Throughout 2022, OMO funding was provided through repo quantity auctions at the one-week repo auction rate, which is the main policy tool.

Under the Liraization Strategy, to increase the share of Turkish lira assets in securities accepted as collateral against Turkish lira funding provided by the CBRT, implementation principles of collateral management were revised and important changes were introduced in the blockage composition of the collateral system and in discount rates in 2022.

Accordingly,

In 2022, the CBRT continued to implement the floating exchange rate regime. Therefore, exchange rates are determined by supply and demand conditions in the market. In addition, the CBRT does not have any nominal or real exchange rate target under the current exchange rate regime. However, the CBRT may intervene in the market in case of unhealthy pricing and excessive volatility in exchange rates in order to limit the risks to financial stability.

The CBRT continued to closely monitor exchange rate developments and related risk factors and take necessary measures to ensure effective functioning of the foreign exchange market and support healthy price formations. In 2022, in the scope of the CBRT’s Turkish lira currency swap transactions, the CBRT provided funding via the quotation method with one week maturity, and funding via traditional auction method with maturities of two weeks, one month, two months and three months. In this period, no funding was provided by means of Turkish lira currency swap transactions with a maturity of six months. In 2022, all currency swap transactions were carried out at the CBRT’s markets. As of 30 December 2022, the outstanding amount of Turkish lira currency swap market transactions via the traditional auction method was USD 44 billion, while the outstanding amount of Turkish lira currency swap market transactions via the quotation method was USD 251 million.

In order to increase banks’ effectiveness in liquidity management and incorporate gold savings into the financial system, the CBRT had introduced the TRY/Gold Swap Market transactions and FX/Gold Swap Market transactions in 2019, and the TRY/Gold swap auctions in 2020 and these transactions continued in 2022 as well. As of 30 December 2022, the outstanding amount in the TRY/Gold Swap Market and the FX/Gold Swap Market via the quotation method was 18.7 tons and 17.4 tons, respectively, and the outstanding amount in TRY/Gold Swap Auctions was approximately 37 tons. There is no FX/Gold Swap Market transaction on the sell side. Moreover, in 2022, FX/Gold and TRY/Gold transactions at the CBRT and BIST Precious Metals and Diamond Market as well as location swap transactions, and standard gold buying produced from domestic ore against TRY to boost reserves continued. As of 30 December 2022, the total amount of FX selling position originating from TRY-settled FX futures selling transactions conducted at the BIST Futures and Options Market (VIOP) depending on market conditions was USD 500 million. Whereas, the TRY-settled FX futures selling transactions, which were introduced in December 2021 in order to help exporters and importers manage their exchange rate risk and conducted via the auction method by the CBRT, were terminated in February 2022 due to inadequate demand.

In 2022, in tandem with developments in global interest rates, the interest rate applied to collateral FX deposits received was gradually raised from 0.0% to 4.25% for the US dollar, and from 0.0% to 2.5% for the euro across all maturities. The interest rates applied to FX deposits that banks can borrow from the CBRT for US dollar were gradually raised from 2.50% to 6.75% for one-week maturity and from 3.25% to 7.50% for one-month; while those for the euro were gradually increased from 2.00% to 4.50% for one-week maturity and from 2.50% to 5.00% for one-month maturity.

In 2022, with reference to the macroprudential policy framework, and as per an approach based on ensuring permanent and strengthened Liraization in the sector, the CBRT continued to use reserve requirements (RR) as a macroprudential tool supporting the monetary policy and introduced the practice of maintaining long-term TRY-denominated securities.

In order to increase the share of TRY deposits/participation funds in total deposits/participation funds in the banking system and to support financial stability, the amounts converted from FX deposits/participation funds to time TRY deposits/participation funds were exempted from the RR implementation.

The interest/remuneration rate to be applied to TRY-denominated RRs was determined as 0% as of 15 April 2022.

In the MPC decision of April 2022, the Committee stated that credit growth -including TRY-denominated long-term investment loans- and the targeted use of accessed funds for real economic activity were important for financial stability and decided to strengthen the macroprudential policy set. Accordingly, reserve requirements, which used to be applied to the liability side of balance sheets, started to be applied to the asset side of balance sheets as well in order to strengthen the macroprudential policy toolkit. The loans extended by banks and financing companies outside the targeted areas became subject to reserve requirements. The maintenance ratio for assets subject to RR was applied as 10% as of 29 April 2022 and 20% as of 24 June 2022. Moreover, it was decided that: for banks with a growth rate of assets subject to RR above 20% between May 2022- December 2021, 20% of the difference between their outstanding loan balances between March 2022 and December 2021 shall be subject to reserve requirement for a period of six months.

