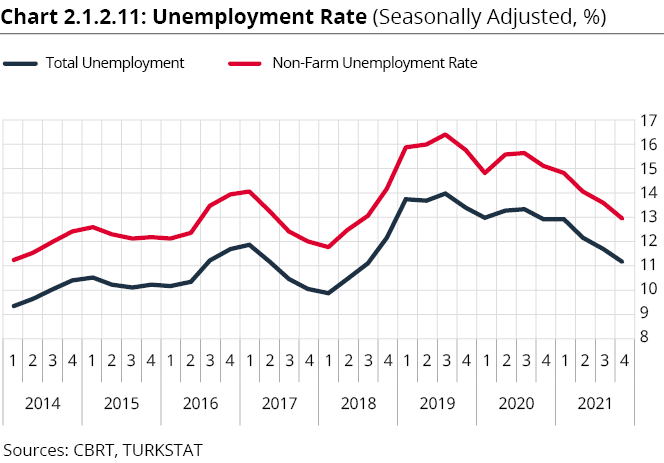

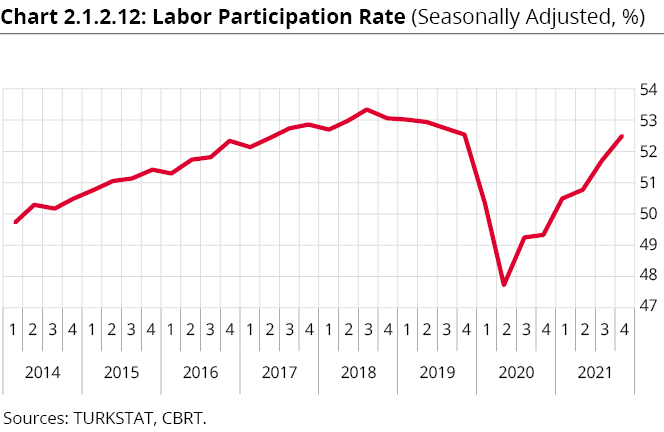

The strong course in economic activity also affected the labor market positively. Nonfarm employment started to recover backed primarily by the industrial sector, and reached pre-pandemic levels in the first quarter of 2021 despite the limited contribution from the services sector. In the third quarter of the year, services employment continued to increase with the help of related sectors boosted by the reopening and the favorable course in tourism while the industrial sector employment continued to increase on the back of strong exports. With the recovery in services employment, nonfarm employment and all sub-components exceeded their pre-pandemic levels. In the last quarter of the year, the labor market continued to improve in line with the economic activity outlook. While employment maintained its uptrend led by the services and industry sectors, thanks to the reopening and the positive course in tourism, the increase in the labor force participation rate served a factor that limited the decline in unemployment rates.

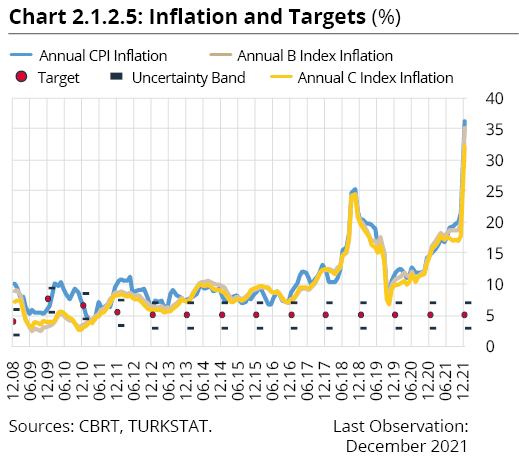

Annual consumer price inflation was on the rise throughout 2021, except for May, when economic activity was interrupted due to the lockdown, and stood at 36.08% at the end of the year. The main determinants of the increase in inflation were demand and cost factors, supply-side factors such as disruptions in supply chains, increases in international food and other commodity prices, exchange rate developments and increases in administered prices. Producer prices increased by 79.89% in 2021. This was mainly driven by, in addition to exchange rate developments, increases in commodity prices, energy in particular, and supply constraints. In 2021, the trend of inflation also registered an increase, and the annual inflation rates of the B and C indices, the core inflation indicators, rose to 34.89% and 31.88%, respectively.

