The funding requirement of the system increased by approximately TRY 474 billion throughout the year and reached TRY 1,089 billion by the end of 2021. The main causes of this increase are: the increased value of banknotes in circulation, readjusted RR regulations, FX transactions against TRY and the increase in the Treasury’s net borrowings. Ending 2020 at TRY 338 billion, swap transactions increased by approximately TRY 261 billion to TRY 599 billion as of 31 December 2021. Amounting to TRY 277 billion at the end of 2020, net OMO increased by about TRY 213 billion to TRY 490 billion as of 31 December 2021.

Throughout 2021, OMO funding was provided through repo quantity auctions at the one-week repo auction rate, which is the main policy rate.

In 2021, the set of securities accepted as collateral for OMO transactions was expanded. In this context, banks were allowed to conduct repo transactions using gold and FX (USD or EUR) denominated government securities and lease certificates issued by the Ministry of Treasury and Finance and the Undersecretary of Treasury Asset Leasing Company (HMVKŞ) for institutional investors, in addition to Turkish lira-denominated government securities and lease certificates issued by the Ministry of Treasury and Finance and HMVKŞ.

For TRY Deposit Selling, Late Liquidity Window (LON) and Intraday Limit transactions conducted at the Interbank Money Market (IMM), the ratio of collateral that banks are required to hold in the form of government securities and/or lease certificates domestically issued by HMVKŞ to debt was changed from 10% to “at least 30% “, effective from 27 December 2021.

The CBRT continued to use reserve requirements effectively as a macroprudential tool as well as to support its monetary policy throughout 2021.

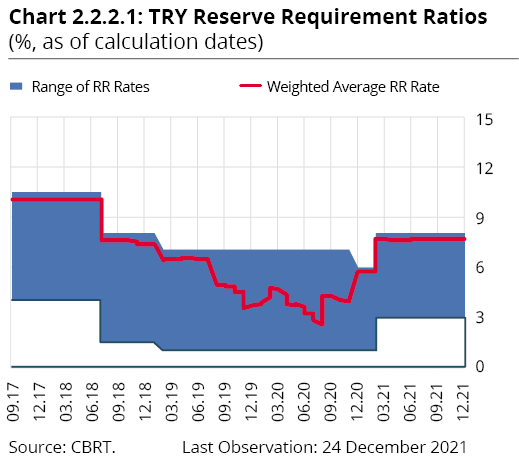

In February, in line with the objective of sustainable price stability, TRY RR ratios were increased by 200 basis points for all liability types and maturity brackets to make the monetary transmission mechanism more effective, and the upper limit of the facility for holding FX was decreased from 30% to 20% of TRY RRs while the upper limit of the facility for holding standard gold was decreased from 20% to 15% of TRY RRs (Table 2.2.2.1). In addition, the remuneration rate applied to TRY-denominated RRs was increased by 150 basis points to 13.5%.

Table 2.2.2.1: TRY Reserve Requirement Ratios (%, as of calculation dates)

Date of Effect |

11.12.2020 |

19.02.2021 |

Deposits/participation funds (excl. bank deposits/participation funds from abroad) |

|

|

Maturity of up to 3 months |

6 |

8 |

Maturity of up to 6 months |

4 |

6 |

Maturity of up to 1 year |

2 |

4 |

Maturity of 1 year or longer |

1 |

3 |

Borrower Funds of Investment Banks |

6 |

8 |

Other Liabilities (incl. bank deposits/participation funds from abroad) |

|

|

Maturity of up to 1 year (incl. 1 year) |

6 |

8 |

Maturity of up to 3 years (incl. 3 years) |

3.5 |

5.5 |

Maturity longer than 3 years |

1 |

3 |

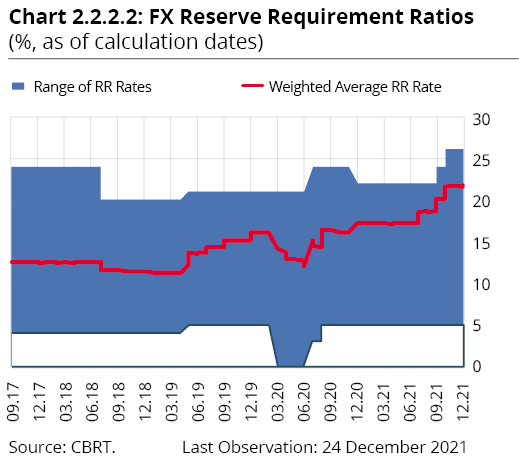

The press release of 1 July 2021 stated that the upper limit of the facility for holding FX for Turkish lira reserve requirements would be decreased from 20% to 10% as of the maintenance period starting on 6 August 2021. This facility was terminated on 1 October 2021 and reserve requirement ratios for FX deposits/participation funds were increased by 200 basis points for all maturity brackets. In September, reserve requirement ratios for FX deposits/participation funds were increased by 200 basis points for all maturity brackets to be effective from the maintenance period starting on 1 October 2021. In November, the upper limit of the facility for holding standard gold for Turkish lira reserve requirements was decreased from 15% to 10%, and this facility was announced to be gradually decreased and terminated. In addition, the reserve requirement ratios for FX deposits/participation funds were increased by 200 basis points for all maturity brackets (Table 2.2.2.2).

