As a sign of the importance that it attaches to academic studies, the CBRT posts working papers and research notes in economics prepared by the CBRT staff on the CBRT website. In 2021, the peer-reviewed CBRT Working Papers series written by the CBRT staff increased by 39. Moreover, with a view to making a timely contribution to discussions on economic developments and sharing the results of the studies on the Turkish economy and monetary policy, three Research Notes in Economics were issued.

In addition, the peer-reviewed journal “Central Bank Review”, which prioritizes studies on macroeconomics, monetary economics, finance and capital markets, banking and financial intermediation, macro and micro prudential regulations, international economy and finance, was published four times in 2021.

On the other hand, articles contributed by CBRT employees were published in journals listed in the Social Sciences Citation Index (SSCI).

In 2021, the CBRT continued to conduct analyses towards determining the structural developments in the Turkish economy, particularly structural factors limiting the effectiveness of monetary policy, carried out research and monitoring activities in the form of on-site observation of the effects of monetary policy on real sector activities, and produced policy recommendations in the framework of inter-institutional cooperation. These research and field observations were supported by new data and models, and the results of the study were communicated within and outside the Bank via research publications and conferences.

Activities carried out regarding structural economic developments can be grouped into four headings:

(1) Research activities on the interaction of structural factors of the Turkish economy with the monetary policy, (2) Secretarial work for the Food and Agricultural Product Markets Monitoring and Evaluation Committee (Food Committee) and establishing the Food Products Early Warning System (FPEWS), (3) Coordination activities for research studies, (4) Activities in the scope of the Real Activity Lens (REAL).

In order to examine the structural developments in the Turkish economy and their interaction with monetary policy, various topics have been examined such as pricing behavior, market structure and competition, foreign trade and current account balance, growth, labor markets, human capital and productivity, and firm dynamics by employing empirical and theoretical methods. The findings were regularly presented to policy makers during MPC processes and at Committee meetings held with stakeholders.

The Food Committee, the secretarial services of which are carried out by the CBRT, focused on solving structural and cyclical problems in the agriculture and food sectors seeking sustainable price stability. Food Committee decisions are made based on cooperation between institutions, and thanks to the representation of relevant institutions at the highest level, a solution-oriented cooperation has been developed and concrete policy measures have been introduced. In this context, five Food Committee meetings and 21 Food Subcommittee Meetings were held in 2021.

The CBRT has been conducting the Food-EWS project as per the decisions of the Food Committee. In the framework of the Food-EWS project, a data warehouse and analysis module have been established to allow analysis of the data on food and agricultural products prices, which are of critical importance for price stability, in a detailed and timely manner and taking measures. In the first half of the year, the CBRT shared data patterns with relevant institutions and continued to work on compilation, visualization and analysis of the data to be included in the system. In September, data transfer from relevant institutions and organizations and protocol processes with stakeholders were completed and the database became ready to use. These data are used in monitoring structural problems and critical developments in the food and agricultural products markets. At the Committee meetings, regular information is provided on the latest developments in the sector and reports are presented.

In 2021, six articles based on research studies examining the structural issues of the Turkish economy were published in journals listed in the Social Sciences Citation Index. In addition, 20 research articles were added to the CBRT Working Papers series, and three articles were published in the Central Bank Review. These studies have been presented to academics and policy makers in 11 national and international seminars and conferences. In 2021, seven online seminars were organized as part of the seminar series. In 2021, the CBRT supported 11 conferences in various fields of the Turkish economy in the scope of the Financial Support Program for Academic Studies. In 2021, 128 articles were submitted to the Central Bank Review, whose editorial processes are carried out by the CBRT, and 13 articles were accepted and published in the journal at the end of referee and editor evaluations.

In 2021, the CBRT continued to incorporate real sector developments into its decision-making processes. In this regard, meetings were organized bringing together the CBRT and senior executives of firms and NGOs to serve as a platform to gather comprehensive information about the economic activity, and real sector sentiment has been monitored in a timely manner.

Information gathered in monthly meetings allowed a healthier evaluation of cyclical developments in economic activity (such as production, domestic and foreign sales, employment, financing conditions, costs and prices). These visits aimed to exchange views on the effects of monetary policy practices on the real sector, thus contribute to the CBRT’s communication policy.