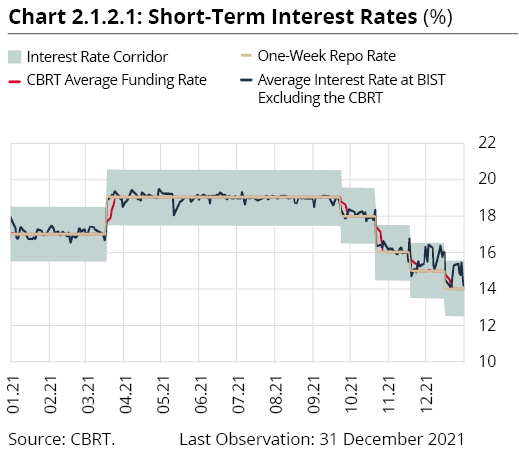

The CBRT delivered a strong monetary tightening in March, and raised the policy rate to 19% from 17%. In the second quarter of 2021, the CBRT communicated that the monetary stance would continue to be determined at a degree of tightness that would restore the disinflation process as soon as possible and ensure the attainment of the medium-term targets. Accordingly, it kept the policy rate constant in the April-August period. The CBRT evaluated the analyses to decompose the impact of demand factors on which the monetary policy can affect, core inflation developments and supply shocks, and reduced the policy rate by a total of 500 basis points in the September-December period. Thus, in December, the CBRT decided to complete the use of the room implied by transitory effects of supply-side factors and other factors beyond monetary policy’s control on price increases.

Announced with a press release on 1 July 2021, the CBRT revised the reserve requirement regulation to improve the effectiveness of the monetary transmission mechanism in line with its main objective of price stability. The CBRT stated in the press release that the upper limit of the facility for holding FX for Turkish lira reserve requirements would be decreased from 20% to 10% commencing from the maintenance period of 6 August 2021 and such facility would be terminated on 1 October 2021 maintenance period. The Bank announced on 9 November 2021 that the upper limit of the facility for holding standard gold for Turkish lira reserve requirements was decreased from 15% to 10%, and that this facility would be gradually decreased and terminated. With another press release on 21 December 2021, the CBRT announced that to support financial stability by increasing the share of Turkish lira in total deposits/participation funds in the banking system, it decided to provide support to deposit and participation fund holders in the event that their FX deposit accounts and FX participation funds as of 20 December 2021 were converted into Turkish lira time deposit and participation accounts and also to exempt converted amounts from the reserve requirement obligation. It was also announced on 29 December that the CBRT would provide incentive to deposit and participation fund holders if their gold deposit accounts and participation funds were converted into Turkish lira time accounts.

Monetary Policy Developments

Leaving the policy rate constant at 17% in January 2021, the CBRT underlined in its statement that the tight monetary policy stance would be maintained until strong indicators point to a permanent fall in inflation and price stability. In its January Inflation Report, the CBRT set out a framework indicating that the impact of the strong monetary tightening implemented in November and December would become more evident in the following period, hence the effects of demand and cost factors on inflation would wane gradually. Having kept the policy rate unchanged in February, the CBRT decided to deliver a strong additional monetary tightening in March considering upside risks to inflation expectations, pricing behavior and the medium-term inflation outlook. In that period, raising the policy rate to 19% from 17%, the CBRT reiterated that the tight monetary policy stance would be maintained decisively for an extended period until strong indicators pointed to a permanent fall in inflation and price stability. In April, the Bank left the policy rate unchanged emphasizing the persisting risks to the inflation outlook.

In May, it was emphasized that the decelerating impact of the monetary tightening on credit and domestic demand began to be observed, but demand and cost factors, supply constraints in some sectors, and high levels of inflation expectations continued to pose risks to the pricing behavior and inflation outlook. In June, saying that the loan growth exhibited a mild course owing to the monetary tightening implemented, CBRT underlined that they were monitoring the course and composition of loans for macroeconomic stability. In the second half of the year, the external balance exhibited a positive outlook thanks to the acceleration in the domestic vaccination rollout and lifting of pandemic restrictions, and economic activity had a more balanced composition. Against this background, the CBRT left the policy rate constant at 19%. Moreover, on 1 July 2021, the Bank announced the revision it made to the RR regulation to improve the effectiveness of the monetary transmission mechanism in line with its main objective of price stability. Accordingly, the FX RR ratios were increased by 200 basis points for all maturity brackets, while announcing that the upper limit of the facility for holding FX for Turkish lira RRs would be phased out by the beginning of October. In September, RR ratios for FX deposits/participation funds were increased by 200 basis points for all maturity brackets, to be effective on the maintenance date of 1 October 2021.