Table 2.2.2.2: FX Reserve Requirement Ratios (%, as of calculation dates)

Date of Effect |

11.12.2020 |

19.07.2021 |

17.09.2021 |

28.10.2021 |

Deposits/participation funds (excl. bank deposits/participation funds from abroad) |

||||

Maturity of up to 1 year |

19 |

21 |

23 |

25 |

Maturity of 1 year or longer |

13 |

15 |

17 |

19 |

Precious metal deposit accounts |

||||

Maturity of up to 1 year |

22 |

22 |

24 |

26 |

Maturity of 1 year or longer |

18 |

18 |

20 |

22 |

Borrower Funds of Investment Banks |

19 |

21 |

23 |

25 |

Other Liabilities (incl. bank deposits/participation funds from abroad) |

||||

Maturity of up to 1 year |

21 |

21 |

21 |

21 |

Maturity of up to 2 years |

16 |

16 |

16 |

16 |

Maturity of up to 3 years |

11 |

11 |

11 |

11 |

Maturity of up to 5 years |

7 |

7 |

7 |

7 |

Maturity longer than 5 years |

5 |

5 |

5 |

5 |

The press release of 1 July 2021 also stated that, in order to decrease the share of FX in the total deposits/participation funds and to increase the share of Turkish lira in banks’ balance sheets, FX deposits/participation funds available as of 25 June 2021 and converted after this date to Turkish lira deposits/participation funds with a maturity of one month or longer would be exempt from reserve requirement liabilities, and an additional remuneration would be paid to banks for the converted amount. Accordingly, banks were paid a remuneration at the policy rate level for the maintenance of reserve requirements equivalent to the amount converted to TRY time deposits.

Following the policy rate changes, the interest/remuneration rate to be applied to TRY-denominated RRs was reduced by 100 basis points to 12.5% at the end of September, by 200 basis points to 10.5% at the end of October, and by another 100 percent in November and December to 8.5%.

With an aim to support financial stability by increasing the share of Turkish lira in total deposits/participation funds in the banking system, in addition to the previously implemented schemes it was decided to provide support to deposit and participation fund holders in the event that their FX deposit accounts and FX participation funds, and gold- denominated deposit accounts and participation funds were converted into Turkish lira time accounts at the account holder’s request as stated in the press releases dated 21 December 2021 and 29 December 2021.

In addition to the said regulations, the amounts converted into TRY time deposit accounts within the scope of the Communiqués numbered 2021/14 and 2021/16 are held exempt from the RR liability and banks receive an additional interest/remuneration for the maintenance of an RR facility corresponding to each account of resident real persons converted into TRY time deposits.

After the regulation changes made in 2021, average weighted RR ratios for TRY and FX were 7.7% and 21.8%, respectively, as of the calculation date of 24 December 2021 (Charts 2.2.2.1 and 2.2.2.2).