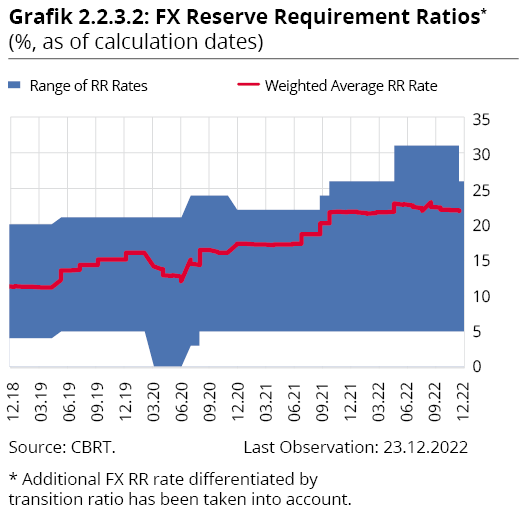

In the scope of the Liraization strategy, to be effective as of the maintenance period starting on 10 June 2022, it was decided to differentiate reserve requirement ratios for FX deposits/participation funds according to the conversion rate of real person’s FX accounts to TRY accounts. It was decided to implement an additional reserve requirement of 5 points to banks with a conversion rate below 5%, and 3 points to banks with a conversion rate between 5% and 10%. As of the maintenance period of 2 September 2022 these rates have been updated to include legal persons’ conversion from FX deposits/ participation funds, and the target ratios of 5% and 10% have been raised to 10% and 20%, respectively. The implementation was terminated as of 23 December 2022 as targets were achieved across the sector.

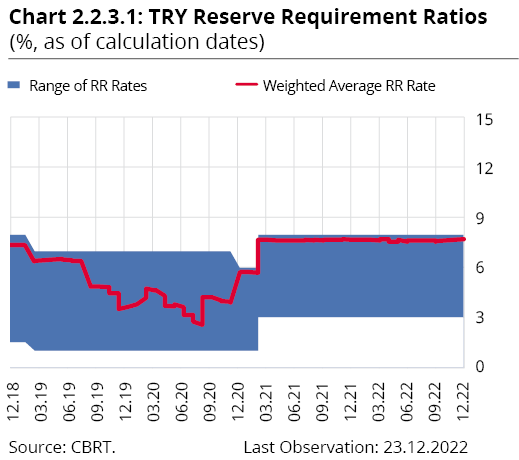

As of the calculation date of 23 December 2022, the average weighted TRY and FX reserve requirement ratios were 7.7% and 21.8%, respectively (Chart 2.2.3.1 and Chart 2.2.3.2).

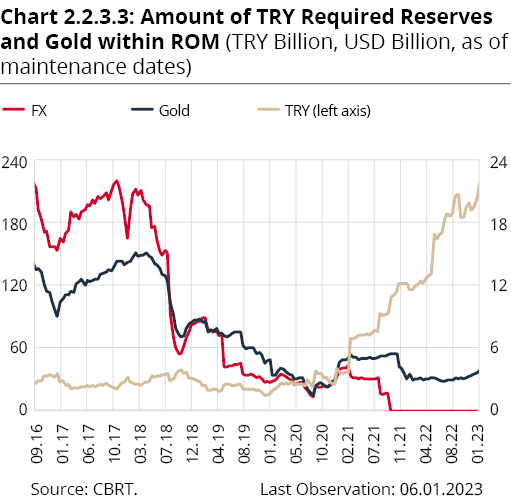

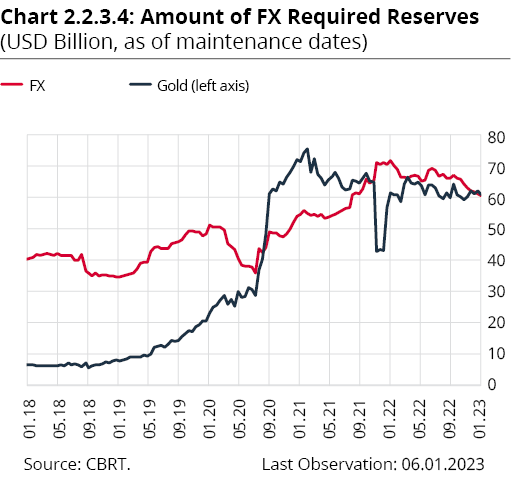

As of the calculation date of 23 December 2022, the amount of TRY liabilities subject to reserve requirements was TRY 3,560 billion, while the amount of FX liabilities subject to reserve requirements was TRY 5,496 billion. As of the maintenance period of 6 January 2023, TRY 218.5 billion was maintained for TRY liabilities, and USD 3.9 billion worth of gold was maintained in the scope of the ROM facility\ while USD 60.9 billion worth of FX and USD 5.3 billion worth of gold was kept for FX liabilities (Chart 2.2.3.3 and Chart 2.2.3.4)

On 31 December 2022, the facility of maintaining gold for Turkish lira reserve requirements in the scope of the Liraization Strategy was terminated and the regulation will take effect on 23 June 2023.

