The CBRT Payment Systems consist of systems developed and operated by the CBRT such as the Interbank Payment System (EFT), the Retail Payment System (RPS), the Electronic Securities Transfer System (ESTS) and the Auction System (IHS), along with an instant payment system called the Instant and Continuous Transfer of Funds (FAST).

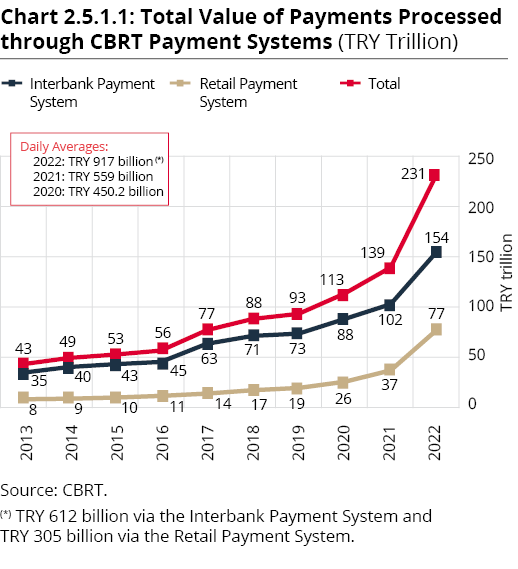

The total value of transactions conducted on the EFT System and delivery versus payment transactions conducted via EFT and ESTS, where funds and securities are transferred simultaneously, was TRY 154.28 trillion in 2022. In 2022, the daily average transaction value on the EFT system was TRY 612.26 billion. Approximately 4.4 million transactions were conducted on the EFT system in 2022 and an average of 17.5 thousands of messages were processed daily. On the EFT system, approximately 50% more transactions were settled in 2022 compared to the previous year (Chart 2.5.1.1).

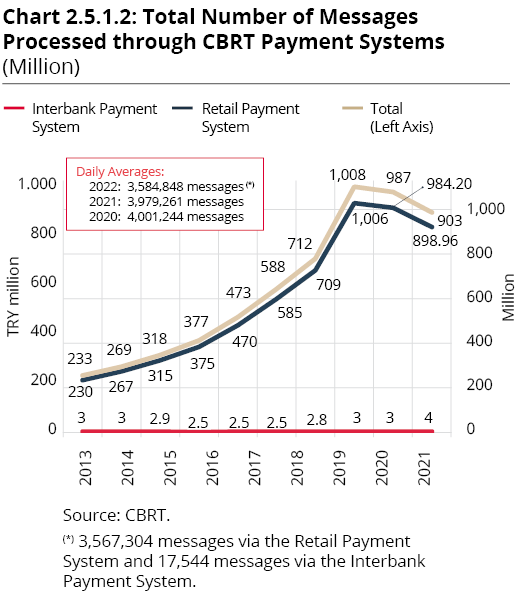

The total value of messages processed via the RPS in 2022 was TRY 76.9 trillion. The daily average value of transactions was TRY 305.34 billion. In 2022, 898.9 million transactions were conducted via the system and the daily average number of messages processed was 3.5 million. The number of settlements carried out via the RPS in 2022 decreased by 8.7% compared to 2021 (Chart 2.5.1.2). The decline can be attributed to the activation of the FAST System on 8 January 2021, which led to a shift in retail payments from the RPS to the FAST System.

The daily average volume of messages processed in the auction system was 1,018.

The number of participants on the CBRT’s Payment Systems was 57 by the end of 2022.

The instant payment system FAST was developed by the CBRT and put into effect on 8 January 2021. The FAST system is one of the major endeavors of the CBRT to modernize Türkiye’s payment systems infrastructure to support innovative business solutions. With the FAST System, which operates 24/7, end-to-end transfers of retail payments are completed within seconds, and the parties are instantly notified.