In addition to the regular field meetings held to follow cyclical developments, thematic studies were carried out on the developments in the areas of interest of the MPC or on the issues specific to the period, and reports were prepared based on real sector interviews. Meanwhile, in order to monitor price volatility of agricultural and livestock products more closely, meetings have been held with organizations operating in that sector since February 2021. Accordingly, first of all, the country’s agriculture and livestock production pattern was determined, and organizations from which qualified and reliable information could be obtained were identified. Findings compiled from the interviews held during periods such as the harvest, which contain important data in terms of yield estimation, were reported. A total of 2,693 interviews were conducted in 2021, 1,785 of which were cyclical studies.

With a Board decision of 12 March 2020, it was decided to adopt a new working model establishing real sector activities in 19 branches excluding Ankara and Istanbul branches. In 2021, the CBRT focused on ensuring operability of real sector and communication functions in all branches except for one. Accordingly, training was completed in three branches and employees learned how to carry out real sector activities on a regular basis. It is planned to complete the training by the end of the first quarter of 2022 in those six branches.

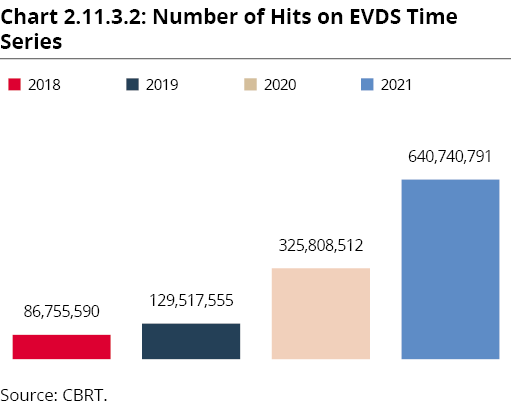

The Electronic Data Distribution System (EVDS) hosts statistical data produced by the CBRT or produced by other institutions and collected within the CBRT as a time series, in a dynamic and interactive manner. In 2021, in the scope of banking statistics, new data groups were added as part of the business tendency, employment, securities, balance of payments, foreign trade, money and banking statistics and the existing series were enriched. In 2021, the total number of EVDS visitors reached 922,208 (Chart 2.11.3.1), while the number of clicks on time series exceeded 640 million, almost doubling the previous year (Chart 2.11.3.2).

In the scope of data governance studies, the Regulation on the Procedures and Principles Regarding Data Governance of the Central Bank of the Republic of Türkiye was prepared in order to regulate the procedures and principles regarding the use and sharing of operational and analytical data within the CBRT; the relevant regulation was approved by the Board on 5 August 2021 and took effect.

The hardware and software infrastructure of the Big Data Platform, which is extensively used in data-oriented decision-making processes and forms the basis of high-frequency data architecture, has been reinforced to support the CBRT’s increasing data volume and utilization needs.

Virtual Data Rooms (SVOs), which provide high performance and data security to researchers at the Bank in accordance with the Data Governance Regulation, were reinforced with up-to-date software, new data sets and advanced security features. Over the Virtual Data Rooms, 70 researchers in seven different units can work on 434 data sets on the Big Data Platform.

The Data Inventory System, which includes variable-level description, ownership, frequency of collection, personal and private quality information of data sets in the CBRT Big Data Platform, was developed and made available to CBRT researchers.

Analyses obtained from high-frequency data were presented to the senior management with new generation monetary policy analysis tools within the scope of data visualization studies.

The CBRT signed protocols with nine different institutions to obtain the data sets that it needs for data-oriented decision-making processes.

The content of the company accounts statistics was enriched by adding 4-digit NACE sector codes. Moreover, in order to facilitate researchers’ data analysis processes, data for all years were made available as a panel data set in the form of both 3-digit and 4-digit NACE sector codes.

The CBRT made a country contribution by uploading aggregated company accounts statistics to the European Committee of Central Balance Sheet Data Offices (ECCBSO) database that allows analysis by a breakdown of country, year and scale level. Thus, our researchers will be able to make comparative sectoral analyses on the international level.