The commission charged on RR amounts that the banks are required to maintain for their FX deposit/participation fund liabilities as per the Liraization Strategy has been revised throughout the year, according to developments. Accordingly:

With a view to establishing permanent and strengthened Liraization in the sector and increasing the effectiveness of the monetary policy, it was decided that as of the maintenance period of 29 July 2022, banks would maintain Turkish lira long-term fixed-rate securities at a ratio of 3% for FX deposits/participation funds; and that 7 points would be added to this ratio for those banks with a real person/legal person conversion ratio below 5%, and 2 points would be added for those banks with a real person/legal person conversion ratio between 5% and 10%.

As per the macroprudential measures taken in August 2022, assets were also included in the scope of the securities maintenance practice. Accordingly, it was decided that to be effective on 30 September 2022, the reserve requirement maintenance rule applied to loans subject to reserve requirements, which was 20%, was replaced by maintenance of securities at 30% for banks; the scope of the regulation was extend to include and TRY commercial loans (that were not subject to reserve requirements) was subjected to securities maintenance if not extended against expenditure. Moreover, the loan amount exceeding the monthly growth rate of 3% from the calculation date of 26 August 2022 until the calculation date of 25 November 2022 (included) and the loan amount exceeding the growth rate of 10% by 30 December 2022 compared to 29 July 2022 became subject to securities maintenance. In addition, it was decided that for commercial loans to be extended until the end of 2022, securities would be maintained at a ratio of 20% of the loan amount to be extended at an annual compound interest rate that is 1.4 -1.8 (included) times higher than the CBRT-released annual compound reference rate, and securities would be maintained at a ratio of 90% of the loan amount to be extended at an annual compound interest rate 1.8 times higher than the CBRT-released annual compound reference rate.

With the amendment made to the securities maintenance practice on 18 October 2022 in the scope of the Liraization Strategy, the securities maintenance ratio, which was 3%, was revised to reach 5% gradually. Moreover, taking into account that banks had attained the conversion targets set by the Central Bank by the second half of 2022 and complied with the securities maintenance practice initiated as part of the Liraization Strategy, it was decided that as of the beginning of 2023, securities maintenance practice would be based on the share of TRY deposits/participations funds in total deposits/participations funds, but not on the conversion rate any more. Accordingly, as per the amendment, it was decided to add an extra 7 points to the securities maintenance ratio for banks with a TRY deposits/participation funds share for real and legal persons, whichever is lower, below 50%, and an extra 2 points for banks with a share between 50% and 60%, along with a transition period of three months.

On 31 December 2022, the securities maintenance practice was revised in the scope of the Liraization Strategy with a view to permanently increasing the weight of the Turkish lira on both the assets side and the liabilities side of the banking system. Accordingly, in addition to banks, other financial institutions were also included in the scope of the securities maintenance regulation, and at the first phase, factoring companies were required to maintain securities based on the interest rate they applied to TRY-denominated factoring receivables. The scope of banks’ assets and liabilities subject to the securities maintenance practice was expanded; moreover, a securities maintenance practice was introduced that would ensure a balanced course in FX loans in line with the decline in FX funding items. The period of the implementation stipulating banks to maintain securities based on loan interest rate and loan growth rate was extended until 29 December 2023.

Table 2.2.3.1: Securities Maintenance Ratios (%, by calculation dates and maintenance periods)

Calculation Dates of Securities |

30.06.22 |

29.07.22 |

26.08. 22 |

30.09.22 |

28.10.22 |

25.11.22 |

30.12.22 |

27.01.23 |

Maintenance Periods of Securities |

29.07.22 |

26.08. 22 |

30.09. 22 |

28.10.22 |

25.11.22 |

30.12.22 |

27.01.23 |

24.02.23 |

FX deposit/ participations funds Liabilities |

3% |

3% |

3% |

3% |

3% +2%*1/3 |

3% +2%*2/3 |

%5 |

%5 |

Additional ratio based on Conversion Ratio |

2% or 7% |

2% or 7% |

2% or 7% |

2% or 7% |

2% or 7% |

2% or 7% |

- |

- |

Additional ratio based on Share of TRY deposits |

|

|

- |

- |

- |

- |

(additional 2% or 7%) *1/3 |

(additional 2% or 7%) *2/3 |

Based on Credit Type |

|

|

%30 |

%30 |

%30 |

%30 |

%30 |

%30 |

Based on Credit Growth |

|

|

Amount exceeding monthly growth of 3% |

Amount exceeding monthly growth of 3% |

Amount exceeding monthly growth of 3% |

Amount exceeding monthly growth of 3% |

Amount calculated by subtracting the amount for which securities are established for monthly growth from the amount exceeding 10% |