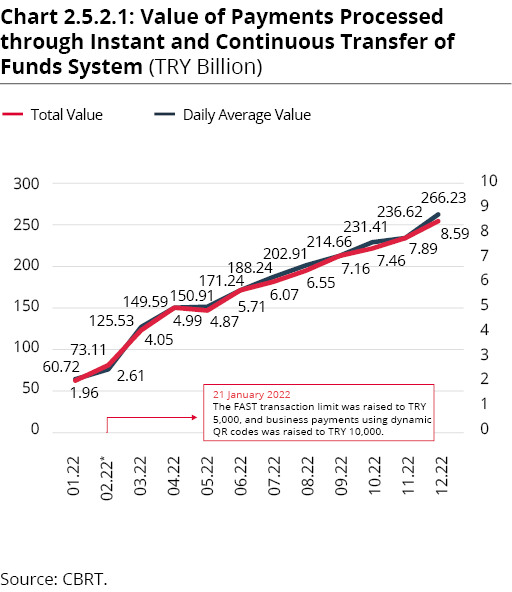

The FAST transaction limit, which is gradually increased, was raised to TRY 5,000 on 21 February 2022, and to TRY 10,000 for business payments using dynamic QR codes.

The Easy Addressing System (KOLAS) allows making money transfers on FAST System using telephone numbers, ID numbers, e-mail addresses, passport numbers or tax numbers, and without need to use of the International Bank Account Number (IBAN) is necessary. By 31 December 2022, the number of Individual customers of the KOLAS system was 19,278,956.

Preparations for the FAST TR QR Code and the certification processes for FAST participants have been successfully completed in order to use the FAST System as an alternative payment method. On the FAST System, P2P money transfers and merchant payments can be conducted without the need to provide IBAN information and by using the TR QR codes generated according to the standards.

In 2022, in order to prevent illegal uses, the “Security Overlay Service” (SIPER) was launched to allow institutions among which a money transfer relationship to share information and documents on accounts and money transfers that are suspected of fraudulent activity. With the SIPER platform, information about the risk of an illegal transaction can be shared between the initiating institution and the receiving institution in all fund transactions, including FAST.

All overlay services are important steps taken in the scope of the Liraization Strategy, contributing to the smooth, fast and reliable realization of payment and money transfer transactions anytime, anywhere.

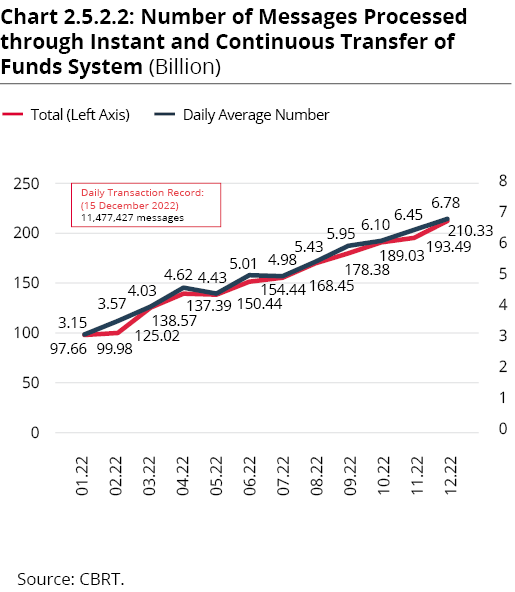

In 2022, the total value of messages processed on the FAST was TRY 2.07 trillion, corresponding to TRY 5.6 billion per day on average. In 2022, the number of transactions conducted via the system was 1.8 billion and the daily average volume of messages processed was 5 million. The highest daily number of transactions in 2022 was recorded on 15 December 2022 with 11.4 million transactions during the year (Chart 2.5.2.1).

As of 31 December 2022, the System has 24 participants.

Issue of Rules Governing Merchant Registration System (MRS)

In order to facilitate the processes related to payment transactions and to prevent fraud and malicious acts in the field of payments, pursuant to the Paragraph 5 of Article 9 of the Regulation on Payment Services and Electronic Money Issuance and Payment Service Providers (Payment Services Regulation) that took effect after being published in the Official Gazette No. 31676 dated 1 December 2021, the Merchant Registration System (MRS) was put into use at the Interbank Card Center (BKM) allowing a unique merchant code to be assigned to each merchant that provides goods and services with a payment method that falls within the scope of payment services.