At MPC meetings of September and October, the CBRT highlighted that the decelerating impact of the monetary tightening on credit and domestic demand continued. Assessing that the increase in inflation was driven by supply-side transitory factors, the CBRT reduced the policy rate by a total of 300 basis points in September and October. In its October statement, the CBRT said that supply-side transitory factors left limited room for the downward adjustment to the policy rate.

At its November meeting, the CBRT evaluated the analyses to decompose the impact of demand factors on which monetary policy can have an effect, core inflation developments and supply shocks, and reduced the policy rate by 100 basis points to 15%. In the last meeting of the year, the Bank cut the policy rate further by 100 basis points, thus decided to complete the use of the limited room implied by transitory effects of supply-side factors and other factors beyond monetary policy’s control on price increases. In sum, in the September-December period, the policy rate was reduced by a total of 500 basis points to 14% (Chart 2.1.2.1). It was also stated that the cumulative impact of the recent policy decisions would be monitored in the first quarter of 2022 and during this period, all aspects of the policy framework would be reassessed in order to create a foundation for a sustainable price stability.

In line with its main objective of price stability, the CBRT revised the reserve requirement regulation to improve the effectiveness of monetary transmission mechanism and announced it with a press release on 9 November 2021. The RR ratios for FX deposits/participation funds were increased by 200 basis points for all maturity brackets. Besides, the Bank reduced the upper limit of the facility for holding standard gold for Turkish lira RRs from 15% to 10%, stating that the facility would be terminated gradually. To increase the share of Turkish lira in total deposits/participation funds in the banking system the CBRT announced in its press release of 21 December 2021 that it would provide support to deposit and participation fund holders in the event that the FX deposit accounts and FX participation funds available as of 20 December 2021 were converted into Turkish lira time deposit and participation accounts. It also announced on 29 December 2021, that it would provide incentive to deposit and participation fund holders in the event that their gold deposits and participation funds were converted into Turkish lira time deposit and participation accounts at the account holder’s request. Under this practice, it was decided to exempt the converted sums from the reserve requirement (RR) obligation.

In 2021, the CBRT provided funding within a simple operational framework through open market operations (OMO) and currency swaps. The funding need of the system increased over the previous year-end by approximately TRY 474 billion to TRY 1,089 billion as of 31 December 2021. In 2021, developments in the monetary base, foreign exchange transactions against TRY, and the increase in the Treasury’s net borrowing amount had an increasing effect on the funding need of the system, while rediscount credits had a reducing effect. The amount of swap transactions, which was TRY 338 billion at the end of 2020, increased by approximately TRY 261 billion and reached TRY 599 billion by 31 December 2021. Net OMO, which was TRY 277 billion at the end of 2020, increased by approximately TRY 213 billion and reached TRY 490 billion as of 31 December 2021 (Chart 2.1.2.2).

