Economic activity was strong in the first half of 2022 on the back of domestic and external demand but lost momentum somewhat in the second half of the year due to the weak external demand outlook. On the expenditures side, the share of sustainable components in the growth composition remained high throughout the year with the contribution of machinery-equipment investments and net exports. On the production side, the services sector stood out as the main driver of growth. On the other hand, industrial production value added, which displayed a strong upward trend in the first half of the year, decreased on an annual basis in the second half of the year amid decelerating external demand. Accordingly, the annual rate of growth was 5.6% in 2022, and the Turkish economy ranked high among G20 and OECD countries with its growth performance since the last quarter of 2019. Meanwhile, in US dollar terms, GDP reached the highest level since 2014.

Despite the Russia-Ukraine War, the strong upward trend in exports continued in the first half of 2022 on the back of the favorable external demand outlook and the flexibility of exporters to change markets. Additionally, services revenues remained high supported particularly by tourism and transportation sectors. On the other hand, energy and other commodity prices, which rose sharply due to geopolitical risks, triggered an increase in imports. This, coupled with the upward trend in gold imports, led to widening of the current account deficit. As a result of weakening external demand driven by the negative global growth outlook and the fall in the euro-dollar parity, export revenues from European countries, Türkiye’s largest trade partner, decreased in the second half of the year while imports remained elevated due to the acceleration in gold imports and energy prices. On the other hand, services revenues increased amid strong tourism demand. Against this background, the current account deficit was recorded at USD 48.8 billion in 2022. Meanwhile, the structural current account surplus calculated by excluding the cyclical effects in international prices rose throughout the year.

This indicates that exports have been making a permanent contribution to the current account surplus capacity. In this period, property purchases and growing deposits of non-residents and the strong increase in companies’ debt rollover ratios contributed to the financing of the current account deficit.

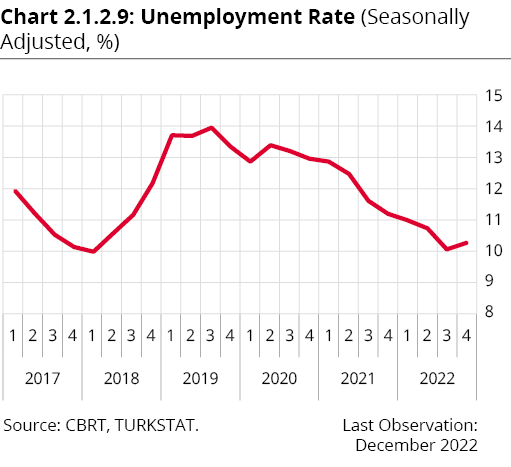

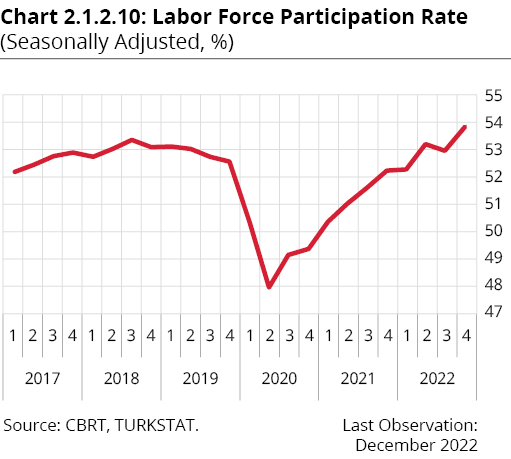

The robust course in economic activity was also positively reflected in the labor market in 2022. Accordingly, employment increased throughout 2022 while the decline in the unemployment rate continued. Analyzed by sectors, employment maintained its upward trend led by services and industrial sectors, and there was a steady rise particularly in the services sector throughout the year due in part to tourism. In this respect, Türkiye was among the OECD countries that registered the largest increase in employment in terms of both the number of people and the growth rate since the pre-pandemic period. The labor force participation rate was on an increasing trajectory during the year, except for the limited decrease in the third quarter which, in fact, contributed to the continuation of the downward trend in the unemployment rate. Against this background, the seasonally adjusted unemployment rate receded to 10.2% at the end of 2022.