The “Merchant Registration System Rules (MRS)” document, which explains the procedures and principles regarding the MRS, including the information and documents to be shared for registration and query purposes on the MRS, was established in cooperation with the BKM and announced on the CBRT’s website in June 2022.

The Guidelines on Stages of Application for Operation License for Payment and Electronic Money Institutions

Pursuant to Article 11 on “Operation License” of the Regulation on Payment Services, the “Guidelines on Stages of Application for Operating License for Payment and Electronic Money Institutions” was issued on the CBRT’s website to clarify the process for institutions that will apply to the CBRT to become a payment and electronic money institution.

The Guidelines for Notifying the CBRT Regarding Unauthorized Payment Service Providers

The “Guidelines for Notifying the CBRT Regarding Unauthorized Payment Service Providers” was issued on the CBRT’s website to inform the public about the issues regarding payment services and issuance of electronic money and the actions that can be taken in cases where unauthorized activities are detected.

The Explanatory Guidelines on Administrative Fines

“Explanatory Guidelines on Administrative Fines under Law No. 6493 on Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions” was issued on the CBRT’s website to provide information on the method to be adopted by the CBRT in determining the administrative fines (AF) to be imposed on payment and electronic money institutions in the scope of Law No. 6493.

In the Guidelines, it is stated that in cases where no benefit is obtained in return for Institutions’ transactions in violation of the Law No. 6493 and secondary regulations, or in cases where a benefit cannot be determined, the amount of the AF to be paid by the institution for the relevant violation can be reached by applying the rates determined according to the subject of the violation to the net sales revenues of the institutions or by determining the penalty from the lower limit determined for the violation. The rates determined according to the subject of the breach are differentiated by types of breach specified in Law No. 6493 and secondary regulations.

The detections and methods set out in the Guidelines aim to increase predictability in the AF process and contribute to the sector’s level of compliance with the regulations.

Studies on the Implementation of TR QR Code Regulation

Efforts by payment service providers to establish the TR QR Code infrastructure and to spread the use of TR QR Code in payments pursuant to the Regulation on the Generation and Use of TR QR Code in Payment Services continues.

Pursuant to Article 6 of the TR QR Code Regulation, the CBRT has prepared and put into effect The Guidelines on BKM (Card Payments) TR QR Code Technical Principles and Rules. The Guide was revised to include card payment flows using the TR QR Code in cases where the card issuing payment service provider and the payment service provider offering the mobile application services are different and the revised guide was published on the CBRT’s website in May 2022.

Paragraph 1 of Article 5 of the TR QR Code Regulation authorizes the Interbank Card Center (ICC) to produce TR QR Codes. The BKM’s centralized generation of common QR codes, which will contain information that will allow payments both with cards and by FAST, would support the development of payments area by improving the TR QR Code payment experience. The centralized generation of QR codes will provide added value to generating common QR codes in e-commerce and at physical workplaces in the near future and to other projects as well.

As of June 2022, when the transition period acknowledged by the TR QR Code Regulation was completed, payment service providers’ work towards establishing the TR QR Code infrastructure had been largely completed. As of December 2022, the readiness to generate TR QR Code on POS devices and receive card payments reached approximately 72%, and the readiness to receive payments via FAST reached 57%.

In this context, seminars were organized between 18 August 2022 and 20 December 2022 for members of the assemblies under the Union of Chambers and Commodity Exchanges of Türkiye (TOBB) to provide members with general information on receiving payments with FAST with TR QR Code. The participants were informed about the benefits of using FAST and TR QR codes, advantages of these compared to other payment methods as well as the methodology to be followed by businesses desiring to receive payments with FAST and TR QR Code.

A reminder was sent to payment service providers via the Banks Association of Türkiye (TBB), the Participation Banks Association of Türkiye and the Payments and Electronic Money Institutions Association of Türkiye to ensure that the TR QR Code display format, the details of which were determined in 2021, can be widely used by payment service providers and merchants.

Guidelines on Association of Business Models Offered in the Field of Payments with Types of Payment Services

The “Guidelines on Association of Business Models in the Field of Payments with Types of Payment Services”, which associates the business models frequently encountered in the field of payments with the payment services listed in Law No. 6493, and ensures compliance with the regulations and uniformity in issues related to authorization, was issued on the CBRT’s website.

In the scope of the Guidelines, the services offered by licensed institutions in the field of payment services were examined with respect to existing regulations and business models, and the activities and business models implemented in the sector were evaluated in the scope of Article 12 and the second paragraph of Article 18 of Law No. 6493.

Issue of the Information Guide on the Obligation of Notification of Those Excluded from the Scope of the Law Pursuant to Subparagraphs (b) and (h) of the Second Paragraph of Article 12 of Law No. 6493

In the scope of Article 82 of the Regulation on Payment Services bearing the title “Obligation of Notification of those who are Excluded from the Scope of Notification”, the “Information Guide on the Obligation of Notification of those who are excluded from the scope of the law pursuant to subparagraphs (b) and (h) of the second paragraph of Article 12 of the Law No. 6493” was issued on the CBRT’s website.

Publication of the Communiqué on Redetermination of Minimum Equity Amounts for Payment and Electronic Money Institutions in the Official Gazette

The first paragraph of Article 33 bearing the title “Minimum equity obligation and professional liability insurance” of the Payment Services Regulation, regulates that the (minimum equity) amounts will be re-evaluated by the CBRT in January every year, taking into account the annual changes in the price indices published by TURKSTAT.

In this context, a Communiqué was published in the Official Gazette No. 31727 dated 22 January 2022 and entered into force on 1 April 2022 and the minimum equity amounts were set as TRY 5.5 million, TRY 9 million and TRY 25 million, respectively.

Amending and Extending the Period of Compliance with the Provisions of the Regulation on Payment Services and the Communiqué on Information Systems of Payment and Electronic Money Institutions and Data Sharing Services of Payment Service Providers in the Field of Payment Services

In the scope of its regulation and supervision authority in the fields of payment and electronic money institutions, the CBRT has conducted secondary regulatory studies towards setting the principles and procedures regarding authorization of payment institutions and electronic money institutions operating in Türkiye as well as their activities, information systems, payment service providers, provision of payment services and electronic money issuance. As a result of these studies, the Regulation on Payment Services and the Communiqué on Information Systems of Payment and Electronic Money Institutions and Data Sharing Services of Payment Service Providers in the Field of Payment Services (Communiqué) were published in the Official Gazette No. 31676 dated 1 December 2021 and entered into force.

The details pertaining to periods of compliance with articles of the Regulation and the Communiqué were stipulated in the first provisional articles of the mentioned regulations. In order to ensure the smooth conclusion of technical and operational works carried out by payment and electronic money institutions towards complying with the provisions of the articles of the said regulations and in the scope of the current developments in the field of financial technologies and payments, some extra time was required, therefore, the relevant paragraphs of the provisional articles have been amended to extend the compliance period.

Accordingly, the one-year compliance period, which was supposed to be terminated on 1 December 2022 as specified in paragraphs 1,5,9,11,17 and 18 of the Provisional Article 1of the Regulation and paragraphs 1,2 and 3 of the Provisional Article 1 of the Communiqué, was extended until 28 February 2023. However, it was stated that the institutions that fell in the scope of the first paragraph of the Provisional Article 1 of the Regulation were obliged to comply with the provisions of paragraphs 4 and 5 of Article 15 and Article 66 of the Regulation by 1 December 2022, i.e. there was no extension for the provisions of the said article.

Data Sharing Services in the Field of Payments, Commissioning of Open Banking Gateway (GEÇİT) Infrastructure

The first paragraph of Article 12 of the Law No. 6493 was amended on 12 November 2019 to include the Payment Initiation Service (subparagraph f) and the Service of Presenting Consolidated Information regarding the payment account on online platforms (subparagraph g), so that these services, called Data Sharing Services in the Field of Payments (DSSP) would be defined as payment services within the scope of the Law.

Consistent with the regulatory framework, the CBRT and the BKM carried out joint work to determine the DSSP implementation strategy, along with the detailed technical and operational requirements, in light of global best practices but with particular consideration of Türkiye-specific needs and conditions. Thus, the DSSP API (Application Programming Interface) Principles and Rules (API Standard) document, setting out the technical and operational requirements for the DSSP, was prepared and published on the CBRT website on 14 February 2022. Additionally, the upgraded versions of this DSSP API Standard were made accessible via the github platform.

Meanwhile, in view of the conditions and needs of our country, a technical service provider-focused application architecture was established to enable a fast integration of stakeholders and an efficient and effective experience of data sharing in the field of payment services. Accordingly, the BKM API Gateway (GEÇİT), developed by the BKM with entirely domestic human and technical resources, was assigned as a common DSSP infrastructure with the BKM as the technical service provider.

In this architecture, where the BKM will also serve as a technical service provider, Account Servicing Payment Service Providers (ASPSPs) will develop services according to the DSSP API Standard and make them available to Authorized Third Party Payment Service Providers (TPPs) through the BKM API Gateway. In this way, ASPSPs only need to build a single integration with the BKM for DSSP via a secure channel. On the other hand, TPPs will also be able to participate in the system through a single integration with the BKM API Gateway.

The ninth paragraph of the Provisional Article 1 of the Regulation had required the top 10 banks with payment accounts, which had the highest volume of payment transactions carried out in the CBRT Payment Systems, to get connected to the BKM Gateway by 1 December 2022, while other payment service providers (banks and institutions) were required to do the same by 1 December 2023. As the CBRT senior management considered it appropriate to grant additional time for the smooth conclusion of the technical and operational work carried out by the payment and electronic money institutions in view of current developments in the field of financial technologies and payments, the transition period for the top 10 banks was postponed to 28 February 2023, and for other payment service providers to 28 February 2024, according to the regulation published in the Official Gazette of 25 November 2022 and No. 32024.

In the meantime, as stipulated by the regulations dated 1 December 2021, the GEÇİT infrastructure was launched on 1 December 2022, and six banks that successfully completed their tests and technical certifications started to serve as account servicing payment service providers (ASPSPs) through the ‘GEÇİT’.

Guideline for External Service Providers Providing Community Cloud Services to Payment and Electronic Money Institutions

The seventh paragraph of Article 16 of the Communiqué on Information Systems of Payment and Electronic Money Institutions and Data Sharing Services in the Field of Payment Services of Payment Service Providers (Communiqué), which took effect upon publication in the Official Gazette of 1 December 2021 and No. 31676, reads that it is possible to outsource the services through the community cloud service model, where hardware and software resources are physically shared but a separate resource specific to each payment service provider is assigned by logical separation, provided that the hardware and software resources are allocated to payment service providers or other credit institutions or financial institutions whose activities related to information systems are regulated and supervised by a competent authority pursuant to the relevant legislation and that the outsourced service provider is approved by the CBRT. Accordingly, the “Guideline for External Service Providers Providing Community Cloud Services to Payment and Electronic Money Institutions”, which includes the application and evaluation process as well as the application requirements for external service providers that are willing to provide such community cloud services to obtain the CBRT’s approval, was published on the CBRT’s website on 23 August 2022 and took effect the same day.

Share Transfer

Number of Payment and Securities Settlement Systems Operating in Türkiye

As of 31 December 2022, there were eight payment systems and four securities settlement systems operating in Türkiye pursuant to Law No. 6493.

Operating License

Expansion of Activities

Share Transfer

Number of Payment and Electronic Money Institutions Operating in Türkiye

As of 31 December 2022, there were 29 payment institutions and 45 electronic money institutions operating in Türkiye pursuant to Law No. 6493.

Following the surveillance and audit activities carried out at institutions, 15 institutions were charged with administrative fines amounting to TRY 49,340,565.35 in total pursuant to Article 27 of Law No. 6493 titled “Failure to comply with regulations and decisions”.