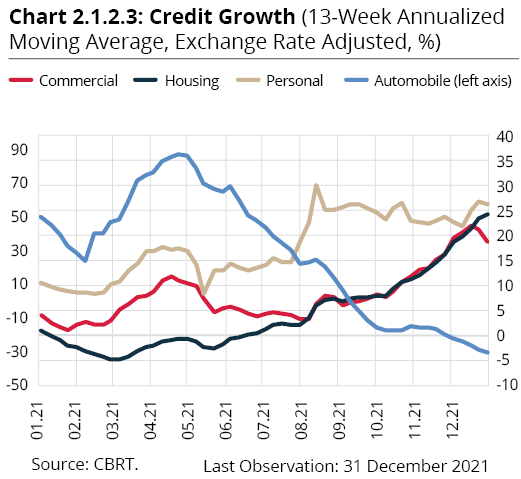

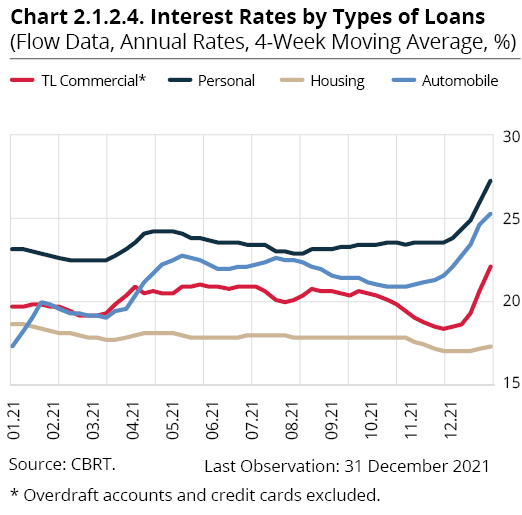

Although the decelerating impact of the monetary tightening implemented in March on credits began to be observed in the second quarter of the year, the retail loan utilization grew noticeably from late May. This is mostly attributable to the deferred demand strongly coming into play following the full reopening. The macroprudential framework was strengthened with the decisions taken by the Banking Regulation and Supervision Agency (BRSA) in July and September to put the retail loan growth on a moderate track. The commercial loan growth recovered following the revisions in the monetary policy stance since September (Chart 2.1.2.3). Due to the CBRT’s policy rate cuts by a total of 500 basis points in the September-December period, banks’ domestic funding costs decreased and deposit rates declined. While housing loan rates were almost flat, consumer loan rates increased, and the decline in commercial loan rates resumed their rise as of December (Chart 2.1.2.4).

Inflation Developments

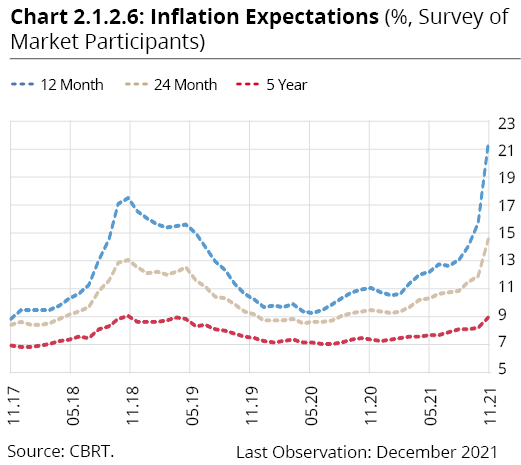

Annual consumer inflation continued its upward trend throughout 2021, with the exception of the economic shutdown in May, and accelerated to 36.08% at the end of the year due to the deteriorated pricing behavior that went beyond the cost effect caused by unhealthy price formations in the foreign exchange market (Chart 2.1.2.5). The main driver of the increase in inflation in 2021 was the depreciation of the Turkish lira, but import prices and unprocessed food prices also contributed to the increase. Commodity prices recorded sharp increases for metals and agricultural commodities, especially energy, due to global supply and demand conditions. Supply-side factors such as transportation costs, agricultural drought, and supply chain disruptions also worsened the inflation outlook. This outlook led to an increase in inflation expectations (Chart 2.1.2.6). Thus, producer inflation remained on the rise throughout the year, reaching 79.89% as of December. In this regard, the trend of inflation recorded an increase in 2021, and annual inflation of core indicators B and C rose to 34.89% and 31.88%, respectively.

The main drivers of the increase in annual inflation were core goods, food and energy. Reflecting a higher exchange rate pass-through, core goods inflation remained high throughout the year, largely on account of exchange rates and international prices. The automobile industry faced vehicle supply issues throughout the year, while the increased Special Consumption Tax (SCT) base in August had a positive, albeit limited, impact on core goods inflation. Amid exchange rate developments, annual core goods inflation surged in December, mostly on the back of durable goods.

Annual food inflation slowed slightly in the first quarter of 2021 mainly due to the performance of fresh fruits and vegetables, but soared in the second and third quarters due to international agricultural commodities and food prices, exchange rate developments, adverse climate conditions and supply shortages in certain products. In 2021, grain yield losses were recorded, especially for wheat and barley, and prices of main inputs, such as animal feed and fertilizers, saw significant increases amid rising import costs. After decreasing slightly in October and November with the correction in prices of fresh fruits and vegetables and the base effect, annual food inflation rose in December due to the course of input costs, becoming one of the drivers of the increase in consumer inflation.

Having decreased significantly in 2020 due to the pandemic, international energy prices posted large increases in 2021. Brent crude oil prices, which ended 2020 at about USD 50, surpassed USD 80 in October. In this period, international prices of energy items such as natural gas, propane and butane increased substantially. Against this background, although the readjusted administered prices of electricity and natural gas put pressure on energy inflation in 2021, this pressure was moderated by the sliding scale system and the price ceilings that made this system more effective. The renewed sliding scale system and the termination of price ceilings in May weighed on energy prices in the following months. October’s zeroed-out SCT on fuel products pushed the sliding scale system to its limit, thus causing Turkish lira-denominated international oil prices to have a direct impact on domestic fuel prices. In the final quarter of the year, energy inflation accelerated dramatically due to the pass-through from the depreciated Turkish lira to fuel, coal and bottled gas prices.

