The CBRT holds FX reserves in support of a range of objectives which include assisting the Turkish Government in meeting its FX denominated domestic and foreign debt obligations, maintaining FX liquidity against external shocks, supporting the monetary and exchange rate policies and giving confidence to the markets. The legal basis for the CBRT’s reserve management practices derives from the CBRT Law No. 1211. Additionally, guidelines and decisions made by the Board based on the authority granted by the Law constitute the other basis of the FX and gold reserve management practices.

The institutional decision-making framework of reserve management has a three-tier hierarchical structure. The Board, as the top decision-making authority of the CBRT, determines the general investment criteria for reserve management by approving the Guidelines for Foreign Exchange Reserve Management that are prepared in accordance with the reserve management priorities set by the Law as security, liquidity and return respectively, and authorizes the Executive Committee and the Governor to make decisions regarding implementation. Upon the proposal of the Foreign Exchange Risk Management and Investment Committee (FXRIC), the decisions made by the Executive Committee or the Governor in accordance with the Guidelines for Foreign Exchange Reserve Management approved by the Board constitute the second tier of the institutional decision-making process. At this stage, the benchmark portfolio, which reflects the general risk tolerance and investment strategy of the CBRT, is determined and approved. Upon the proposal of the FXRIC at each year-end to be implemented in the following year, the benchmark portfolio, indicating the strategic asset allocation preferences of the CBRT, becomes effective with the approval of the Executive Committee. The last tier of the institutional decision-making process is the implementation of reserve management practices within the limits specified by the Guidelines and the benchmark portfolio. Reserve management activities are carried out within an organizational structure formed in accordance with the separation of duties principle. Accordingly, reserve management activities are performed by the Reserve Management Division whereas risk management related to the reserve management operations is carried out by the Risk Management Division.

Based on the objectives and limits set by the Guidelines and the benchmark portfolio, reserve management operations are conducted through spot and forward purchases and sales of FX in international markets, other derivative instruments, time deposit transactions, purchase and sale of securities, repo and reverse repo transactions and securities lending transactions.

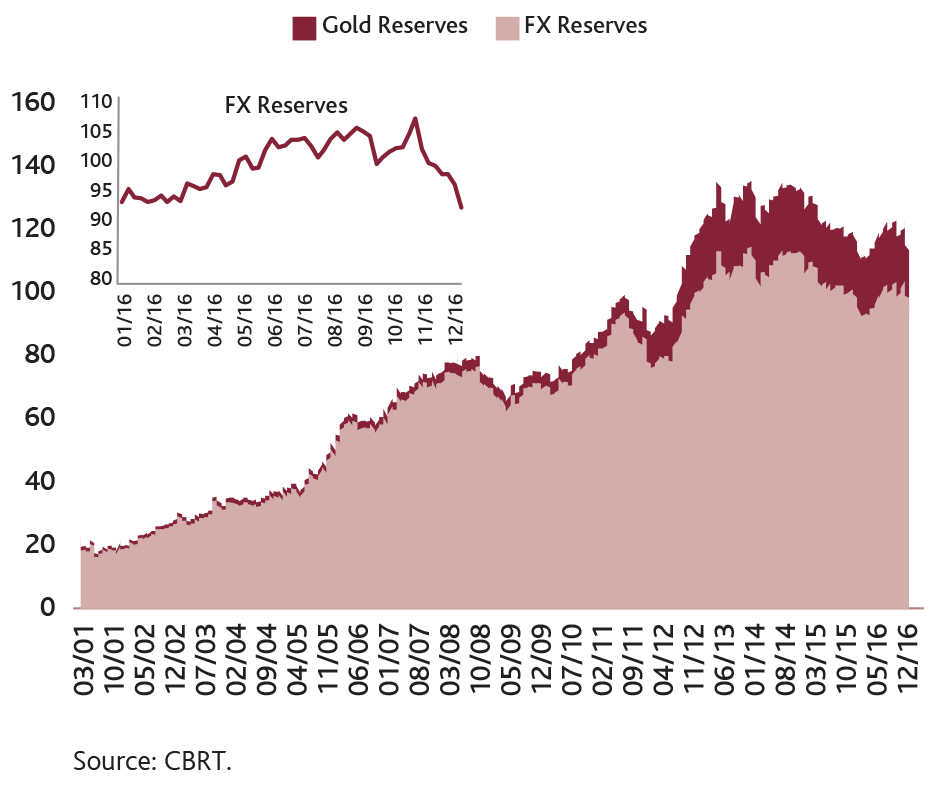

Gold holdings at the CBRT dropped to 377.4 tons and gold reserves constituted 13.2 percent of total reserves as of 30 December 2016 (Graph 32). Gold reserves of the CBRT, which are of international standards, are managed within the regulations and constraints stated in the Law and the guidelines set by the Board. Pursuant to these Guidelines, the CBRT may conduct outright purchase and sale transactions, gold deposit transactions and gold swap transactions. According to the regulation effected from October 2011, Turkish commercial banks have an option to fulfill a certain portion of their reserve requirements with standard gold.

Graph 32. FX and Gold Reserves of the CBRT

(USD Billion)

Controlling risks that the CBRT is exposed to during reserve management operations starts with the strategic asset allocation process; in other words, when defining the benchmark portfolio. Once the currencies and instruments to be used in reserve management and the duration target for the investments are set, the expected return and financial risks involved in reserve management are also determined to a great extent. Reflecting the CBRT’s preferences regarding strategic asset allocation, the benchmark portfolio consists of the target currency composition, duration targets and related deviation limits from these targets, overall credit risk limits and the investment universe representing eligible transaction types, countries and instruments to invest in. The aim in determining the benchmark portfolio is to ensure that an adequate return is obtained while observing capital preservation and liquidity constraints to devote the utmost importance to the prudent management of FX reserves, hence the national wealth of the country. After the overall acceptable risk level is defined with respect to the CBRT’s risk tolerance through the benchmark portfolio, the existing risks are measured, monitored and reported regularly.

Despite positive signs of global economic recovery, the continuing impacts of the global financial crisis witnessed in previous years played an important role in determining the CBRT’s reserve management strategies in 2016 too. In this context, as the financial risks remained elevated in 2016, the conservative approach continued and all necessary measures were taken to preserve the value of reserve assets.

In brief, reserve and risk management practices were performed in line with contemporary practices by taking into account the CBRT’s own requirements and theoretical and technical progress in reserve and risk management practices together with developments in the international economy and financial markets.