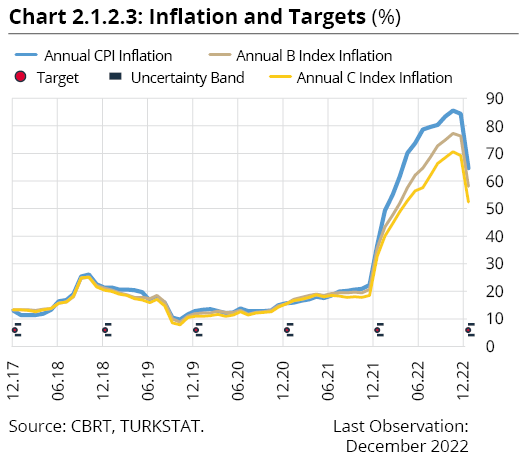

Annual consumer inflation increased sharply in the first half of 2022 due to the depreciation of the Turkish lira and geopolitical developments. However, it decelerated in the second half on the back of largely waning effects of negative global supply shocks and the positive effects of policies implemented, and stood at 64.3% at the end of the year. The increase in inflation was mainly driven by pricing behavior shaped by price formations in the FX market that were detached from economic fundamentals as well as the sharp rise in global commodity and food prices caused by geopolitical developments. Additionally, supply-side factors such as the increases in import prices on USD basis, the elevated level of global transportation costs, and disruptions in supply processes also affected the inflation developments unfavorably. Meanwhile, the impact of aggregate demand conditions on annual inflation remained limited compared to other factors. Producer prices surged by 97.7% in 2022, which was majorly driven by exchange rate developments as well as the rise in global commodity prices, energy in particular, and supply constraints. The underlying trend of inflation also increased in 2022 while the annual inflation of B and C indices among core inflation indicators realized at 57.7% and 51.9%, respectively.

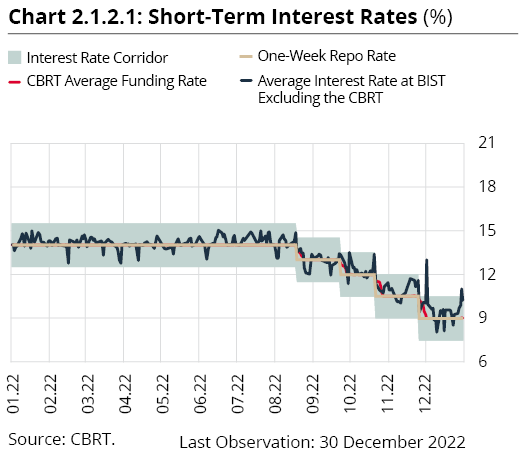

In the January-July 2022 period, the CBRT kept the policy rate (the one-week repo auction rate) constant at 14%. The rise in inflation in this period was attributed to price formations detached from economic fundamentals, supply-side factors such as the increases in global energy, food and agricultural commodity prices as well as supply chain disruptions, and demand developments.

In the August-November period, the CBRT assessed that uncertainties surrounding global growth and geopolitical risks had increased and underlined that it was important to keep financial conditions supportive to preserve the growth momentum in industrial production and the positive trend in employment as well as to sustain the structural gains in supply and investment capacity. Accordingly, it cut the policy rate by a total of 500 basis points from 14% to 9%. In view of the increasing risks regarding global demand, it was evaluated that the current policy rate was adequate, and the policy rate was kept unchanged at 9% in December 2022.

In January 2022, the CBRT announced that it was conducting a comprehensive policy framework review that prioritized the Turkish lira in all its policy tools, to create a foundation for sustainable price stability. Noting that structuring the financial system with Turkish lira instruments would enable the sustainable foundation for price stability, the CBRT evaluated that it was important to align the growth rate of loans and monetary aggregates with sustainable price stability as well as to increase the weight of the Turkish lira in these aggregates. Accordingly, the Bank shared with the public the Liraization Strategy as an essential element of the policy review process.