After fluctuating in a narrow range that can be considered horizontal in the first two months of the year, annual services inflation increased in March due to the upward effect of the controlled normalization on some subcategories and the lagged effect of the increased special communication tax. In the second quarter, annual services inflation reflected the effects of the food inflation outlook, backward indexation, the expired Value Added Tax (VAT) reductions for the education sector, exchange rate developments as well as closures and reopening, both in 2021 and 2020. With the normalization and the tourism outlook in the third quarter, services inflation increased further. The accelerated annual services inflation of the last two months of the year was a result of exchange rate developments and the effects of the food price outlook.

Supply - Demand Developments, External Balance and Labor Market

Despite the restraining effects of the pandemic, economic activity remained strong in the first half of 2021 thanks to domestic and external demand, and sustained its strength in the second half of the year via the increasing external demand. Faster and widespread vaccination throughout the year helped the pandemic-stricken services and tourism sectors to recover and economic activity to be maintained with a more balanced composition.

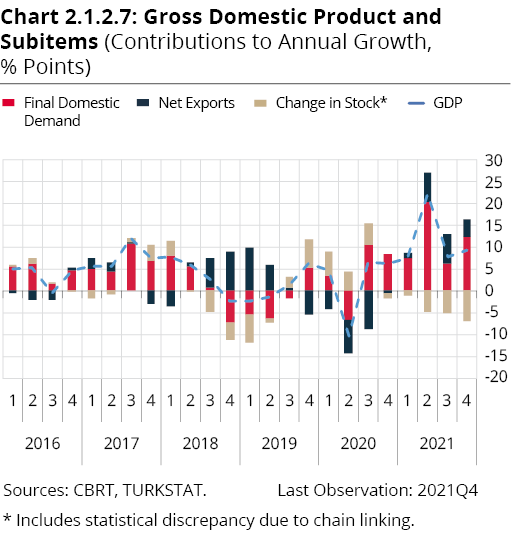

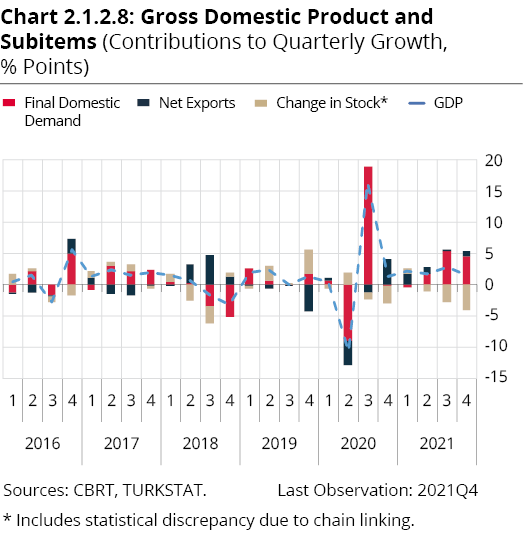

Economic activity followed a strong course in the first quarter of the year, and GDP grew by an annual 7.3% and a quarterly 2.2% (Chart 2.1.2.7). In this period, the added value of services made a limited contribution to growth due to coronavirus restrictions, while final domestic demand slowed due to private consumption amid tighter financial conditions, and total investments and net exports contributed positively to quarterly growth (Chart 2.1.2.8). In the second quarter of the year, economic activity was somewhat slower due to the restrictive effects of pandemic measures and the tightening in financial conditions. However, due to the strong base effect, annual growth amounted to 21.9%. With the normalization steps that started in June and the strong industrial sector benefiting related items, both final domestic demand and net exports, especially private consumption, contributed to quarterly growth on the expenditures side. Economic activity remained strong in the third quarter on the back of the reopening and buoyant external demand. In this quarter, GDP grew by 7.5% year-on-year and 2.8% quarter-on-quarter. Meanwhile, the increased contribution from domestic demand was driven by private consumption expenditures due to the reopening-induced rapid recovery in sectors that were hit by the pandemic (retail trade, accommodation, catering services, etc.). In the last quarter, the driver of growth was final domestic demand led by private consumption, while net exports continued to contribute to growth, and GDP grew by an annual 9.1% and a quarterly 1.5%. Overall, GDP increased by 11% in 2021 and remained above its long-term trend. Private consumption made a large contribution to growth during 2021, while the contribution of net exports to annual growth was around 5 points thanks to strong external demand conditions throughout the year, but stocks had a limiting effect on annual growth.