Amount exceeding monthly growth of 3% |

Based on Credit Interest Rate/ Participation Fund Rate |

|

|

20% and %90 |

%20 and 90% |

20% and 90% |

20% and 90% |

20% and 90% |

20% and 90% |

Based on Interest Rates on Factoring Receivables |

|

|

- |

- |

- |

- |

- |

90% |

According to Funding- Credit Difference |

|

|

|

|

|

|

|

At the amount of increase |

The aim of rediscount credits for exports and FX earning services is to provide exporters access to funds at cheaper costs and to reinforce the CBRT’s reserves. Rediscount credits, which are governed by Article 45 of the CBRT Law, are extended to exporters and firms that engage in FX earning services and activities by accepting TRY and FX-denominated bills for rediscount. Rediscount credits are extended via intermediary banks based on the TRY equivalent of the bills.

The total limit of rediscount credits is USD 30 billion. USD 20 billion of this limit is assigned to Turk Eximbank and the remaining USD 10 billion to other banks. Banks other than Turk Eximbank are assigned a limit per bank depending on their asset size and rediscount credit balance. In the scope of the Liraization Strategy, it was decided to increase the rediscount credit limit to TRY 405 billion as of the beginning of 2023.

In 2022, in line with the Liraization Strategy, firm-based credit limits were also converted into Turkish lira and revised. Accordingly, firm limits were determined as follows: TRY 5 million for micro firms, TRY 20 million for small firms, TRY 100 million for medium-sized firms in the scope of Small and Medium-Sized Enterprises (SMEs), TRY 4.5 billion for firms engaged in FX earning services, export intermediaries and firms operating in the defense industry, and TRY 2.5 billion for other firms.

As of December 2022, the following changes have been made in the rediscount credits implementation:

In 2022, a total of TRY 346.29 billion worth of rediscount credits were extended, TRY 124.9 billion of which was in FX, and TRY 221.3 billion was in TRY. The contribution of rediscount credit repayments to reserves in 2022 was USD 17.6 billion in total. Additionally, the contribution made to the CBRT reserves through the additional FX export proceeds sales amounted to USD 4.4 billion.

In 2022, the Regulation on Rediscount Credits Originating from Currency Swap Agreements was amended to allow the extension of rediscount credits denominated in the South Korean Won (KRW) and the United Arab Emirates Dirham (AED). Thus, four currencies became eligible for rediscount credits based on currency swap agreements, namely the Chinese Yuan, the Qatari Riyal, the South Korean Won and the United Arab Emirates Dirham.

Moreover, in 2022, approximately CNY 291.9 million (USD 44.3 million) worth of rediscount credits were extended for trade and investment activities with local currencies between the Republic of Türkiye and the People’s Republic of China; and approximately UAE 5.6 million (USD 4.2 million) worth of rediscount credits were extended for trade and investment activities with local currencies between the Republic of Türkiye and the United Arab Emirates.

Advance Loans Against Investment Commitment (YTAK) are extended pursuant to Article 45 of the CBRT Law through development and investment banks to investment firms for financing investments that have a decreasing effect on the current account deficit, by accepting TRY-denominated bills for advance, at a maximum maturity of 10 years and with a maximum grace period of two years. The CBRT policy rate is applied to these loans.

The purpose of advance loans against investment commitment (YTAK) is to support highly efficient investments that will reduce imports and boost exports, to lower external dependence as well as reduce the current account deficit problem and support sustainable growth, in tandem with the price stability and financial stability objectives. The total limit of advance loans against investment commitment is TRY 150 billion, with a breakdown of TRY 100 billion to be extended to industrial investments and TRY 50 billion to tourism investments. The firm-based lending limit is TRY 250 million for SMEs and TRY 1.5 billion for other firms.

In 2022, the following changes were made in the YTAK implementation:

A rule was introduced stipulating that all contracts and pricing to be made with residents concerning the investment subject to the loan shall be denominated in Turkish liras.

The pricing and sales of the goods to be produced or services to be provided for residents after the investment, except for the transactions to be made with domestic agencies bringing non-resident customers, shall be made only in Turkish liras.

Tourism companies, which are generating income from foreign currency-earning services, also became eligible to use YTAK.

The loan interest rate was reduced by 50 basis points for loans extended for investments in regions classified as underdeveloped regions according to the Socio-Economic Development Level Survey Report prepared by the Ministry of Industry and Technology.

The interest rate was further decreased if domestic machinery is used: the interest rate is decreased by 25 basis points for investments with a domestic machinery ratio between 10% and 50%, and by 50 basis points if the ratio is above 50%.

If at least 25% of the investment amount is obtained from abroad, the interest rate on the loan is decreased by 100 basis points.

By the end of 2022, the total amount of credits allocated in the scope of YTAK was TRY 87.4 billion, and TRY 29 billion of this amount was allocated to investment companies.