In the scope of the Systemic Risk Data Monitoring System, data on firms with a credit debt of USD 15 million and over had been reported on a quarterly basis since 2018. However, as of January 2021, these data started to be reported on a monthly basis and in a data structure enhanced in line with the CBRT’s needs for analyses.

The CBRT has established the human resources and physical infrastructure necessary for the early warning and monitoring system to be supported by high-frequency data, which will allow a timely analysis of impacts of monetary and fiscal policies on real persons’ and firms’ investment, credit use and saving behaviors.

In order to provide effective data support to the CBRT reserve and risk management; rating and risk analysis systems have been established allowing analysis of companies’ financial tables and credit risk with traditional and machine learning techniques.

Working files have been updated in order to make Money and Bank Statistics clearer.

In order to allow users to follow the revisions made in the Financial Accounts statistics, a revisions table (process table) started to be produced as of the fourth quarter of 2020, with the publication in April 2021.

In order to reduce banks’ workload stemming from repetitive reporting, the CBRT stopped receiving report forms in the same format and content from banks directly, but started to obtain them from the BRSA.

The automation project for the weekly Money and Bank Statistics publication has been completed.

As of 19 February 2021, the amount of change in FX deposits of residents compared to the previous week “adjusted for the parity effect” has been included in the scope of the Weekly Money and Banking Statistics publication.

The compilation method of commercial loans consisting of export receivables and import debts has been revised as a result of a joint study carried out with the Turkish Statistical Institute. The new data compiled by using direct reporting method have been reflected on the Short-term External Debt and International Investment Position Statistics on 19 August 2021 and on Balance of Payments statistics on 13 September 2021. Regarding the revision, a research note in economics and a blog post have been issued, and a box was inserted in the Inflation Report 2021-III.

Securities Statistics, which was renewed as per the efforts towards harmonization with international statistical standards in the scope of G20 Data Gaps Initiative, was issued in its new content and format on 19 August 2021. Accordingly, the sector classification has been adapted to international guidelines, the definition of ownership has been improved, the net change calculation method has been harmonized with international practices, information has been added on the holder of the security with respect to the currency type and maturity for securities issued abroad, the maturity breakdown has been updated in line with international practices, and the publication format has been simplified.

With the implementation change introduced in August 2021, improvements were made in the Foreign Currency Assets and Liabilities Table of Non-financial Companies with respect to data sources and methods used. As the “Export Receivables” and “Import Payables” data started to be compiled by the Turkish Statistical Institute (TURKSTAT) by direct reporting method, the relevant items have been updated starting from December 2002 data. Deposits held in domestic banks and loans obtained from domestic banks items started to be prepared based on original balances by using the additional data source, and the relevant time series have been updated starting from January 2015 data.

A number of research and development studies have been carried out to improve the banknote printing process.

Signatures on E9 Emission Group, Series V and Series VI banknotes have been changed (200, 20, 10 and 5 Turkish Lira banknotes of Series V and 20 Turkish lira banknotes of Series VI).

The Banknote Printing Plant started to operate Integrated Management System which is a combination of ISO 9001 Quality Standards, ISO 45001 Occupational Health and Safety Management, ISO 14001 Environmental Management System in 2021. Between 16-18 November 2021, the Banknote Printing Plant underwent an integrated audit by the Turkish Standards Institution to verify compliance of the Banknote Printing Plant’s Quality Management System with the ISO 9001 Quality Standards, Occupational Health and Safety Management System with ISO 45001 standards, and Environmental Management System with ISO 14001 system. At the end of the audit, the Banknote Printing Plant ‘s ISO 9001 Quality and ISO 45001 Occupational Health and Safety Management System documents have been revised and ISO 14001 Environmental Management System document was decided to prevail.

As for Information Technologies (IT), new technological solutions and systems have been established in line with the Bank’s objectives, and the necessary steps were taken to ensure the security and continuity of these systems. Below are the most significant of many improvements carried out throughout the year:

The CBRT continued to carry out a wide range of research activities in innovative technology areas that will affect the future of central banking and the financial system such as digital money, blockchain, machine learning and artificial intelligence. Highlights from the CBRT’s activities in the field of financial innovation towards its goals are listed below: