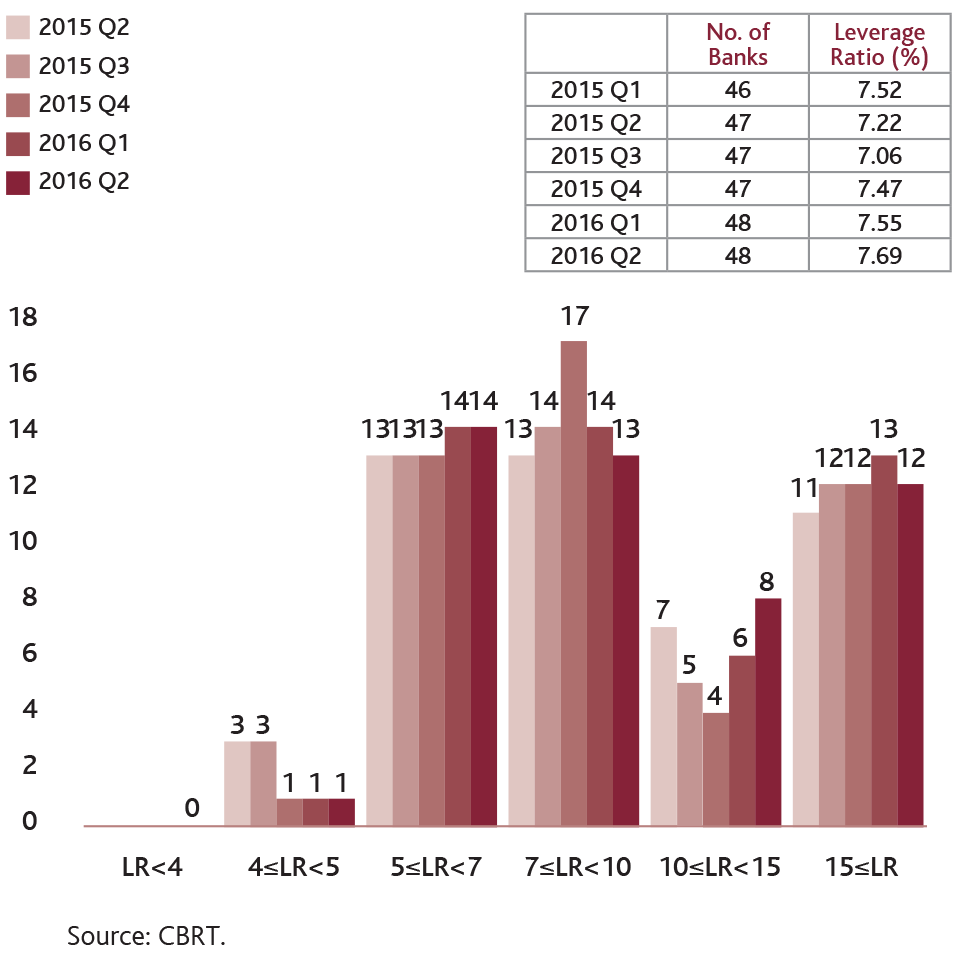

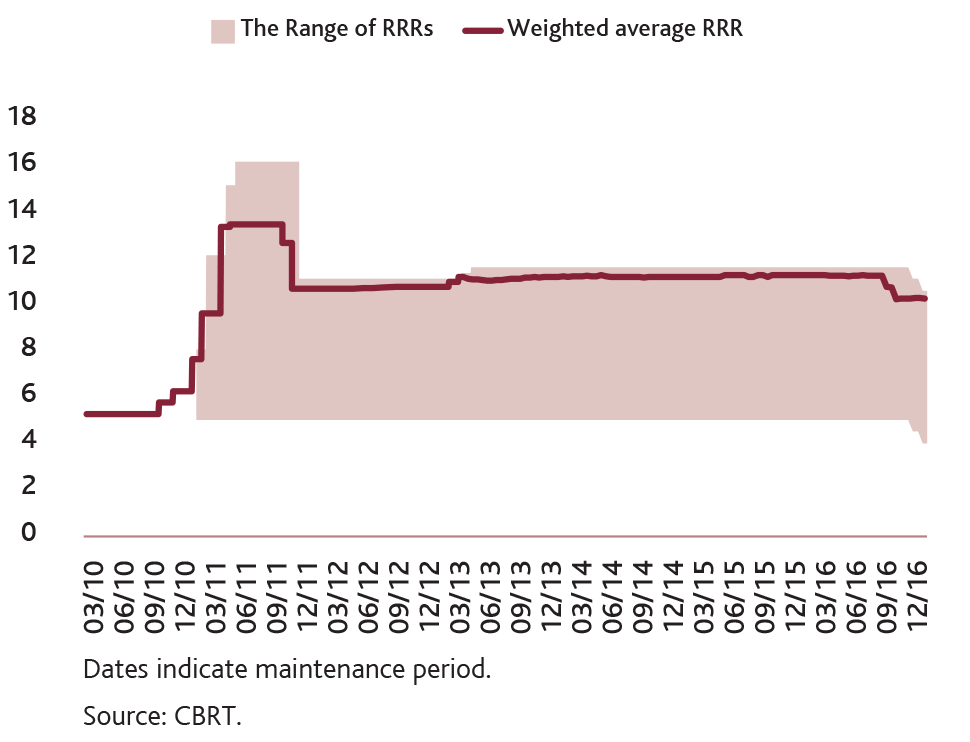

The CBRT continues to use reserve requirements as a monetary policy and macroprudential policy instrument. As of year-end 2016, the weighted average reserve requirement ratios for TL and FX were 10.1 percent and 13 percent, respectively (Graphs 19 and 20).

Graph 19. TL Reserve Requirement Ratios

(Percent)

Graph 20. FX Reserve Requirement Ratios

(Percent)

In the first half of 2016, development and investment banks’ borrower funds were subjected to reserve requirements and it has