The CBRT holds foreign currency reserves in support of a range of objectives that include assisting the government in FX-denominated domestic and foreign debt servicing; maintaining adequate FX liquidity against external shocks; supporting monetary and exchange rate policies, and enhancing market confidence. The CBRT’s reserve management practices are governed by the CBRT Law No. 1211. Pursuant to this law, foreign exchange reserves are managed by the CBRT in consideration of the three priorities as investment safety, liquidity and return, respectively. Accordingly, the objective of management of foreign exchange reserves is to generate returns under the constraints of protecting capital and providing the necessary liquidity, with the ultimate aim being the prudent management of the reserves, the country’s national wealth.

The CBRT’s institutional decision-making framework for reserve management has a three-tier hierarchical structure. Firstly, in line with the duties and powers entrusted by the CBRT Law No. 1211, the Board, as the Bank’s top decision-making authority, sets the general investment criteria for reserve management by approving the Guidelines for Foreign Exchange Reserve Management and the Guidelines for Gold Reserve Management (the Guidelines). Decisions made by the Executive Committee or the Governor in accordance with the Guidelines approved by the Board constitute the second tier of the institutional decision-making process. At this point, a benchmark portfolio that reflects the CBRT’s investment strategy and general risk tolerance for the relevant year is determined upon the approval of the Executive Committee. The third and final tier of the institutional decision-making process is the implementation of reserve management practices within the preferences and constraints specified by the Guidelines and the benchmark portfolio. Reserve management activities are carried out within an organizational structure based on the segregation of duties principle. Accordingly, the reserve management activities are carried out by the Reserve Management Division, while related risk management activities are carried out by the Corporate Risk Management Division.

Subject to the objectives, constraints and limits set by the Guidelines and the benchmark portfolio, transactions that can be conducted is listed as FX buying-selling transactions in international markets, FX deposit transactions, securities buying-selling transactions, repo and reverse repo transactions, securities lending transactions, and derivatives transactions. Regarding the management of the CBRT’s gold reserves of international standard, outright purchase and sales of gold, gold deposit transactions, gold currency swaps, location currency swaps and physical gold transfer transactions can be carried out.

Management of risks that the CBRT may be exposed to during the conduct of its reserve management operations begins with the determination of the benchmark portfolio. Reflecting the CBRT’s preferences for strategic asset allocation, the benchmark portfolio is the investment universe which consists of target currency composition, target duration and limits of deviation from these targets, maximum permissible transaction limits, eligible transaction types and countries and instruments to invest in. Accordingly, once the currencies, instruments and maturities to be employed in reserve management are set, the expected return and the financial risks involved are identified to a large extent.

In 2022, global economies and financial markets were affected mainly by the lifting of lockdown measures in the aftermath of the coronavirus pandemic, the adverse effects of the Russian-Ukrainian war and the monetary tightening policies of major central banks. In this period, while the reopening of national economies as a result of global vaccination campaigns against the coronavirus pandemic supported global economic growth, geopolitical uncertainties arising from the Russian-Ukrainian war that broke out in February, the energy crisis and supply chain problems, and China’s zero-COVID policy were the factors limiting global growth. In addition to energy price hikes, adverse climatic conditions and supply-demand imbalances added to inflationary pressure on a global basis, leading inflation to reach multi-year highs in many countries, which in turn caused major central banks to tighten their monetary stances and start to raise interest rates. Against this background, 2022 was marked by high economic and financial uncertainties.

Geopolitical risks coupled with expectations and developments regarding the policies of major central banks shaped the CBRT’s reserve management strategies for 2022. Accordingly, reserve management activities continued in 2022, which was marked by high global economic and financial risks, in line with the safe investment, liquidity and return priorities.

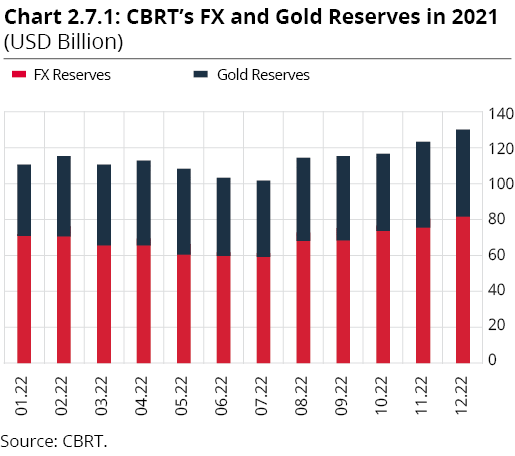

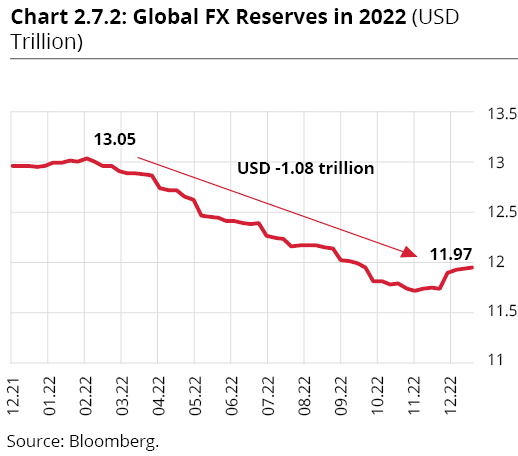

In 2022, significant steps were taken to strengthen reserves. In 2022, KKM, the YUVAM account, the sale of a portion of export revenues to the CBRT and the sale to the CBRT of foreign exchange obtained from the sale of real estate to foreign real persons and as per the Citizenship Law, which were put into effect within the scope of the Liraization Strategy, ensured resource diversification in reserves and led to strong and regular inflows to reserves. Following these arrangements, CBRT reserves rose by USD 10.4 billion in 2022, a year that saw a global decline in FX reserves, and reached USD 82.9 billion as of 30 December 2022 (Charts 2.7.1 and 2.7.2). A similar trend was also seen in gold reserves, with international standard gold reserves increasing by approximately 129 tons to 787 tons by 30 December 2022. As of December 30, 2022, total international reserves stood at USD 128.8 billion, and the share of gold reserves in total reserves was 35.6%.