The CBRT holds foreign currency reserves in support of a range of objectives that include assisting the government in FX-denominated domestic and foreign debt servicing; maintaining adequate FX liquidity against external shocks; supporting monetary and exchange rate policies, and enhancing market confidence. The CBRT’s reserve management practices are governed by the CBRT Law No. 1211. Pursuant to this law, foreign exchange reserves are managed by the CBRT in consideration of the three priorities as investment safety, liquidity and return. Accordingly, the objective of management of foreign exchange reserves is to generate returns while observing constraints such as protecting capital and ensuring the availability of liquidity, the ultimate aim being the prudent management of the reserves, the country’s national wealth.

The CBRT’s institutional decision-making framework for reserve management has a three-tier hierarchical structure. Firstly, in line with the duties and powers entrusted by the CBRT Law No. 1211, the Board, as the Bank’s top decision-making authority, approves the Guidelines for Foreign Exchange Reserve Management (the Guidelines) and sets the general investment criteria for reserve management, and authorizes the Executive Committee and Governor to make decisions about implementation. Decisions made by the Executive Committee or the Governor in accordance with the Guidelines approved by the Board constitute the second tier of the institutional decision-making process. At this point, a benchmark portfolio that reflects the CBRT’s investment strategy and general risk tolerance is determined and becomes effective upon the approval of the Executive Committee and it is revised every three months and updated when needed. The third and final tier of the institutional decision-making process is the implementation of reserve management practices within the preferences and constraints specified by the Guidelines and the benchmark portfolio. Reserve management activities are carried out within an organizational structure based on the segregation of duties principle. Accordingly, the reserve management activities are carried out by the Reserve Management Division, while related risk management activities are carried out by the Corporate Risk Management Division.

Subject to the objectives, constraints and limits set by the Guidelines and the benchmark portfolio, operations are conducted through FX buying selling transactions in international markets, FX deposit transactions, securities buying-selling transactions, repo and reverse repo transactions, securities lending transactions, and derivatives transactions.

Management of risks that the CBRT may be exposed to during the conduct of its reserve management operations begins with the definition of the benchmark portfolio. Reflecting the CBRT’s preferences for strategic asset allocation, the benchmark portfolio consists of target currency composition, target maturities and limits of deviation from these targets, maximum permissible transaction limits, eligible transaction types, the investment universe representing countries and instruments to invest in. Accordingly, once the currencies, instruments and maturities to be employed in reserve management are set, the expected return and the financial risks involved are to a large extent identified. Upon setting the overall permissible risk level in line with the CBRT’s risk tolerance by means of the benchmark portfolio, risks are measured, monitored, and reported regularly.

2021 was marked by the start of a global program of vaccination against the coronavirus pandemic, which affected national economies and international financial markets severely. It was also marked by global economic recovery with the gradual lifting of closure measures. Given the improved economic outlook, setbacks in the supply chain and mounting inflationary pressures amid soaring energy prices, major central banks tightened their monetary stances by gradually reducing the monetary support provided to the markets during the pandemic period, and concrete steps were taken in this respect in the last quarter of the year. However, concerns over variants of the virus that emerged during the year further weighed on uncertainties in national economies and financial markets.

Uncertainties over the course of the pandemic, expectations and developments regarding the policies of major central banks shaped the CBRT’s reserve management strategies for 2021. In this context, the conservative approach adopted in reserve management was maintained in 2021, when financial risks continued to remain high, and all due measures were taken to maintain reserves.

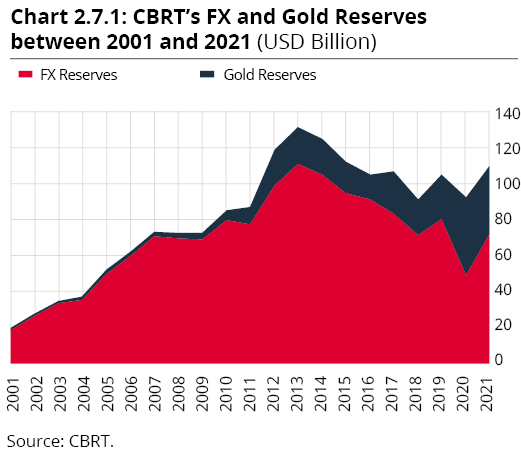

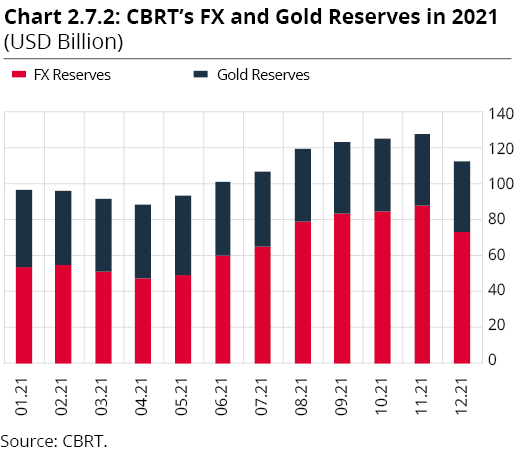

As of 31 December 2021, our international reserves stood at USD 111.1 billion, and the share of our gold reserves became 34.7% (Charts 2.7.1 and 2.7.2). Gold reserves of the CBRT, which are of international standard, are managed according to the Gold Reserve Management Regulation approved by the CBRT Board, within the terms and conditions of the CBRT Law No. 1211. Pursuant to this regulation, outright gold purchase and sale, gold deposit, gold coin swap, location coin swap and physical gold transfer transactions are facilitated.