been decided that deposits/participation funds obtained from banks abroad will be subject to the reserve requirement ratios of other liabilities except deposits/participation funds, since these liabilities are regarded as non-core liabilities.

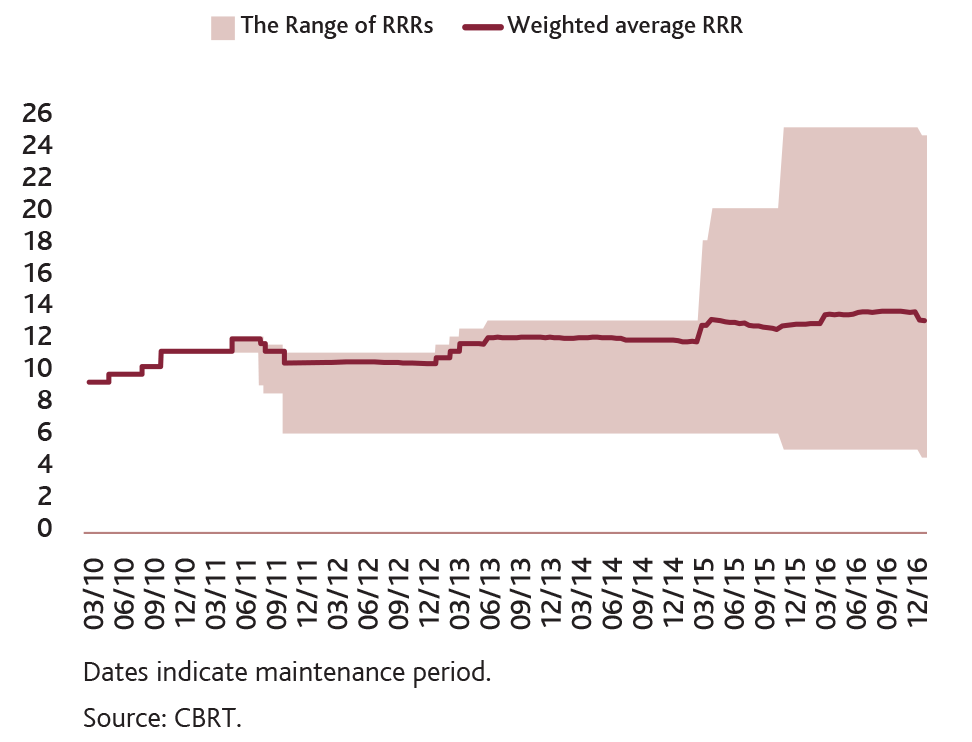

The Reserve Option Mechanism (ROM) not only contributes to total reserves but also limits potential impacts of capital flow volatility on the FX market. Besides, the automatic stabilizing feature of the ROM constitutes a buffer against possible changes in external finance conditions.