The CBRT emphasized that the Liraization Strategy was developed with a holistic approach that centered around the use of the Turkish lira. Accordingly, the aim of the liraization process was to make the Turkish lira and Turkish lira-denominated assets the main store of value in the financial system, gradually increase the weight of Turkish lira items in the assets and liabilities of households, companies, and the banking sector, as well as to ensure that Turkish lira assets would be used entirely in liquidity transactions and the Turkish lira would be the only medium of exchange in domestic commercial transactions. Through the Liraization Strategy, while the exchange rate sensitivity of inflation and pricing behavior was taken into consideration for the short term, it was aimed to take structural steps in the medium term towards strengthening the permanent improvement in the current account balance by supporting production and exports.

Use of targeted loans was another important pillar of monetary policy to ensure creation of financial conditions that would support the current account balance target. In the scope of the targeted loan approach aimed at increasing investments and exports, the growth rate, accessibility and financing cost of loans as well as loan interest rates were closely monitored, and a perspective that takes into account loan composition was adopted to ensure broad-based use of loans for real economic activity purposes.

Additionally, the CBRT conducted an effective reserve management to strengthen international reserves in 2022. While sources of reserves were diversified through new instruments devised as part of the Liraization Strategy, international reserves increased and exchange rates stabilized.

To conclude, in addition to the interest rate policy, the CBRT effectively used reserve requirements, securities maintenance, various products regarding the management of liquidity, collaterals and international reserves, and macroprudential policies in a holistic approach under the Liraization Strategy in 2022. Thus, a liraization-centered approach was put forth in line with the price stability objective that also took into account risks to financial stability.

Monetary Policy Developments

In January and February 2022, the CBRT shared its evaluation that the increase in inflation was driven by exchange rate-indexed pricing behavior due to unhealthy price formations in the foreign exchange market, supply side factors such as the rise in global food and agricultural commodity prices as well as supply constraints, and demand developments. Accordingly, stating that it expected disinflation process to start on the back of measures taken for sustainable price and financial stability along with the decline in inflation owing to the base effect, the CBRT decided to keep the policy rate unchanged at 14% (Chart 2.1.2.1). Besides, to create a foundation for sustainable price stability, it announced that a comprehensive review of the policy framework was being conducted that prioritizes Turkish lira in all its policy tools.

In March and April, the CBRT noted that the increase in inflation in the recent period had been driven by rising energy costs resulting from geopolitical developments, temporary effects of pricing formations that were not supported by economic fundamentals, supply-side factors such as the rise in global energy, food and agricultural commodity prices as well as supply constraints, and demand developments. Accordingly, it kept the policy rate constant at 14%. Additionally, the CBRT underlined that to create an institutional basis for sustainable price stability, the comprehensive review of the policy framework was continuing with the aim of encouraging permanent and strengthened liraization in all its policy tools.

In May, keeping the policy rate intact, the CBRT announced that the collateral and liquidity policy actions, of which the review process was finalized, would be implemented. The CBRT also kept the policy rate unchanged in June and July, and stated that the collateral and liquidity policy actions, of which the review process was finalized, would continue to be implemented to strengthen the effectiveness of the monetary policy transmission mechanism.

In August and September, noting that the leading indicators for the third quarter pointed to a continued loss of momentum in economic activity due to the decreasing foreign demand, the CBRT said it was important that financial conditions remained supportive to preserve the growth momentum in industrial production and the positive trend in employment in a period of increasing uncertainties regarding global growth as well as escalating geopolitical risks. Accordingly, the Committee decided to reduce the policy rate by 100 basis points each in both months to 12%.

The CBRT pointed to a further increase in uncertainties regarding global growth and geopolitical risks in October and November, and said it was critical that financial conditions remained supportive to preserve the growth momentum in industrial production and the positive trend in employment. Accordingly, it cut the policy rate by 150 basis points in each month to 9%. Additionally, considering the increasing risks regarding global demand, the CBRT evaluated in November that the current policy rate was adequate and decided to end the rate-cut cycle that started in August.

In December, the CBRT did not change the policy rate, and underlined that to create an institutional basis for sustainable price stability, the comprehensive review of the policy framework would continue with the aim of encouraging permanent and strengthened liraization in all its policy tools. It added that the credit, collateral and liquidity policy actions, of which the review process was finalized, would continue to be implemented to strengthen the effectiveness of the monetary policy transmission mechanism.

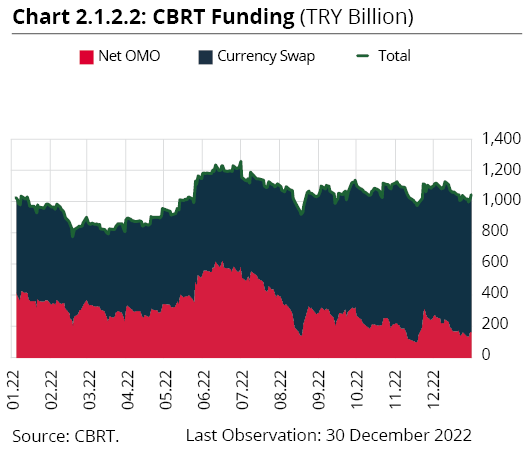

In 2022, the funding need of the system was met through open market operations (OMO) as well as currency and gold swap transactions. The net amount of OMO funding decreased by TRY 322 billion from TRY 490 billion at end-2021 to TRY 168 billion as of 30 December 2022. The amount of swap transactions, which was TRY 599 billion at the end of 2021, increased by TRY 284 billion and reached TRY 883 billion by 30 December 2022. The average funding need of the system hovered around TRY 1,026 billion throughout 2022 due to the balanced effect of components. Following a stable course during the year, the funding need of the system declined by TRY 38 billion over the previous year-end to TRY 1,051 billion by 30 December 2022 (Chart 2.1.2.2).

Inflation Developments

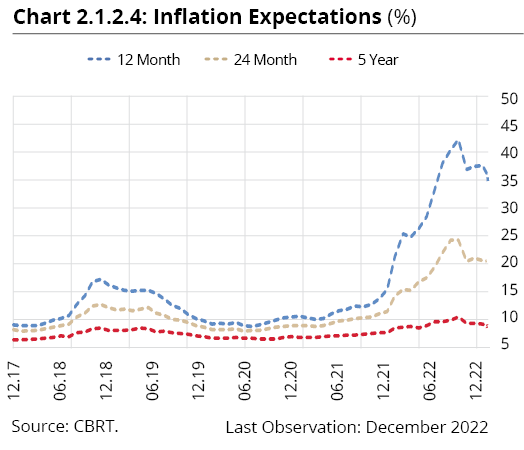

Annual consumer inflation increased rapidly in the first half of 2022 amid the depreciation of the Turkish lira and geopolitical developments, while it lost momentum in the following months on the back of largely waning effects of negative global supply shocks and the positive effects of the policies implemented. Having decelerated in the second half of the year, monthly inflation rates lost pace markedly in the last two months. Due to the improvement in the underlying trend of inflation as well as the high base effect, annual consumer price inflation closed the year at 64.3%, remaining below the mid-point of the forecast shared in the October Inflation Report (Chart 2.1.2.3). In 2022, the rise in inflation was mainly driven by pricing behavior linked to price formations in the FX market that were detached from economic fundamentals and the rapid increases in global commodity and food prices caused by geopolitical developments. In addition to the increases in import prices on USD basis, supply-side factors such as the elevated level of global transportation costs and disruptions in supply processes also affected the inflation developments unfavorably. Meanwhile, the impact of aggregate demand conditions on annual inflation remained limited compared to other factors. International energy prices, natural gas in particular, rose substantially due to the Russia-Ukraine War. Accordingly, among administered prices, price adjustments in the energy group (electricity, natural gas, municipal water) closely affected consumer inflation whereas subsidies in energy and various tax reductions across the year alleviated the cost pressures. Inflation expectations were on the upside throughout the year at large but started to decline as of September (Chart 2.1.2.4). Against this background, annual producer inflation increased until October while monthly rates of increase decelerated significantly in the last two months on the back of positive developments in international energy prices and the stable course of the Turkish lira. In this framework, producer prices surged by 97.7% in 2022. The deceleration registered in the rates of price increases in the second half of 2022 was also closely reflected in the core, underlying trend and diffusion indicators while the annual inflation of B and C indices among core indicators realized at 57.7% and 51.9% at the end of the year, respectively.