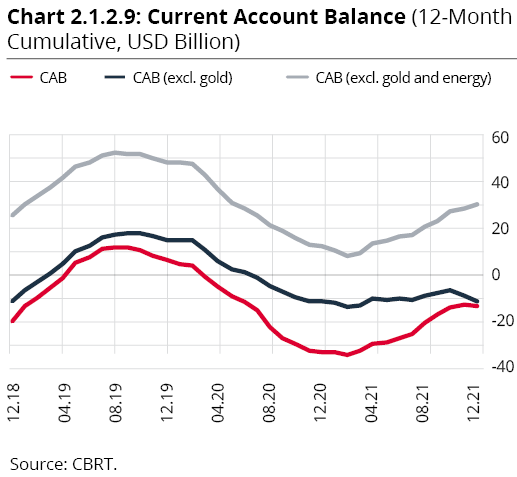

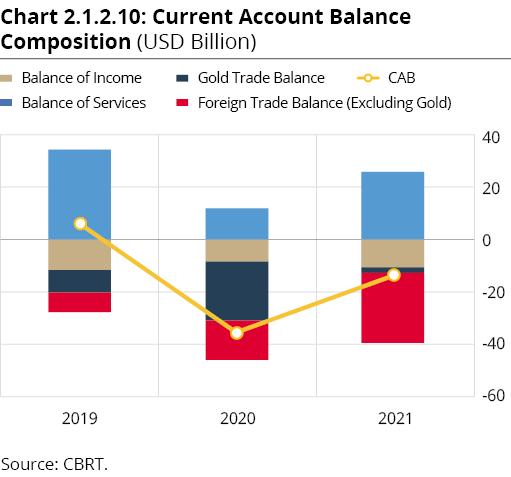

In 2021, external trade grew in line with the recovery in global demand, while the current account balance improved with the decline in gold imports and the recovery in services revenues (Chart 2.1.2.9). Amid buoyant global economic activity, exports continued to be strong, while imports increased due to the rise in commodity prices. Adjusted for price effects, external trade was stable in real terms. Thanks to faster vaccination and the lifting of restrictions, services revenues recorded a significant increase in the third quarter and the services balance made an increased contribution to the current account balance (Chart 2.1.2.10). Thus, the current account deficit narrowed to USD 14.9 billion in 2021. The recovery in capital inflows and the increase in the real sector’s debt rollover ratio contributed to the financing of the current account deficit.

The strong economic activity of 2021 also had a positive impact on the labor market, bringing unemployment rates down. Despite the strong economic activity and the practices of short-time work allowance, the ban on dismissals, and unpaid leave, unemployment rates remained flat in the first quarter of the year due to the ramifications of pandemic measures and the increase in the participation rate (Chart 2.1.2.11). Employment continued to vary across sectors, and the course of pandemic-led uncertainties and of restrictions on the services sector limited the recovery in employment. On the other hand, despite a small contribution from the services sector, non-farm employment reached pre-pandemic levels in the first quarter on the back of the industrial sector. In the second quarter, labor force participation increased marginally on a quarterly basis, while the increase in employment drove unemployment lower (Chart 2.1.2.12). The gradual easing of pandemic restrictions, the promising outlook for vaccination and the anticipated recovery in tourism had a positive impact on services employment, but the sectoral divergence continued. In the third quarter, the impact of reopening on economic activity was also evident in the labor market. The increase in employment helped bring unemployment down, whereas the increase in the participation rate limited the decrease in the unemployment rate. In this period, employment grew on account of the services sector, led by the reopening and the upbeat tourism sector, and non-farm employment and all its sectoral components exceeded their pre-pandemic levels. Accordingly, employment developments are in line with the economic balancing observed across sectors. In the last quarter of the year, the labor market continued to improve in tandem with the economic outlook. Employment remained on the rise on the back of the services and industrial sectors, with the help of the reopening and the positive course in tourism, while the increase in the labor force participation rate continued to limit the decline in unemployment rates.