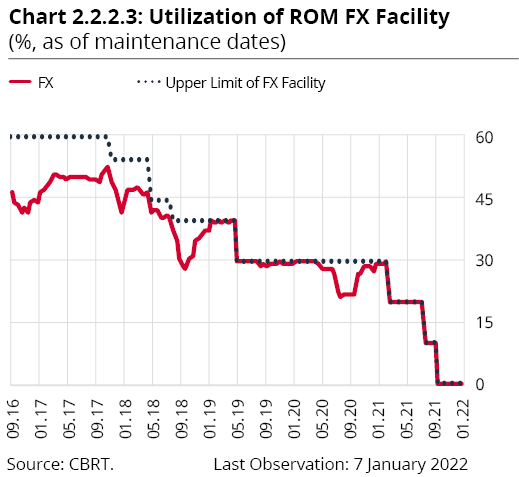

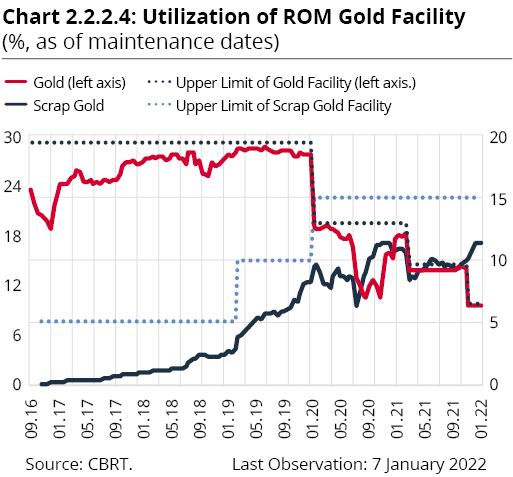

The FX facility under the ROM was terminated as of the maintenance period starting on 1 October 2021 (with the calculation date of 17 September 2021). In the maintenance period pertaining to the calculation date of 24 December 2021, the ROM utilization rate was 98.3% for the gold facility and 75.4% for the scrap gold facility (Charts 2.2.2.3 and 2.2.2.4). On the other hand, banks can also maintain standard gold for their precious metal deposit accounts, and this facility’s utilization rate was 65% as of the same maintenance period.

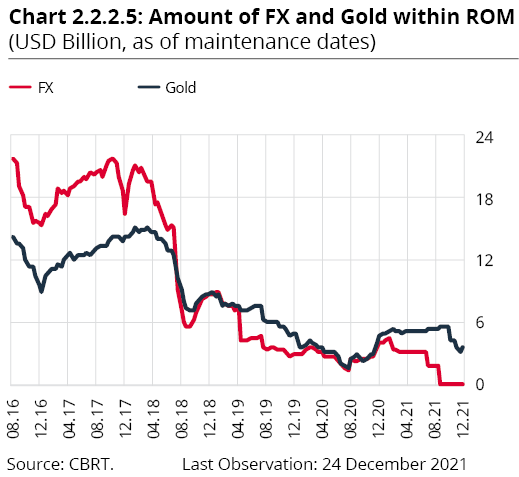

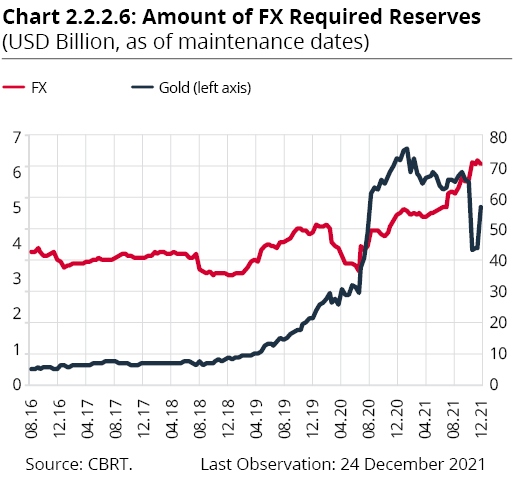

In the maintenance period starting on 24 December 2021 with the calculation date of 10 December 2021, USD 3.1 billion worth of gold was maintained for Turkish lira liabilities within the framework of the ROM facility (Chart 2.2.2.5). For FX liabilities, USD 70.9 billion worth of FX and USD 5.0 billion worth of gold were maintained (Chart 2.2.2.6).

In 2021, the Bank continued with the floating exchange rate regime, in which exchange rates are determined by supply and demand conditions in the market. Therefore, the CBRT does not have any nominal or real exchange rate target. However, the CBRT may intervene in the market in case of unhealthy pricing or excessive exchange rate volatility in order to limit the risks to financial stability.

In 2021, no FX buying or selling transactions were conducted via the auction method. Due to unhealthy exchange rate pricing, the Bank intervened in the FX market through direct sales on 1 December, 3 December, 10 December, 13 December and 17 December 2021, and injected a total of USD 7,278 million liquidity into the market with these interventions.

Among currency swap transactions in 2021, the CBRT provided funding through traditional Turkish lira currency swap auctions, BIST Currency Swap Market transactions and Turkish lira currency swap market transactions. As of 31 December 2021, the outstanding amount of traditional Turkish lira currency swap transactions was USD 32.8 billion, and the outstanding amount of Turkish lira currency swap market transactions via the quotation method was USD 6.6 billion. On the other hand, the outstanding amount of Turkish lira currency swap transactions via the quantity auction method fell to zero as of 22 March 2021, and no new transactions were carried out in 2021. The CBRT continued to conduct USD and EUR transactions aligned with the monetary policy interest rates at the BIST Swap Market in 2021. As of 31 December 2021, the CBRT’s swap transactions at the BIST Swap Market amounted to USD 3.8 billion.