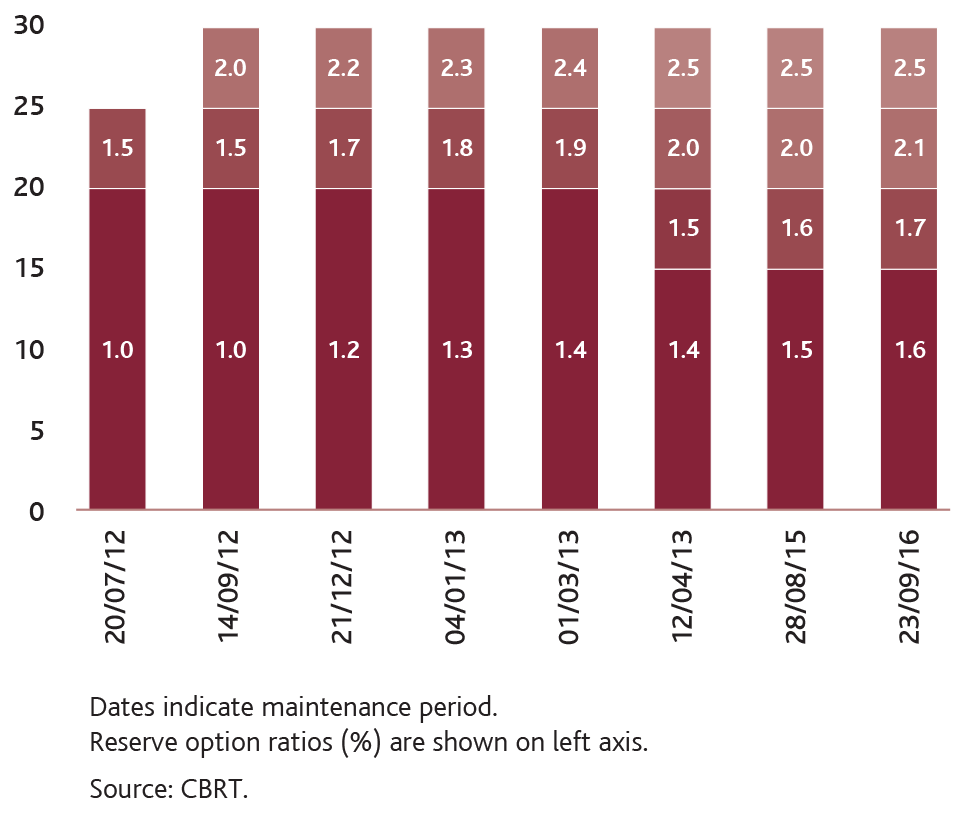

To strengthen the automatic stabilizing feature of the ROM and to provide the FX liquidity needed by the financial sector, technical adjustments have been made in reserve option ratios of FX liabilities and coefficients. With the technical adjustments, by the end of 2016, the maximum coefficients corresponding to the last tranches of the FX and gold reserve options stood at 4.5 and 2.5, respectively (Graph 21 and Graph 22).

Graph 21. Reserve Option Coefficients for Required Reserves Held as FX

Graph 22. Reserve Option Coefficients for Required Reserves Held as Gold

While banks and financing companies reduced ROM utilization ratio, in comparison with the end of 2015, in line with their liquidity management, in large part the sector continues to steadily utilize the ROM facility. As of the maintenance period of 30 December 2016, the utilization ratio of the FX facility became 73.5 percent, and that of the gold facility reached 64.2 percent across the sector. Banks can also maintain standard gold for precious metal deposit accounts, the utilization ratio of which is around 71 percent.

As of November 2016, in order to bring out residents’ gold into the economy and to increase FX reserves, it was decided to establish a new separate tranche of 5 percent, in addition to the existing facility of 30 percent allowing reserve requirements to be maintained as “standard gold” within the context of the ROM. Only wrought or scrap gold collected by banks from residents after 3 October 2016 has been eligible for this new tranche.