Across subgroups, food and energy were the main drivers of the rise in annual inflation. Following the geopolitical developments in February 2022, global food and energy prices rose significantly. In this context, annual food inflation gained momentum in the first half of the year due to the negative outlook of international agricultural commodity and food prices, exchange rate developments, increases in input costs with energy in the lead, and supply problems, while it remained elevated yet relatively flat in the third quarter consistent with the positive developments regarding the grain corridor and the global demand outlook. Annual food inflation picked up again in October and November due to the rise in prices of fresh fruits and vegetables driven by the field-to-greenhouse transition and the new season products included in the index as well as due to the adjustments in raw milk reference prices. In December, food prices increased at a monthly rate close to their historical averages. At 77.9% by the end of 2022, food inflation was above the headline inflation, and stood among the drivers of the rise in consumer inflation throughout the year. In 2022, in addition to the value added tax (VAT) reductions in food to alleviate cost pressures, an array of measures, foreign trade measures in particular, were taken for food security to mitigate the impact of the Russia-Ukraine War.

In 2022, the largest increase among the subgroups was seen in energy prices with 94.4%. The depreciation of the Turkish lira in the final quarter of 2021 brought about price increases spread across the energy group in the first quarter of 2022. Accordingly, among administered items, prices of electricity, natural gas and municipal water also increased substantially. Price hikes in electricity were partly taken back upon the transition to a graded tariff system in residential energy consumption towards the end of January. As of the second quarter of the year, global energy markets, the volatility of which was significantly increased by geopolitical developments, became the main factor shaping domestic prices. Crude oil prices, which started to increase with Russia’s invasion of Ukraine, began decreasing as of the third quarter of the year. On the other hand, EU countries, which imposed sanctions on Russia and therefore sought to build up stocks, faced sudden and strong increases in natural gas prices. After having risen sharply in the third quarter, natural gas prices in Europe declined in the last quarter of the year. These developments were rapidly reflected in domestic prices but subsidies in natural gas, which were at significantly high levels particularly in residential tariffs, prevented a more negative outlook in consumer prices. On the other hand, these subsidies were limited in the manufacturing industry and electricity producer tariffs, which led to a widespread cost increase in the industrial sector due to energy prices. Accordingly, indirect effects of producer prices were observed in consumer prices. The tight energy market also pushed up the international prices of products such as coal, propane, and butane while price hikes in items related to these products became prominent in certain periods. Increases in municipal water tariffs also continued throughout the year due to rising energy costs and the backward-indexation behavior.

The marked increase in food and energy prices also had negative implications for services inflation. Transport and restaurants-hotels services, which were affected by the rise in input costs in 2022, diverged from other subgroups with their large price increases and stood as the main sub-items that drove services inflation up. Fuel price increases had significant effects on transport services and food price increases on catering services. While carry-over effects of exchange rates from 2021 and the minimum wage hike affected services inflation unfavorably in the early months of the year, cost increases in food and energy items and the backward-indexation tendency were the factors on the forefront in the remainder of the year. In the first months of the year, the price changes in the other services subgroup, which includes items with different macroeconomic determinants and pricing behavior, were mainly driven by maintenance-repair that is highly sensitive to exchange rates and by health services that are subject to time-dependent pricing. Education services, in which the backward-indexation behavior and time-dependent pricing are prevalent, stood out with price hikes in certain periods during the year. After following a mild course in the first half of the year, monthly increases in rents accelerated in the second half. With the provisional article added to the Code of Obligations, rent hikes were limited for a period of one year, which prevented a more negative outlook and also weakened the backward-indexation behavior to some extent. As a result, the rise in annual inflation in the services group, which has a strong inertia tendency, was relatively more limited than in other main groups in 2022.

Prices of core goods surged by 49.0% in 2022. Annual inflation in core goods maintained its upward trend until October 2022, which was driven by the effects of exchange rate and commodity price developments as well as consumer loans. Tax base regulations in the Special Consumption Tax (SCT) made in January and November affected automobile prices, while the reduction of VAT on basic hygiene products from 18% to 8% had positive implications for prices. On the other hand, price increases were notable in white goods and furniture as well as in medicines in which the imported content and exchange rate pass-through are high. Among the components of the core goods group, annual inflation in clothing and footwear was relatively low in 2022.

Supply-Demand Developments, External Balance and Labor Market

Economic activity remained strong on the back of domestic and external demand in the first half of 2022 but lost momentum slightly in the third quarter due to the weakening external demand outlook. On the production side, the services sector was the main driver of growth in the first three quarters of the year. While the value added of the industrial sector continued to increase in the first half of the year with the contribution of strong external demand, it remained flat on an annual basis in the third quarter due to the deceleration in external demand. On the expenditures side, the share of sustainable components in growth rose, and the contributing share of machinery-equipment investments and net exports accounted for approximately two thirds of the average annual growth in the first three quarters of the year.

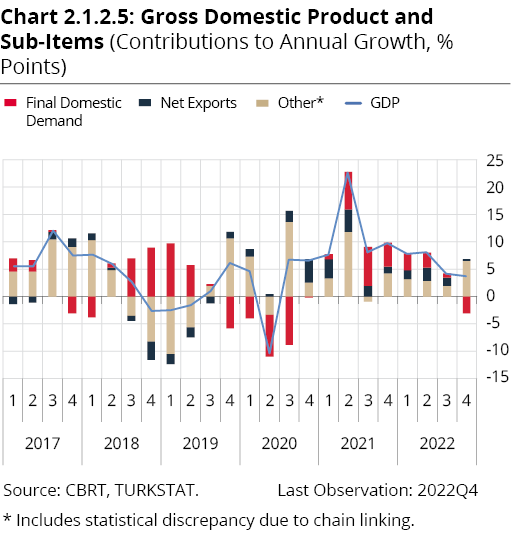

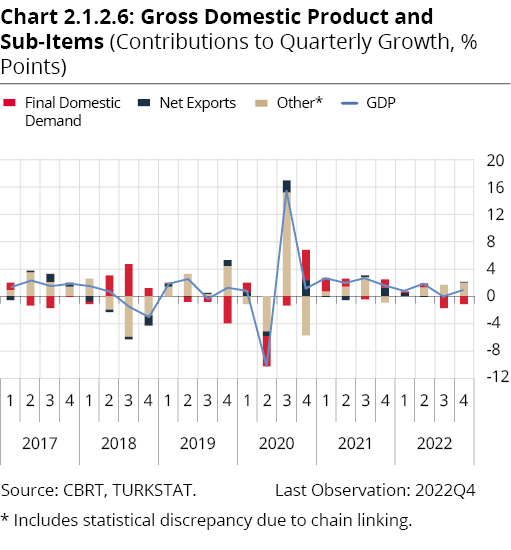

In 2022, economic activity was strong and GDP was up by 5.6%. In the first quarter of the year, GDP rose by 7.6% on an annual basis and by 0.7% quarter-on-quarter (Chart 2.1.2.5). In the second quarter, economic activity remained on the rise, and GDP increased by 7.8% annually and by 1.8% compared to the previous quarter. On the production side, the services sector continued to be the main driver of annual and quarterly growth in the second quarter underpinned by strong tourism despite the impact of the war. Likewise, industrial value added continued to increase on the back of strong export performance despite the war. On the expenditures side, private consumption remained robust while final domestic demand and net exports contributed positively to quarterly growth (Chart 2.1.2.6). On the other hand, growth lost pace in the third quarter of the year, and GDP grew by 4% annually but remained almost flat in quarterly terms. While industrial value added had a smaller contribution to growth in this period due to weak external demand, value added of the construction sector continued to contribute negatively to growth. Amid the strong course of wholesale and retail trade, transport and tourism-related services sectors as well as the ongoing high levels of banking sector profitability in financial and insurance activities, value added of the services sector increased further. In the last quarter of the year, GDP growth was 3.5% on an annual basis and 0.9% on a quarterly basis. While the contribution of net exports to annual growth turned into negative in the last quarter, that of services items remained positive.