In line with the steps taken on 27 December 2021 to ensure a balance between OMO funding and currency swap funding, shorten the maturity structure in a measured way, and have a better distribution of banks winning the currency swap auctions, the CBRT decided to move its transactions at the BIST Swap Market to traditional two-week currency swap transactions. In addition, the amount of bids that each bank can make for traditional currency swap auctions was limited to a maximum of 30% of the total auction amount, and the practice of transferring the unused portion of the total currency swap position determined for the auctions to banks’ currency swap transaction limits determined via the quotation method was terminated.

In order to help banks conduct better liquidity management and incorporate gold savings into the financial system, the Bank continued with TRY Gold Swap Market and FX Gold Swap Market transactions in 2021. As of 31 December 2021, the net outstanding amount at the TRY Gold Swap Market via the quotation method was 65.8 tons, the net outstanding amount at the FX Gold Swap Market was 5.1 tons, and the net outstanding amount of TRY gold swap auctions was 40.7 tons.

In order to contribute to banks’ gold liquidity management, gold selling transactions against FX and location swap transactions with banks continued at the CBRT and BIST Precious Metals and Diamond Market in 2021. In June 2021, standard gold buying transactions against TRY were launched at the BIST Precious Metals and Diamond Market.

After being suspended on 8 October 2020, the transactions of buying gold produced from ore against TRY resumed in May 2021.

In 2021, the CBRT continued to conduct TRY-settled FX futures transactions, launched on 31 August 2018 at the BIST Derivatives Market (VIOP), depending on market conditions. In addition, to help exporters and importers manage their exchange rate risk, TRY-settled FX futures selling auctions were resumed on 29 December 2021.

The aim of rediscount credits for exports and FX yielding services is to provide exporters access to funds at cheaper costs and to reinforce the CBRT’s reserves. Rediscount credits, which are governed by Article 45 of the CBRT Law, are extended to exporters and firms that engage in FX yielding services and activities by accepting TRY and FX-denominated bills for rediscount through intermediary banks. The loans have a maturity of up to 360 days and are repaid to the CBRT in either TRY or FX, depending on the bill’s denomination.

The total limit available for rediscount credits was raised from USD 20 billion to USD 30 billion in 2021, USD 20 billion of which is assigned to Turk Eximbank and the remaining USD 10 billion to other banks. Banks other than Turk Eximbank are assigned a limit per bank depending on their asset size, rediscount credit balances and amounts of conversion from FX deposits to TRY deposits. Credit limits for firms were updated in 2021. Accordingly, among SMEs, the credit limit is USD 250,000 for micro firms, USD 1 million for small firms, USD 5 million for medium-sized firms, USD 350 million for companies engaged in FX yielding services, export intermediaries and firms operating in the defense industry, and USD 200 million for other firms. The entire limit can be used in applications for credits with a maturity of up to 120 days, whereas a maximum of 60% of the limit can be used in credit applications with a maturity of 121 to 360 days. Moreover, these limits are doubled, tripled and quadrupled for firms with net sales revenues (pertaining to the last fiscal year) above TRY 5 billion, TRY 15 billion and TRY 20 billion, respectively.

Effective from 1 October 2021, the conditions for rediscount credits were changed as follows:

On 27 October 2021, the Bank decided to simplify the interest rates and maturities applied to rediscount credits. In this regard, in addition to the zero interest on loans against an additional selling guarantee for FX loans, their maturities are extended to 181 to 360 days if the additional FX selling guarantee is doubled. Meanwhile, the interest rate on a loan is the policy rate minus 100 basis points in case no additional FX selling guarantee is given for TRY-denominated loans, or the policy rate minus 500 basis points if an additional FX selling guarantee is given.

The new arrangement requires the selling of twice as much additional FX if a firm wants to borrow TRY rediscount credits with a maturity of 181 to 360 days, the interest on which is the policy rate minus 400 basis points. The firm must sell at least as much as the additional FX export proceeds within two months after borrowing, and at least as much as the remainder of the guarantee within six months after borrowing. FX export proceeds sales must be fulfilled by the date of maturity under all circumstances.

In 2021, a total of USD 19.72 billion worth of rediscount credits were extended, of which USD 19 billion was in FX and USD 0.72 billion was in TRY. The contribution of rediscount credit repayments to reserves was USD 21.08 billion in total. Additionally, the contribution made to the CBRT reserves through the additional FX export proceeds sales amounted to USD 0.37 billion.

Extended in 2020 within the scope of the measures taken by the CBRT to counter the coronavirus pandemic, TRY 10.3 billion worth of rediscount credits were repaid in 2021.

In addition, in order to finance trade or investment activities to be carried out between the Republic of Türkiye and the People’s Republic of China in local currency, about CNY 100.72 million (USD 15.57 million) worth of rediscount credits originating from currency swap agreements were extended in 2021.