In the second half of 2016, to support financial stability, reserve requirement ratios for TL liabilities have been reduced 100 basis points in total for all maturity brackets. Moreover, reserve requirement ratios for FX liabilities have been reduced 50 basis points for all maturity brackets

The method of the remuneration of the Turkish lira required reserves held at the CBRT by the financial institutions has been changed. Starting from 1 January 2017, the remuneration rate for each quarterly period has been taken as 400 basis points less than the one week repo auction rate of CBRT.

In October, the upper limit of FX reserve requirements that can be maintained as average has been increased to 4 points from 3 points in order to facilitate the FX liquidity management of banks.

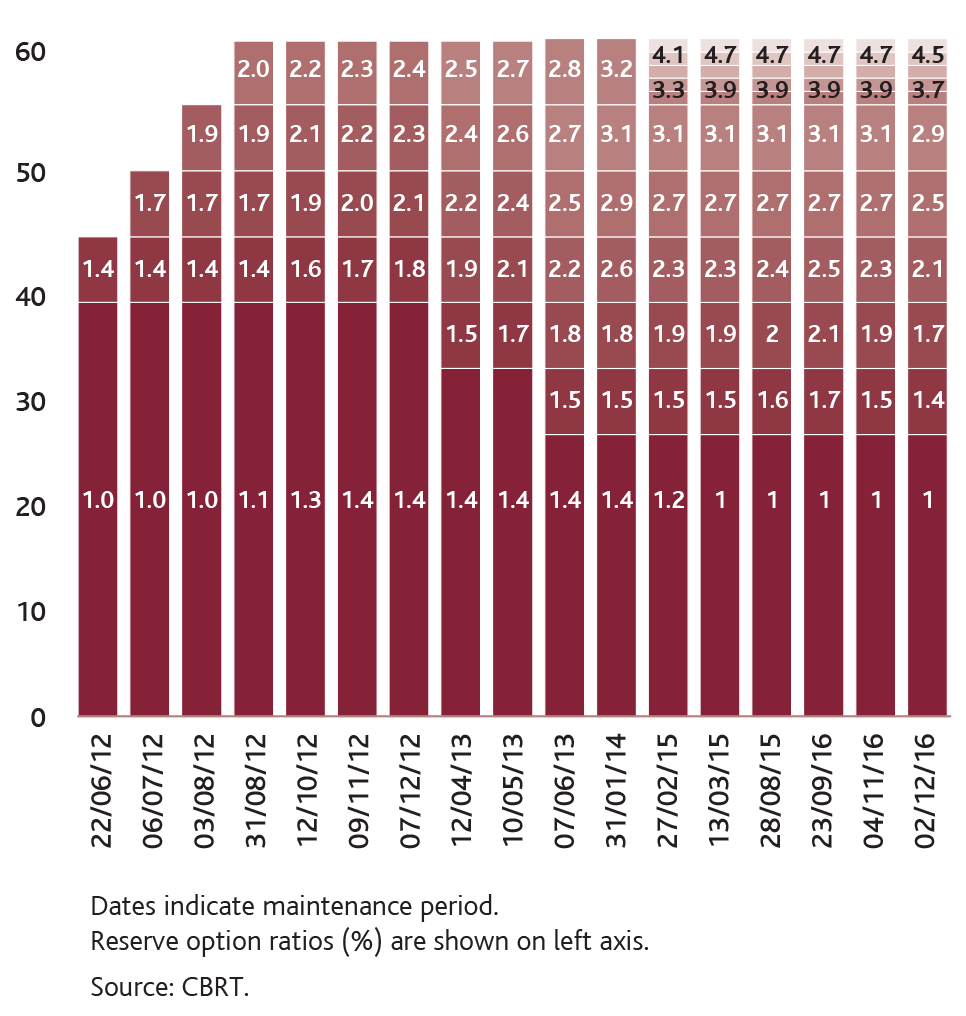

Within the context of the leverage-based reserve requirement regulation that aims to boost the resilience of the banking sector to shocks by containing its indebtedness, the leverage ratio of the sector was around 7.7 percent as of June 2016 (Graph 23). The data pertaining to April-June 2016 term suggest that the leverage ratio of the banking sector followed a stable course that was well above the minimum ratio of 3 percent set by the Basel III regulation and 5 percent set by the CBRT for the last three quarters of 2015.

Graph 23. Distribution of the Leverage Ratio