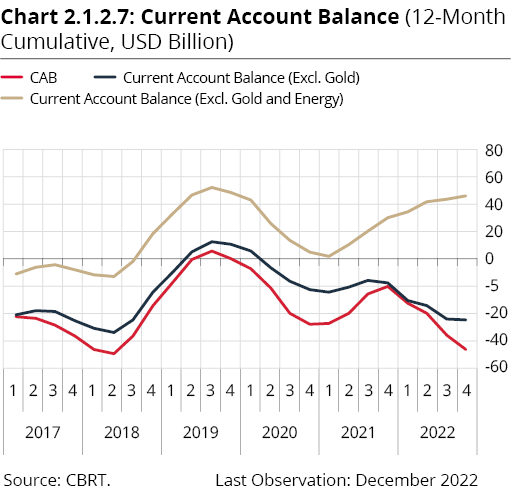

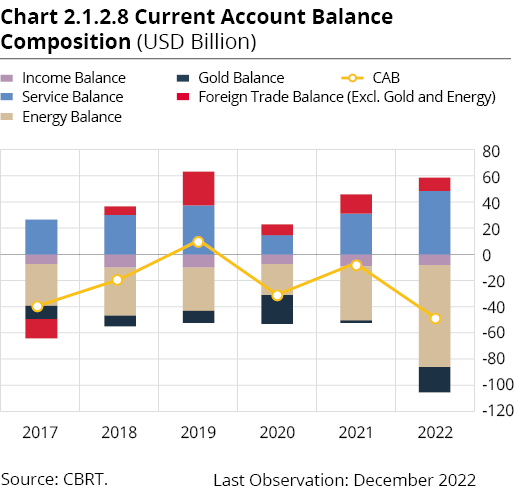

In 2022, the marked increase in global commodity prices, energy in particular, and the strong course of gold imports triggered a rise in the current account deficit despite the substantial increase in services revenues (Chart 2.1.2.7). In the first half of the year, exports were robust due to the strong course in external demand and the flexibility of exporters to diversify markets while imports assumed a rapid upward trend due to the rise in energy, oil and natural gas in particular, and other commodity prices driven by increased geopolitical risks. The growth in gold imports had an upward effect on the current account deficit whereas the rise in services revenues bolstered by the stronger than expected contribution of tourism and transport sectors supported the current account balance. The global increase in inflation and tighter monetary policies led to a slowdown in global growth trend while the fall in the euro-dollar parity caused export revenues from European countries, Türkiye’s largest trade partner, to decrease. Against this background, exports tended to decelerate as of the third quarter of the year, and imports remained strong due to the momentum in gold imports whereas the contribution of the services balance to the current account balance increased on the back of robust tourism demand. The energy balance made the largest negative annual contribution to the current account deficit that widened to USD 48.8 billion in 2022 (Chart 2.1.2.8). The foreign trade balance excluding gold and energy continued to contribute positively to the current account balance while the positive contribution of services items increased significantly compared to the previous year. On the financing front, direct investments continued predominantly through property purchases of non-residents, and portfolio investments saw capital outflows whereas capital inflows were recorded largely through the increase in non-residents’ deposits. As was the case in 2021, the banking sector was the net payer of long-term loans while debt rollover ratios of companies increased forcefully and contributed to the financing of the current account deficit.

The strong course of economic activity in the first three quarters of 2022 was also mirrored in the labor market, and the downtrend in the unemployment rate continued (Chart 2.1.2.9). In the first quarter of the year, employment increased quarterly in industrial and services sectors but declined in the construction sector. In this period, the labor force participation rate remained flat, and the unemployment rate stood at 11.0% (Chart 2.1.2.10). In the second quarter, the upward trend in nonfarm employment continued across all sub-sectors in line with the developments in economic activity. In this period, despite the rise in labor force participation rate, the strong increase in employment played an effective role in the fall in unemployment rate. In the third quarter of the year, the loss of momentum in economic activity driven by weak external demand led to a sectoral divergence in employment developments. In this period, industrial sector employment dropped due in part to slowing exports whereas services sector employment continued to increase on the back of strong tourism. On the other hand, labor force participation rate posted a limited decrease on a quarterly basis, contributing to the continuation of the downward trend in unemployment rate. In the final quarter of 2022, the seasonally adjusted unemployment rate decreased by 1.0 points cumulatively compared to the previous year-end and dropped to 10.2%. Meanwhile, the labor force participation rate increased by 1.6 points to 53.9%.